Region:Global

Author(s):Shubham

Product Code:KRAB0536

Pages:99

Published On:August 2025

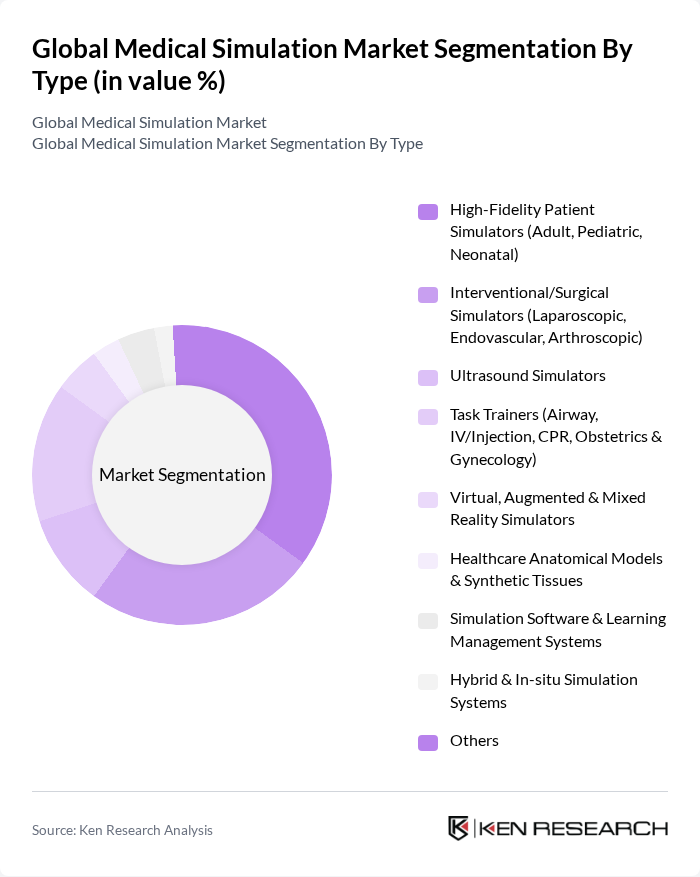

By Type:The market is segmented into various types of medical simulation technologies, including high-fidelity patient simulators, interventional/surgical simulators, ultrasound simulators, task trainers, virtual/augmented/mixed reality simulators, healthcare anatomical models, simulation software, hybrid systems, and others. Among these, high-fidelity patient simulators are leading the market due to their realistic representation of human physiology and ability to provide immersive training experiences. The demand for these simulators is driven by their effectiveness in enhancing clinical skills and decision-making abilities among healthcare professionals. Recent growth catalysts include expanded use of VR/AR for procedural rehearsal, increased demand for minimally invasive surgery training, and broader LMS/analytics integration into simulation centers in hospitals and academic institutions .

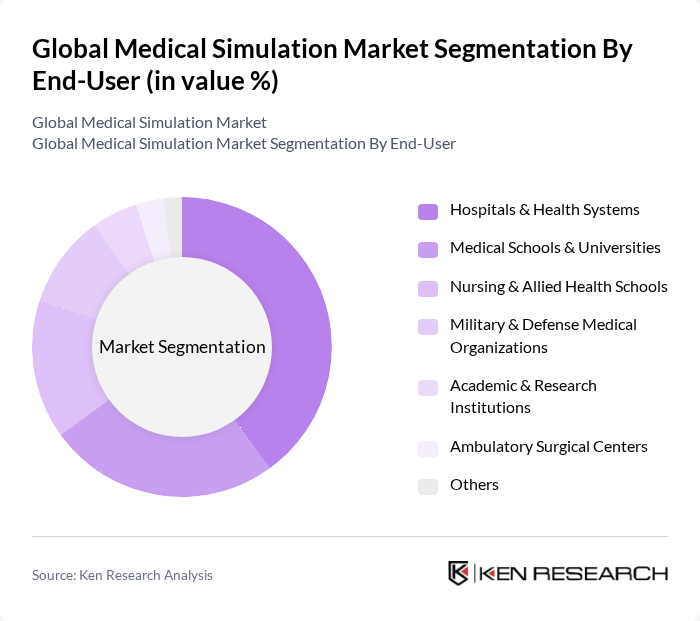

By End-User:The end-user segmentation includes hospitals and health systems, medical schools and universities, nursing and allied health schools, military and defense medical organizations, academic and research institutions, ambulatory surgical centers, and others. Hospitals and health systems are the leading end-users, driven by the need for continuous training and skill enhancement of healthcare staff. The increasing focus on patient safety and quality of care in these institutions further propels the demand for medical simulation technologies. Growth is reinforced by academic program expansions and government/charitable grants that extend simulation to rural and community settings .

The Global Medical Simulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Laerdal Medical AS, CAE Healthcare (CAE Inc.), Gaumard Scientific Company, Inc., 3D Systems, Inc. (Simbionix/Surgical AR/VR), Limbs & Things Ltd., Simulab Corporation, SynDaver Labs, Mentice AB, VirtaMed AG, Intelligent Ultrasound Group plc, InSimo SAS, Kyoto Kagaku Co., Ltd., Adam,Rouilly Ltd., MedVision Group, B-Line Medical (AdvSim; a CAE company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical simulation market appears promising, driven by technological advancements and an increasing emphasis on quality healthcare. As healthcare systems worldwide continue to evolve, the integration of simulation training into curricula is expected to become standard practice. Additionally, the growing recognition of the importance of interprofessional education will further enhance collaboration among healthcare professionals, ultimately leading to improved patient care and safety outcomes in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Fidelity Patient Simulators (Adult, Pediatric, Neonatal) Interventional/Surgical Simulators (Laparoscopic, Endovascular, Arthroscopic) Ultrasound Simulators Task Trainers (Airway, IV/Injection, CPR, Obstetrics & Gynecology) Virtual, Augmented & Mixed Reality Simulators Healthcare Anatomical Models & Synthetic Tissues Simulation Software & Learning Management Systems Hybrid & In-situ Simulation Systems Others |

| By End-User | Hospitals & Health Systems Medical Schools & Universities Nursing & Allied Health Schools Military & Defense Medical Organizations Academic & Research Institutions Ambulatory Surgical Centers Others |

| By Application | Medical Training & Education Surgical & Interventional Training Emergency & Trauma Response Team Training & Interprofessional Education Patient Safety & Risk Management Others |

| By Component | Hardware (Manikins, Sensors, Haptics) Software (Authoring, Scenario Management, Analytics) Services (Installation, Training, Simulation-as-a-Service) |

| By Sales Channel | Direct Sales to Institutions Value-Added Distributors/Resellers Online & E-Procurement Others |

| By Delivery Mode | On-Premise Simulation Centers Web-Based & Cloud-Delivered Simulation Mobile & In-situ Simulation |

| By Price Range | Entry-Level Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Schools and Training Institutions | 120 | Deans, Curriculum Directors, Simulation Coordinators |

| Healthcare Providers and Hospitals | 110 | Chief Medical Officers, Training Managers, Nursing Educators |

| Medical Simulation Technology Manufacturers | 80 | Product Managers, Sales Directors, R&D Heads |

| Regulatory Bodies and Accreditation Organizations | 50 | Policy Makers, Accreditation Officers, Compliance Managers |

| Healthcare Simulation Research Institutions | 70 | Research Directors, Academic Researchers, Grant Managers |

The Global Medical Simulation Market is valued at approximately USD 2.6 billion, driven by the increasing emphasis on patient safety, standardized clinical training, and the integration of advanced simulation technologies in medical education and hospital training programs.