Region:Global

Author(s):Rebecca

Product Code:KRAA1462

Pages:85

Published On:August 2025

By Type:The market is segmented into various types of applications that cater to different aspects of menstrual health. The dominant sub-segment is Period Tracking Apps, which have gained immense popularity due to their user-friendly interfaces and the ability to provide personalized insights. These apps allow users to track their menstrual cycles, symptoms, and overall reproductive health, making them essential tools for many women. Other types, such as Fertility Tracking Apps and Wellness and Lifestyle Apps, are also gaining traction as they address broader health concerns, including symptom management, education, and community support.

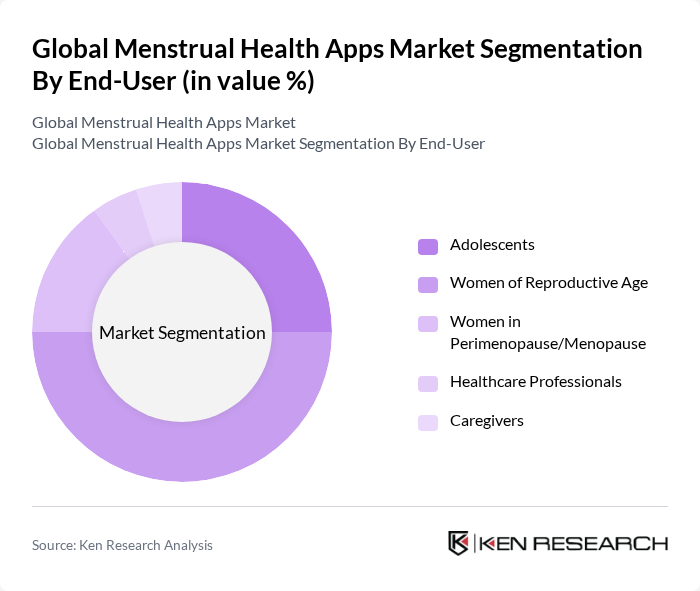

By End-User:The end-user segmentation includes various demographics that utilize menstrual health apps. The leading sub-segment is Women of Reproductive Age, who actively seek tools to manage their menstrual health and fertility. This demographic is increasingly tech-savvy and relies on mobile applications for health management. Adolescents and Women in Perimenopause/Menopause are also significant users, as they require tailored solutions for their specific health needs. Healthcare professionals and caregivers use these apps to support patient education and care coordination.

The Global Menstrual Health Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Clue (BioWink GmbH), Flo Health, Inc., Glow, Inc., Ovia Health (Labcorp), GP Apps (Period Tracker), MyFLO (Flo Living LLC), Cycles (Perigee AB), Life Period (Life Healthcare, Inc.), Eve by Glow, Menstrual Health Hub (MHHub), My Menstrual Calendar (SimpleInnovation LLC), Period Pal (Amila App), Lady Cycle (Christian Frank), Maya (Plackal Tech), HealthTap, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of menstrual health apps appears promising, driven by technological advancements and evolving consumer preferences. As integration with wearable technology becomes more prevalent, users will benefit from enhanced tracking capabilities and real-time health insights. Additionally, the growing emphasis on mental health will likely lead to the incorporation of wellness features within these apps, fostering a holistic approach to menstrual health. Companies that adapt to these trends will be well-positioned to capture a larger share of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Period Tracking Apps Fertility Tracking Apps Symptom Tracking Apps Wellness and Lifestyle Apps Educational Apps Community Support Apps Menopause Tracking Apps Pregnancy Planning Apps Others |

| By End-User | Adolescents Women of Reproductive Age Women in Perimenopause/Menopause Healthcare Professionals Caregivers |

| By Distribution Channel | App Stores (Google Play, Apple App Store) Direct Downloads from Company Websites Partnerships with Healthcare Providers/Organizations Social Media Promotions & Influencer Marketing Telehealth Platform Integrations |

| By Pricing Model | Free Apps Freemium Apps Subscription-Based Apps One-Time Purchase Apps In-App Purchases/Upgrades |

| By Feature Set | Basic Tracking Features (Cycle, Symptoms) Advanced Analytics & AI-Based Insights Community Interaction & Support Integration with Wearables & Health Devices Telemedicine/Consultation Features Educational Content & Resources |

| By User Engagement Level | High Engagement (Daily/Weekly Active Users) Moderate Engagement (Monthly Active Users) Low Engagement (Occasional Users) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Menstrual Health App Users | 120 | Women aged 18-45, Regular app users |

| Healthcare Professionals | 90 | Gynecologists, Family Physicians, Health Educators |

| App Developers | 60 | Product Managers, UX/UI Designers, Software Engineers |

| Market Analysts | 50 | Industry Analysts, Research Consultants, Data Scientists |

| Investors in Health Tech | 40 | Venture Capitalists, Angel Investors, Health Tech Fund Managers |

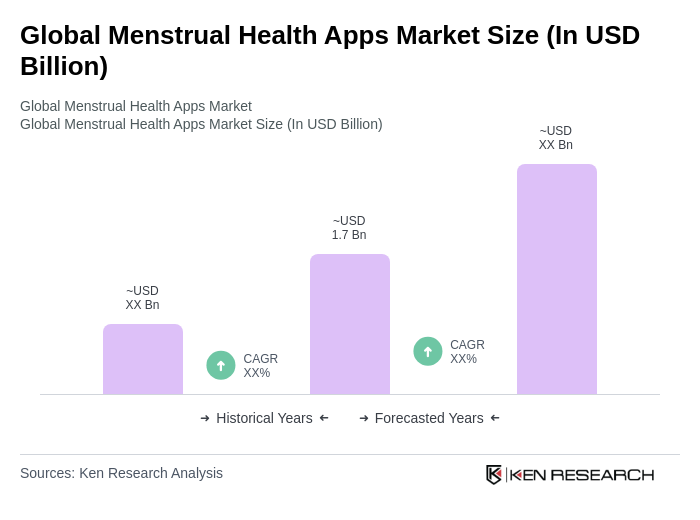

The Global Menstrual Health Apps Market is valued at approximately USD 1.7 billion, reflecting a significant growth trend driven by increased awareness of menstrual health and the adoption of mobile health technologies.