Region:Global

Author(s):Dev

Product Code:KRAD0529

Pages:96

Published On:August 2025

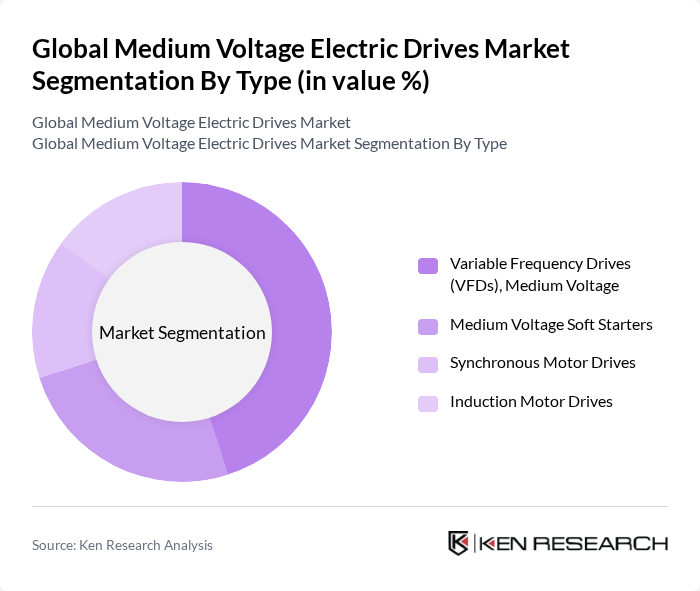

By Type:The medium voltage electric drives market is segmented into various types, including Variable Frequency Drives (VFDs), Medium Voltage Soft Starters, Synchronous Motor Drives, and Induction Motor Drives. Among these, Variable Frequency Drives (VFDs) are the most widely used due to their ability to control motor speed and torque, leading to significant energy savings and improved process control in pumps, compressors, fans, conveyors, and similar applications. The increasing demand for energy-efficient solutions in industrial applications is driving the growth of VFDs, making them the leading subsegment in this market.

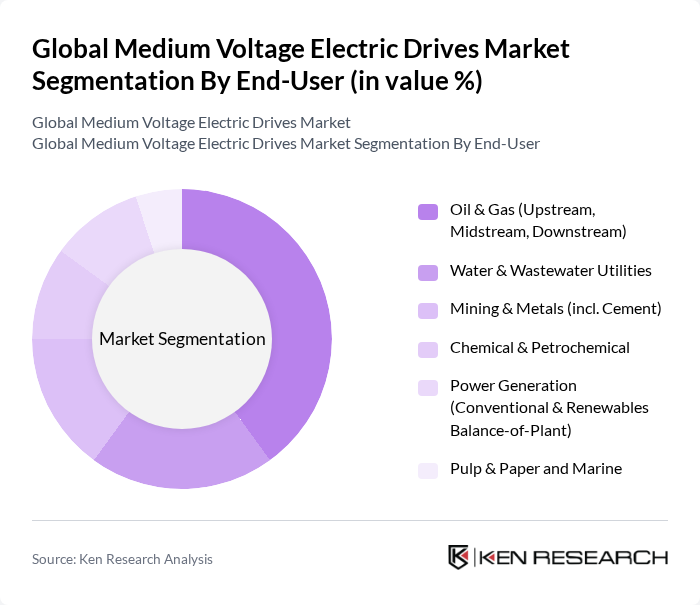

By End-User:The end-user segmentation of the medium voltage electric drives market includes Oil & Gas (Upstream, Midstream, Downstream), Water & Wastewater Utilities, Mining & Metals (including Cement), Chemical & Petrochemical, Power Generation (Conventional & Renewables Balance-of-Plant), and Pulp & Paper and Marine. The Oil & Gas sector is the dominant end-user, driven by the need for efficient and reliable power solutions in exploration, production, and refining processes—where MV drives provide high-torque, variable-speed control for pumps and compressors to cut energy use and downtime. Increasing investments in oil and gas infrastructure, alongside modernization of water/wastewater treatment and expansion in mining and materials handling, further propel demand for medium voltage electric drives.

The Global Medium Voltage Electric Drives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Schneider Electric SE, Rockwell Automation, Inc., Mitsubishi Electric Corporation, Emerson Electric Co., General Electric Company (GE Vernova), Danfoss A/S (Incl. Vacon heritage), Toshiba International Corporation, Yaskawa Electric Corporation, Nidec Corporation, Inovance Technology Co., Ltd., Control Techniques Ltd. (Nidec), Delta Electronics, Inc., Parker Hannifin Corporation, WEG S.A., Fuji Electric Co., Ltd., TMEIC (Toshiba Mitsubishi-Electric Industrial Systems), LS Electric Co., Ltd., Eaton Corporation plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medium voltage electric drives market appears promising, driven by technological advancements and increasing demand for sustainable solutions. As industries continue to embrace digitalization and automation, the integration of IoT technologies into electric drives will enhance operational efficiency and predictive maintenance capabilities. Furthermore, the ongoing transition towards renewable energy sources will create new opportunities for electric drive applications, particularly in energy management and smart grid technologies, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Variable Frequency Drives (VFDs), Medium Voltage Medium Voltage Soft Starters Synchronous Motor Drives Induction Motor Drives |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Water & Wastewater Utilities Mining & Metals (incl. Cement) Chemical & Petrochemical Power Generation (Conventional & Renewables Balance-of-Plant) Pulp & Paper and Marine |

| By Application | Pumps Fans & Blowers Compressors Conveyors/Crushers/Mills HVAC Large Systems and Chillers |

| By Distribution Channel | Direct (OEM/Project) Sales System Integrators & EPCs Authorized Distributors Online/Inside Sales (Spare Parts & Services) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Power Rating | –1 MW –3 MW Above 3 MW |

| By Integration | Standalone Drives Integrated Drive Systems (with Motors/PLC) Drive Panels & Skid-Mounted Packages |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Applications | 140 | Plant Managers, Operations Directors |

| Commercial HVAC Systems | 100 | Facility Managers, Energy Efficiency Consultants |

| Water and Wastewater Treatment | 80 | Environmental Engineers, Project Managers |

| Mining and Mineral Processing | 70 | Mining Engineers, Equipment Procurement Officers |

| Oil & Gas Sector | 90 | Field Engineers, Asset Managers |

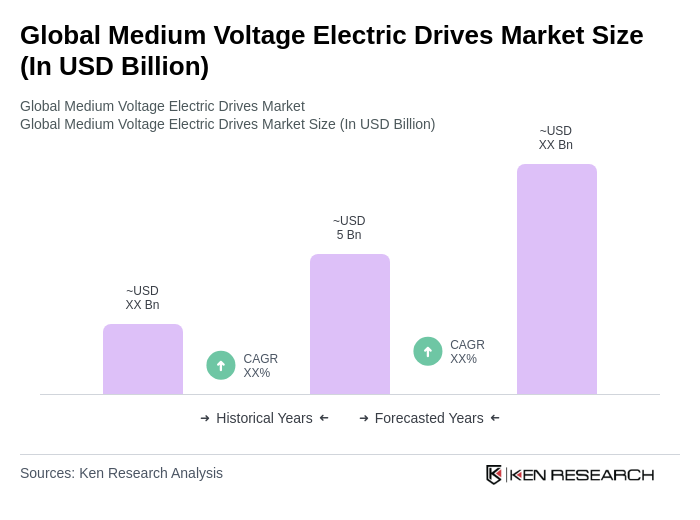

The Global Medium Voltage Electric Drives Market is valued at approximately USD 5 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand for energy efficiency and automation across various industries.