Region:Global

Author(s):Shubham

Product Code:KRAC0668

Pages:82

Published On:August 2025

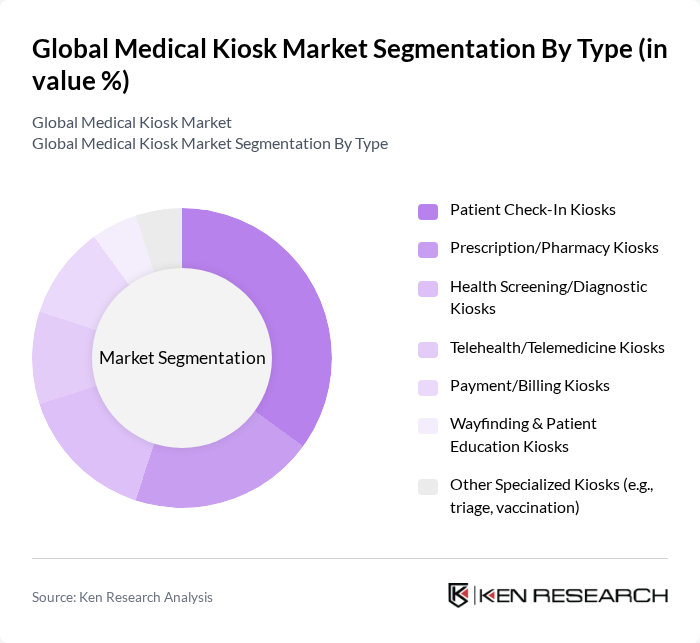

By Type:The market is segmented into various types of kiosks, each serving distinct functions within healthcare settings. The primary subsegments include Patient Check-In Kiosks, Prescription/Pharmacy Kiosks, Health Screening/Diagnostic Kiosks, Telehealth/Telemedicine Kiosks, Payment/Billing Kiosks, Wayfinding & Patient Education Kiosks, and Other Specialized Kiosks (e.g., triage, vaccination). Among these, Patient Check-In Kiosks are leading the market due to their ability to streamline patient flow, manage registration, insurance verification, and payment, and reduce wait times—capabilities consistently cited as core value drivers for self-service kiosks in healthcare .

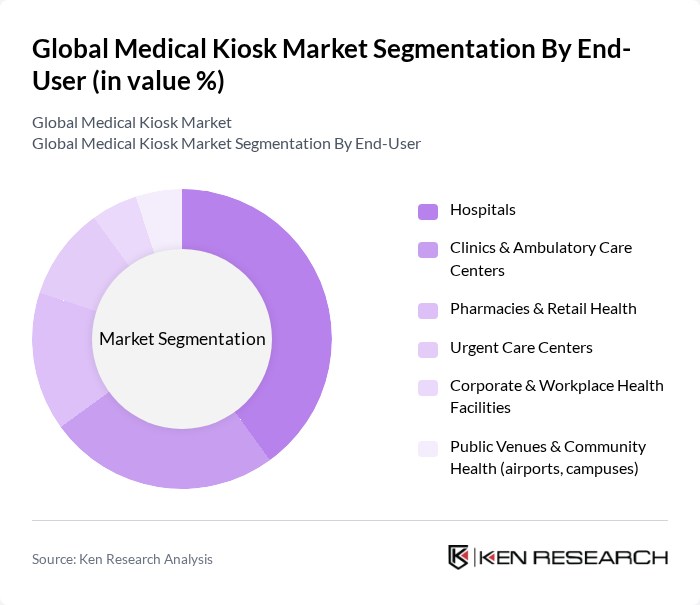

By End-User:The market is segmented based on end-users, including Hospitals, Clinics & Ambulatory Care Centers, Pharmacies & Retail Health, Urgent Care Centers, Corporate & Workplace Health Facilities, and Public Venues & Community Health (airports, campuses). Hospitals are the dominant end-user segment, driven by the need for efficient patient management systems, EHR-integrated self?service workflows, and the increasing use of kiosks for registration, eligibility, co?pay, and wayfinding in high?volume settings .

The Global Medical Kiosk Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, KIOSK Information Systems (a Posiflex Group company), OLEA Kiosks Inc., Diebold Nixdorf, Advanced Kiosks (H32 Design & Development), ZIVELO (now part of Verifone), Meridian Kiosks, RedyRef Interactive Kiosks, Vecna Healthcare, eKiosk GmbH, Kiosk Group, Inc., Aila Technologies, Advantech Co., Ltd., Fabcon (Fabcon Engineering, Inc.), Oracle Corporation (Cerner-integrated kiosk software) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the medical kiosk market is poised for significant growth, driven by technological advancements and an increasing focus on patient-centered care. As healthcare providers seek to enhance operational efficiency and patient engagement, the integration of AI and contactless technologies will become more prevalent. Additionally, the ongoing shift towards telehealth services will further propel the demand for kiosks, enabling seamless patient interactions and data collection in various healthcare environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Patient Check-In Kiosks Prescription/Pharmacy Kiosks Health Screening/Diagnostic Kiosks Telehealth/Telemedicine Kiosks Payment/Billing Kiosks Wayfinding & Patient Education Kiosks Other Specialized Kiosks (e.g., triage, vaccination) |

| By End-User | Hospitals Clinics & Ambulatory Care Centers Pharmacies & Retail Health Urgent Care Centers Corporate & Workplace Health Facilities Public Venues & Community Health (airports, campuses) |

| By Application | Patient Registration & Scheduling Payment & Insurance Verification Health Monitoring & Vitals Screening Information & Wayfinding Telemedicine & Remote Consultations E?Prescription & Refill Management |

| By Distribution Channel | Direct Sales (OEMs/ISVs) System Integrators & Distributors Online/Inside Sales Strategic/VAR Partnerships Managed Service Providers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Country Spotlight (U.S., Canada, U.K., Germany, France, China, Japan, India, Brazil, South Africa) |

| By Price Range | Entry/Low-End Kiosks Mid-Range Kiosks Premium/High-End Kiosks |

| By Technology | Touchscreen & Contactless (NFC/QR) Biometric Authentication (fingerprint, facial) Cloud-Connected Software AI/ML-Enabled Features Integrated Peripherals (printers, scanners, vitals sensors) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Adoption | 120 | Hospital Administrators, Clinic Managers |

| Patient Experience with Kiosks | 100 | Patients, Caregivers |

| Technology Vendor Insights | 80 | Product Managers, Sales Executives |

| Regulatory Impact Assessment | 60 | Healthcare Policy Analysts, Compliance Officers |

| Market Trends and Innovations | 70 | Industry Analysts, Research Scientists |

The Global Medical Kiosk Market is valued at approximately USD 1.6 billion, reflecting a consistent trend in patient self-service and digital engagement within healthcare settings. This valuation is based on a five-year historical analysis of the market.