Region:Global

Author(s):Shubham

Product Code:KRAD0669

Pages:84

Published On:August 2025

By Type:The menswear market can be segmented into various types, including Suits & Formalwear, Casualwear, Sportswear & Athleisure, Activewear & Performance, Outerwear, Innerwear & Loungewear, and Accessories. Each of these segments caters to different consumer needs and preferences, reflecting the diverse nature of men's fashion .

The Casualwear segment is currently dominating the market, driven by a shift in consumer preferences towards comfort and versatility. This shift has been reinforced by hybrid work models and ongoing adoption of athleisure and relaxed silhouettes across occasions, particularly among younger cohorts .

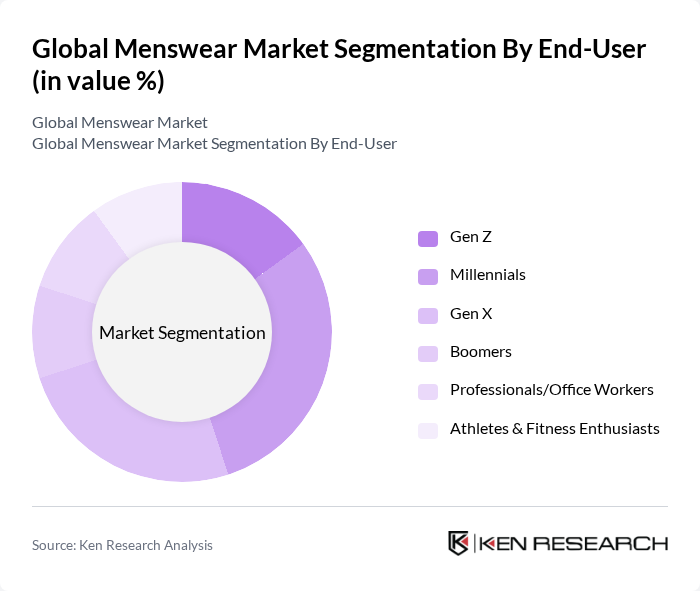

By End-User:The menswear market can also be segmented by end-user demographics, including Gen Z, Millennials, Gen X, Boomers, Professionals/Office Workers, and Athletes & Fitness Enthusiasts. Each demographic has distinct preferences and purchasing behaviors that influence market trends. In particular, digital-native Gen Z and Millennials show higher engagement with online channels, sustainability claims, and casual/athleisure categories, influencing assortment and marketing strategies .

Millennials are the leading end-user segment, characterized by their strong inclination towards fashion and brand engagement. This demographic is responsive to trends and values sustainability and digital shopping convenience, prompting brands to emphasize responsible materials, transparency, and omnichannel experiences .

The Global Menswear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, H&M Hennes & Mauritz AB, Zara (Industria de Diseño Textil, S.A. – Inditex), Levi Strauss & Co., Ralph Lauren Corporation, Under Armour, Inc., Fast Retailing Co., Ltd. (Uniqlo), Lululemon Athletica Inc., Gap Inc., Tommy Hilfiger (PVH Corp.), Calvin Klein (PVH Corp.), Hugo Boss AG, Indochino (Indochino Apparel Inc.), Next plc, ASOS plc, Boohoo Group plc (boohooMAN), Marks and Spencer Group plc, VF Corporation (The North Face, Timberland), Kering (Gucci, Saint Laurent – menswear lines) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the menswear market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to invest in eco-friendly materials and practices, aligning with consumer demand for responsible fashion. Additionally, the integration of augmented reality in online shopping experiences is likely to enhance customer engagement, making the purchasing process more interactive and personalized, thus driving sales growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Suits & Formalwear (suits, blazers, dress shirts, trousers) Casualwear (shirts, polos, chinos, denim) Sportswear & Athleisure (training apparel, joggers, hoodies) Activewear & Performance (gym wear, compression, technical tees) Outerwear (jackets, coats, parkas) Innerwear & Loungewear (underwear, socks, sleepwear) Accessories (belts, ties, caps, small leather goods) |

| By End-User | Gen Z (aged ~12–27) Millennials (aged ~28–43) Gen X (aged ~44–59) Boomers (aged ~60+) Professionals/Office Workers Athletes & Fitness Enthusiasts |

| By Distribution Channel | Online (brand.com, marketplaces) Specialty Retailers Department Stores Supermarkets/Hypermarkets Direct-to-Consumer (owned stores, subscriptions) Off-price & Outlet Stores |

| By Price Range | Mass/Budget Mid-Range Premium Luxury |

| By Fabric Type | Cotton & Organic Cotton Polyester & Recycled Polyester Wool & Merino Linen Blends (cotton-poly, stretch blends) Performance Fabrics (moisture-wicking, technical) |

| By Occasion | Work & Business Casual & Weekend Sports & Training Formal & Events Travel & Outdoor |

| By Brand/Buyer Profile | Brand-Conscious Price-Sensitive/Value Quality- & Fit-Seeking Trend- & Streetwear-Focused Sustainability-Minded |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Menswear Retailers | 120 | Store Managers, Regional Directors |

| Fashion Designers | 90 | Creative Directors, Design Managers |

| Consumer Insights | 140 | Fashion Enthusiasts, Regular Shoppers |

| Online Retail Platforms | 80 | E-commerce Managers, Digital Marketing Heads |

| Supply Chain Experts | 70 | Logistics Managers, Procurement Specialists |

The Global Menswear Market is valued at approximately USD 620 billion, reflecting sustained demand and growth in e-commerce. This valuation is supported by historical analyses and industry trackers indicating a consistent market presence in the low-to-mid USD 600 billion range.