Region:Global

Author(s):Shubham

Product Code:KRAC0796

Pages:100

Published On:August 2025

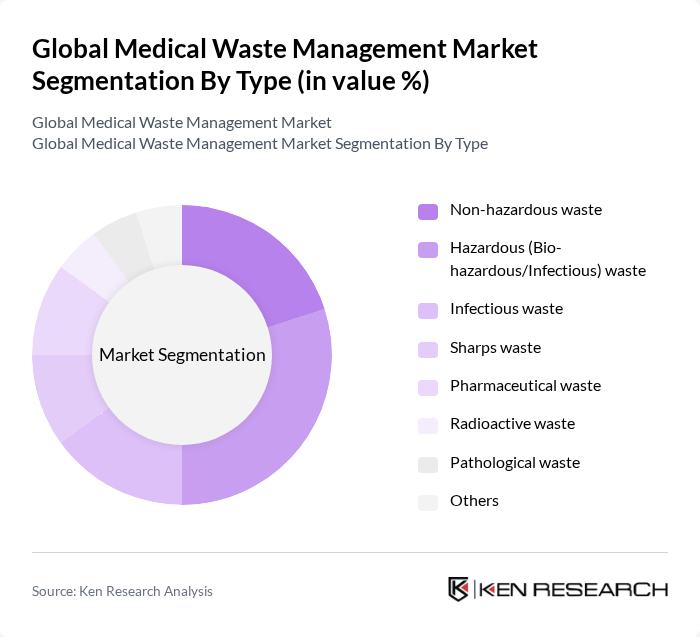

By Type:The market is segmented into various types of medical waste, including non-hazardous waste, hazardous (bio-hazardous/infectious) waste, infectious waste, sharps waste, pharmaceutical waste, radioactive waste, pathological waste, and others. Among these,hazardous wasteis the most significant segment due to the increasing regulations and awareness regarding the safe disposal of potentially harmful materials. Hazardous waste includes biohazardous, infectious, and chemical waste, which require specialized handling and treatment to prevent environmental and health risks .

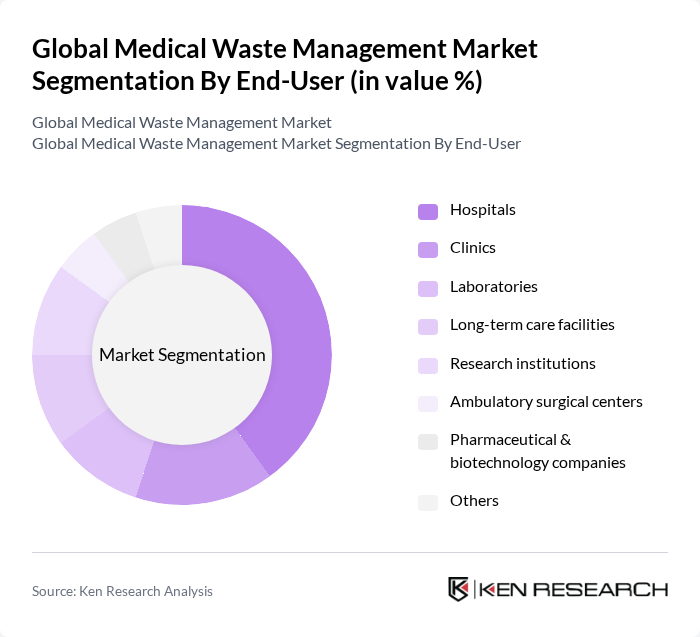

By End-User:The end-user segmentation includes hospitals, clinics, laboratories, long-term care facilities, research institutions, ambulatory surgical centers, pharmaceutical & biotechnology companies, and others.Hospitalsare the leading segment, primarily due to the high volume of waste generated from various medical procedures and treatments. Hospitals generate the majority of both hazardous and non-hazardous medical waste, driven by the scale and diversity of healthcare services provided .

The Global Medical Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stericycle, Inc., Veolia Environnement S.A., Waste Management, Inc., Republic Services, Inc., Clean Harbors, Inc., Daniels Health, MedPro Disposal, BioMedical Waste Solutions, GFL Environmental Inc., SUEZ S.A., Covanta Holding Corporation, Sharps Compliance, Inc., Remondis Medison GmbH, Triumvirate Environmental, Inc., Waste Connections, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of medical waste management is poised for transformation, driven by technological advancements and regulatory changes. As healthcare facilities increasingly adopt digital solutions for waste tracking, efficiency and compliance will improve. Furthermore, the emphasis on circular economy principles will encourage innovative waste treatment technologies. In future, partnerships between waste management companies and healthcare providers are expected to strengthen, fostering sustainable practices and enhancing overall waste management effectiveness in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-hazardous waste Hazardous (Bio-hazardous/Infectious) waste Infectious waste Sharps waste Pharmaceutical waste Radioactive waste Pathological waste Others |

| By End-User | Hospitals Clinics Laboratories Long-term care facilities Research institutions Ambulatory surgical centers Pharmaceutical & biotechnology companies Others |

| By Waste Treatment Method | Incineration Autoclaving Chemical treatment Microwave treatment Landfilling Recycling Others |

| By Collection Method | On-site collection Off-site collection Scheduled collection Emergency collection Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Service Type | Collection services Transportation services Treatment services Disposal services Consulting services Onsite services Offsite services Others |

| By Compliance Level | Fully compliant Partially compliant Non-compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Waste Management | 120 | Facility Managers, Environmental Health Officers |

| Pharmaceutical Waste Disposal | 60 | Pharmacy Managers, Compliance Officers |

| Clinical Waste Treatment | 50 | Waste Management Supervisors, Operations Managers |

| Regulatory Compliance in Waste Management | 40 | Regulatory Affairs Specialists, Legal Advisors |

| Innovative Waste Management Technologies | 45 | Technology Developers, R&D Managers |

The Global Medical Waste Management Market is valued at approximately USD 13 billion, driven by increasing healthcare activities, environmental sustainability awareness, and stringent waste disposal regulations.