Region:Global

Author(s):Shubham

Product Code:KRAC0762

Pages:92

Published On:August 2025

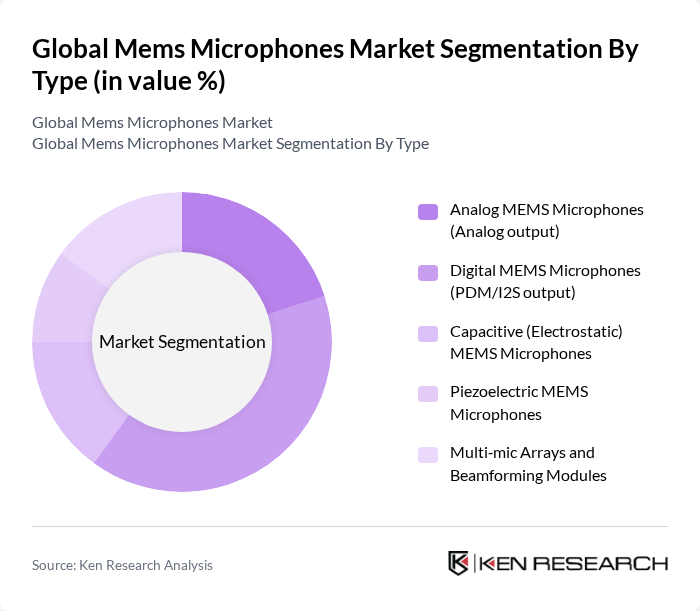

By Type:The MEMS microphones market can be segmented into various types, including Analog MEMS Microphones, Digital MEMS Microphones, Capacitive MEMS Microphones, Piezoelectric MEMS Microphones, and Multi-mic Arrays and Beamforming Modules. Among these, Digital MEMS Microphones are currently leading the market due to their superior performance in terms of sound quality and integration capabilities in modern devices. The increasing demand for digital audio processing in smartphones and smart speakers has significantly contributed to the growth of this segment.

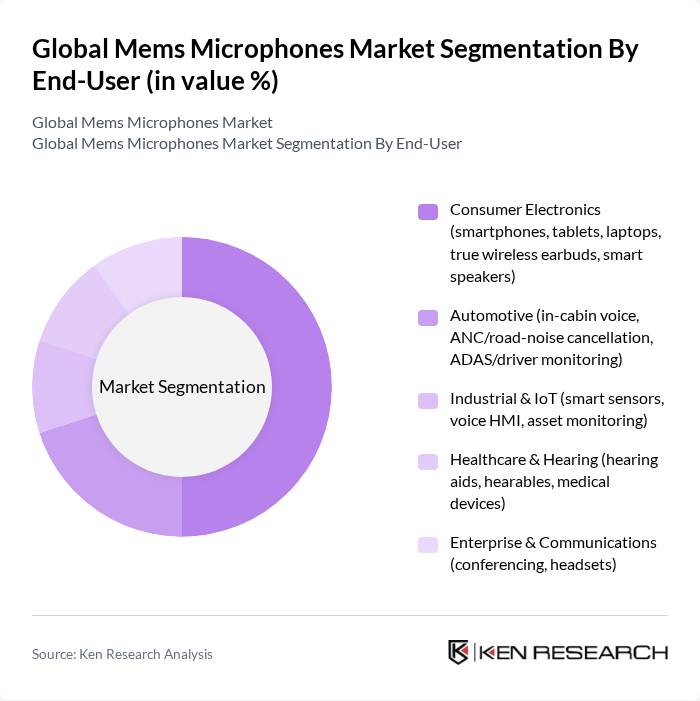

By End-User:The end-user segmentation includes Consumer Electronics, Automotive, Industrial & IoT, Healthcare & Hearing, and Enterprise & Communications. The Consumer Electronics segment is the most dominant, driven by the rapid growth of smartphones, tablets, and smart speakers. The increasing consumer preference for high-quality audio experiences and the integration of voice assistants in everyday devices have propelled this segment's growth significantly.

The Global MEMS Microphones Market is characterized by a dynamic mix of regional and international players. Leading participants such as Knowles Corporation, STMicroelectronics, TDK Corporation (including InvenSense), Bosch Sensortec GmbH, Cirrus Logic, Inc., AAC Technologies Holdings Inc., ON Semiconductor Corporation (onsemi), Analog Devices, Inc., NXP Semiconductors N.V., Microchip Technology Inc., Infineon Technologies AG, Qualcomm Technologies, Inc., Texas Instruments Incorporated, Goertek Inc., BSE (BEST) Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the MEMS microphones market appears promising, driven by technological advancements and evolving consumer preferences. As the demand for wireless audio solutions continues to rise, manufacturers are likely to focus on enhancing the integration of MEMS microphones with AI and smart technologies. Additionally, the growing trend towards sustainability will push companies to develop eco-friendly products, ensuring compliance with environmental regulations while meeting consumer expectations for responsible manufacturing practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog MEMS Microphones (Analog output) Digital MEMS Microphones (PDM/I2S output) Capacitive (Electrostatic) MEMS Microphones Piezoelectric MEMS Microphones Multi?mic Arrays and Beamforming Modules |

| By End-User | Consumer Electronics (smartphones, tablets, laptops, true wireless earbuds, smart speakers) Automotive (in-cabin voice, ANC/road-noise cancellation, ADAS/driver monitoring) Industrial & IoT (smart sensors, voice HMI, asset monitoring) Healthcare & Hearing (hearing aids, hearables, medical devices) Enterprise & Communications (conferencing, headsets) |

| By Application | Mobile Phones & Tablets True Wireless Stereo (TWS) and Wearables Smart Home & Voice Assistants (smart speakers, hubs, appliances) Automotive Systems (ANC, hands-free, voice assistants) AR/VR/MR Devices and Gaming Hearing Aids and Hearables |

| By Distribution Channel | Direct Sales to OEMs/ODMs Authorized Distributors Online Components Marketplaces Design Houses/Module Integrators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry (Sub-$0.20) Mid (US$0.20–$0.60) Premium (Above US$0.60) Automotive/Medical-Grade |

| By Technology | Signal-to-Noise Ratio (SNR) Class: <60 dB, 60–65 dB, >65 dB Directionality: Omnidirectional vs. Directional (beamforming arrays) Acoustic Performance: Low-Noise, High AOP, Wide Dynamic Range Interface & Power: Analog, PDM, I2S; ultra?low power/always?on voice |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 120 | Product Development Managers, Audio Engineers |

| Automotive Industry Applications | 90 | R&D Engineers, Procurement Managers |

| Healthcare Device Manufacturers | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Smart Home Technology Developers | 50 | Technical Leads, Product Managers |

| Telecommunications Equipment Providers | 70 | Network Engineers, Product Strategy Directors |

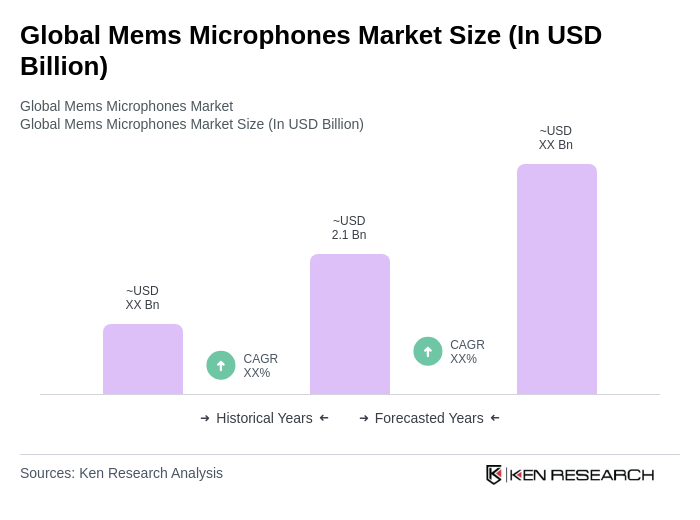

The Global MEMS Microphones Market is valued at approximately USD 2.1 billion, driven by the increasing demand for high-quality audio in consumer electronics, automotive applications, and smart home devices.