Region:Global

Author(s):Dev

Product Code:KRAC0388

Pages:93

Published On:August 2025

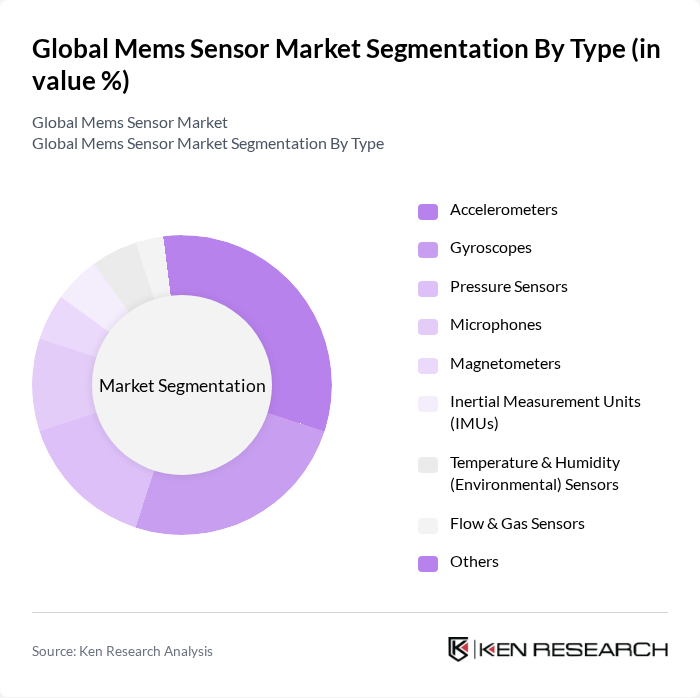

By Type:The MEMS sensor market is segmented into various types, including accelerometers, gyroscopes, pressure sensors, microphones, magnetometers, inertial measurement units (IMUs), temperature & humidity sensors, flow & gas sensors, and others. Among these, accelerometers and gyroscopes are the most dominant due to their extensive use in smartphones, automotive applications, and wearable devices. The increasing demand for motion sensing and orientation detection in consumer electronics has significantly boosted the market for these subsegments.

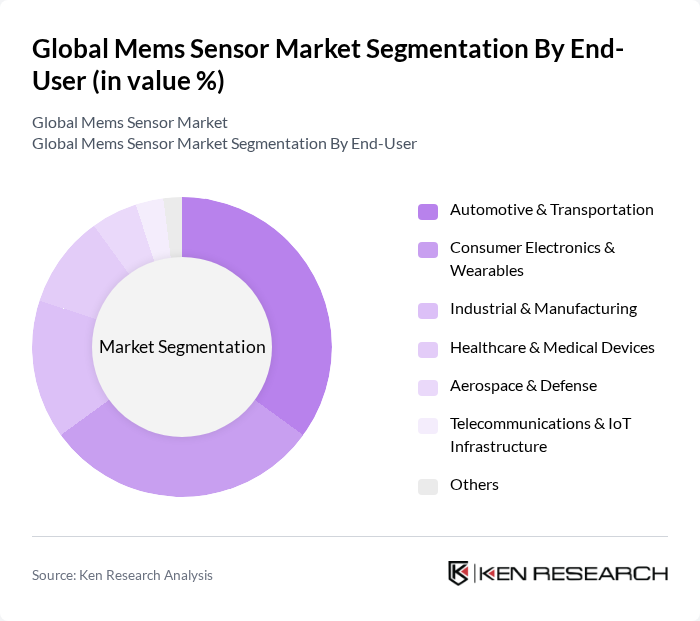

By End-User:The MEMS sensor market is also categorized by end-user applications, including automotive & transportation, consumer electronics & wearables, industrial & manufacturing, healthcare & medical devices, aerospace & defense, telecommunications & IoT infrastructure, and others. The automotive & transportation sector is the leading end-user, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the growing demand for safety features in vehicles.

The Global MEMS Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch Sensortec GmbH (Robert Bosch GmbH), STMicroelectronics N.V., Analog Devices, Inc., Honeywell International Inc., InvenSense, Inc. (TDK Corporation), Texas Instruments Incorporated, NXP Semiconductors N.V., Murata Manufacturing Co., Ltd., Qualcomm Technologies, Inc., MEMSIC, Inc., Kionix, Inc. (ROHM Co., Ltd.), Infineon Technologies AG, TDK Corporation (including InvenSense & Micronas), Omron Corporation, Seiko Epson Corporation, Sensirion AG, ams-OSRAM AG, TE Connectivity Ltd. (Measurement Specialties), Goertek Inc., AAC Technologies Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The MEMS sensor market is poised for significant advancements driven by technological innovations and increasing integration with AI and machine learning. As industries prioritize automation and data-driven decision-making, the demand for MEMS sensors is expected to rise. Additionally, the focus on environmental sustainability will lead to the development of eco-friendly MEMS solutions. Companies are likely to invest in R&D to enhance sensor capabilities, ensuring they remain competitive in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Accelerometers Gyroscopes Pressure Sensors Microphones Magnetometers Inertial Measurement Units (IMUs) Temperature & Humidity (Environmental) Sensors Flow & Gas Sensors Others |

| By End-User | Automotive & Transportation Consumer Electronics & Wearables Industrial & Manufacturing Healthcare & Medical Devices Aerospace & Defense Telecommunications & IoT Infrastructure Others |

| By Application | Smartphones & Tablets Wearable Devices & Hearables ADAS & Vehicle Safety Systems Robotics & Drones Industrial Condition Monitoring Environmental & Smart Home Monitoring Medical Monitoring & Diagnostics Others |

| By Component | MEMS Dies/Chips Packaging & Test Sensor Fusion Software & Algorithms Calibration & Reference Designs |

| By Sales Channel | Direct (OEM) Sales Distributors & Representatives Online/Marketplace Sales |

| By Distribution Mode | Contract Manufacturers (Foundry/OSAT) In-house Manufacturing Hybrid (Fab-lite) |

| By Price Range | Entry-Level Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive MEMS Sensors | 140 | Automotive Engineers, Product Development Managers |

| Healthcare MEMS Applications | 100 | Medical Device Engineers, Regulatory Affairs Specialists |

| Consumer Electronics MEMS | 120 | Product Managers, Electronics Engineers |

| Industrial MEMS Sensors | 80 | Operations Managers, Industrial Engineers |

| MEMS Sensor Research & Development | 90 | R&D Directors, Technology Analysts |

The Global MEMS Sensor Market is valued at approximately USD 17 billion, driven by the increasing demand for miniaturized sensors across various sectors, including consumer electronics, automotive applications, and industrial automation.