Region:Global

Author(s):Rebecca

Product Code:KRAA1434

Pages:89

Published On:August 2025

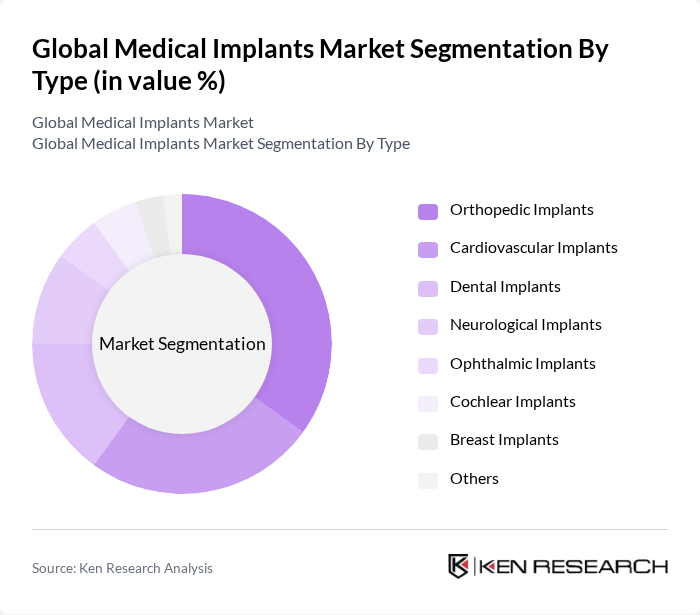

By Type:The market is segmented into various types of implants, including orthopedic, cardiovascular, dental, neurological, ophthalmic, cochlear, breast implants, and others. Among these, orthopedic implants are leading the market due to the rising incidence of orthopedic disorders and the increasing number of joint replacement surgeries. The demand for advanced materials, minimally invasive procedures, and smart implant technologies in orthopedic implants is driving innovation and growth in this segment.

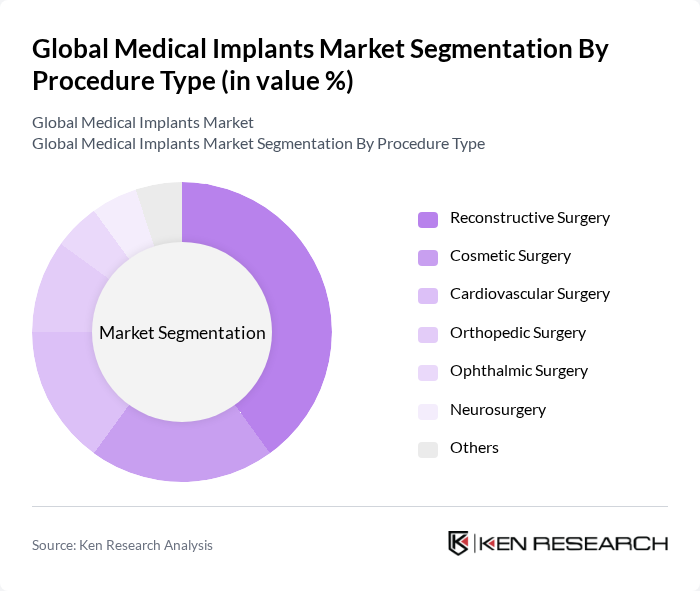

By Procedure Type:This segmentation includes reconstructive surgery, cosmetic surgery, cardiovascular surgery, orthopedic surgery, ophthalmic surgery, neurosurgery, and others. The reconstructive surgery segment is currently dominating the market due to the increasing number of surgical procedures performed globally, driven by trauma cases, congenital defects, and the rising adoption of advanced reconstructive techniques. The growing awareness and demand for cosmetic enhancements is also contributing to the rise in cosmetic surgery procedures.

The Global Medical Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings, Inc., Boston Scientific Corporation, Abbott Laboratories, B. Braun Melsungen AG, Smith & Nephew plc, NuVasive, Inc., Conmed Corporation, Orthofix Medical Inc., Integra LifeSciences Holdings Corporation, Hologic, Inc., Wright Medical Group N.V., Straumann Group, Dentsply Sirona, 3M Health Care, Cardinal Health, Coloplast A/S, Cochlear Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical implants market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centric care. As the demand for minimally invasive procedures rises, the integration of smart technology into implants is expected to enhance patient monitoring and outcomes. Additionally, the expansion into emerging markets will provide new growth avenues, as healthcare infrastructure improves and access to advanced medical technologies increases, fostering a more inclusive healthcare environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Orthopedic Implants Cardiovascular Implants Dental Implants Neurological Implants Ophthalmic Implants Cochlear Implants Breast Implants Others |

| By Procedure Type | Reconstructive Surgery Cosmetic Surgery Cardiovascular Surgery Orthopedic Surgery Ophthalmic Surgery Neurosurgery Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Research and Academic Institutes |

| By Material | Metal Implants Polymer Implants Ceramic Implants Composite Implants |

| By Application | Joint Replacement Spine Surgery Cardiovascular Procedures Dental Restoration Hearing Restoration Cosmetic Enhancement |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Implant Procurement | 120 | Hospital Procurement Managers, Orthopedic Surgeons |

| Cardiovascular Device Usage | 90 | Cardiologists, Cardiac Surgeons |

| Dental Implant Market Insights | 60 | Dentists, Oral Surgeons |

| Regulatory Compliance in Implants | 50 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Emerging Technologies in Implants | 70 | Biomedical Engineers, R&D Managers |

The Global Medical Implants Market is valued at approximately USD 121 billion, driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technology, and a growing aging population requiring surgical interventions.