Region:Global

Author(s):Geetanshi

Product Code:KRAC0138

Pages:91

Published On:August 2025

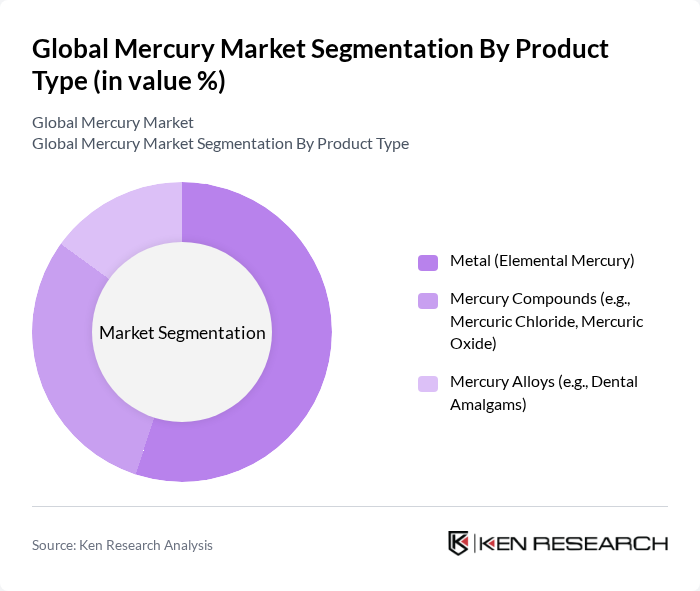

By Product Type:The product types in the mercury market include Metal (Elemental Mercury), Mercury Compounds (such as Mercuric Chloride and Mercuric Oxide), and Mercury Alloys (notably Dental Amalgams). Metal (Elemental Mercury) remains the leading subsegment due to its widespread use in electrical devices, scientific instruments, and industrial processes. Mercury compounds are also significant, particularly in healthcare, chemical synthesis, and catalysts. Mercury alloys are primarily utilized in dental applications, though their use is declining in regions with stricter regulations .

By Application:Mercury is used in Electrical & Electronics (including switches, relays, and lamps), Batteries, Measuring & Controlling Devices (such as thermometers and barometers), Dental Applications, Gold Processing, and Chemical Synthesis & Catalysts. The Electrical & Electronics segment remains dominant due to mercury's essential role in specific electronic devices and lighting products. However, regulatory pressure is driving the adoption of mercury-free alternatives, especially in batteries and measuring devices. Dental applications persist in some regions, but are declining where amalgam restrictions are enforced .

The Global Mercury Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merck KGaA, Avantor, Inc. (Thermo Fisher Scientific), Sigma-Aldrich, China Minmetals Corporation, Hunan Nonferrous Metals Group Co., Ltd., Aldrett Hermanos SA de CV, Wake Group, American Elements, AHSA, China Jin Run Industrial Co., Ltd., Umicore, KGHM Polska Mied? S.A., Aurubis AG, Tohoku Chemical Co., Ltd., AGA AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mercury market is shaped by a combination of regulatory pressures and technological advancements. As industries increasingly adopt sustainable practices, the demand for eco-friendly alternatives is expected to rise. Innovations in mercury recovery technologies will likely enhance recycling efforts, reducing reliance on new mercury sources. Additionally, emerging markets in Asia and Africa present opportunities for growth, as these regions continue to develop their mining and manufacturing sectors while navigating regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Metal (Elemental Mercury) Mercury Compounds (e.g., Mercuric Chloride, Mercuric Oxide) Mercury Alloys (e.g., Dental Amalgams) |

| By Application | Electrical & Electronics (Switches, Relays, Lamps) Batteries Measuring & Controlling Devices (Thermometers, Barometers) Dental Applications Gold Processing Chemical Synthesis & Catalysts |

| By End-User Industry | Healthcare Mining Industrial Manufacturing Research & Laboratory |

| By Region | Asia-Pacific North America Europe Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mercury in Electronics Manufacturing | 100 | Production Managers, Quality Assurance Specialists |

| Dental Applications of Mercury | 60 | Dentists, Dental Product Suppliers |

| Industrial Uses of Mercury | 50 | Plant Managers, Safety Compliance Officers |

| Mercury Regulation Compliance | 40 | Environmental Compliance Managers, Legal Advisors |

| Mercury Remediation Technologies | 70 | Environmental Engineers, Project Managers |

The Global Mercury Market is valued at approximately USD 4.7 billion, driven by demand in sectors such as electronics, healthcare, industrial manufacturing, and gold processing. This valuation is based on a five-year historical analysis of market trends and growth.