Region:Global

Author(s):Shubham

Product Code:KRAC0823

Pages:85

Published On:August 2025

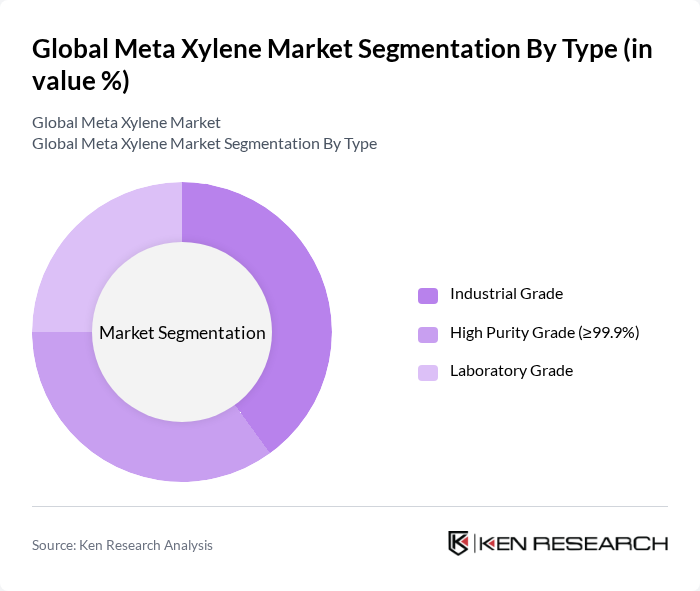

By Type:

The market is primarily dominated by theIndustrial Gradesegment, which accounts for a significant portion of the overall market share. This dominance is attributed to the high demand for industrial-grade meta xylene in applications such as the production of solvents, adhesives, and chemicals used in large-scale manufacturing. The continued expansion of the industrial sector, particularly in Asia-Pacific and North America, has led to increased consumption of industrial-grade products, reinforcing its position as the leading subsegment in the market.

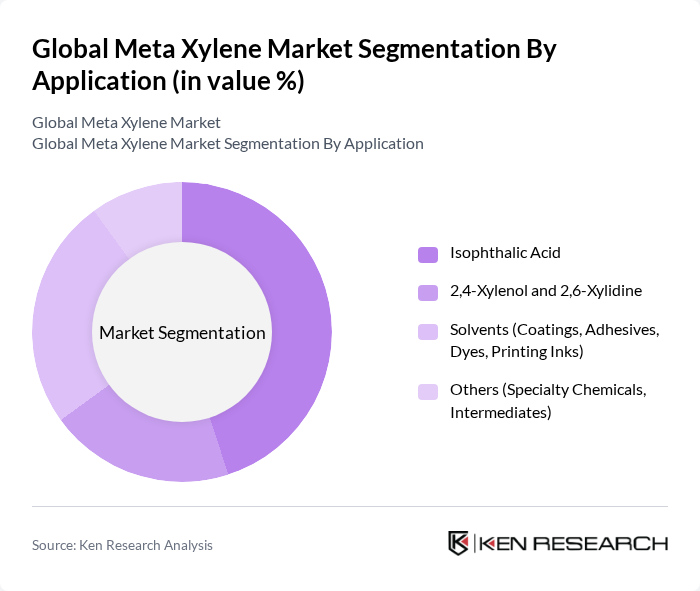

By Application:

TheIsophthalic Acidapplication segment is the largest in the market, driven by its extensive use in the production of high-performance plastics and resins. The rising demand for lightweight and durable materials in the automotive, construction, and packaging industries has significantly boosted the consumption of isophthalic acid, making it the leading application for meta xylene. The continued growth of the coatings and adhesives market further supports this trend, as manufacturers seek advanced materials for improved product performance.

The Global Meta Xylene Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Chevron Phillips Chemical Company, INEOS Group, Mitsubishi Gas Chemical Company, Inc., Reliance Industries Limited, LyondellBasell Industries, Eastman Chemical Company, Shell Chemicals, BASF SE, Formosa Plastics Corporation, SABIC, GS Caltex Corporation, Compañía Española de Petróleos S.A.U. (CEPSA), Lotte Chemical Corporation, Honeywell International Inc., Parchem Fine & Specialty Chemicals, Thermo Fisher Scientific Inc., Tokyo Chemical Industry Co., Ltd., Braskem S.A., Huntsman Corporation, and TotalEnergies SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the meta xylene market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt bio-based chemicals and circular economy principles, the demand for high-purity meta xylene is expected to rise. Additionally, digital transformation in supply chains will enhance operational efficiency, allowing companies to respond swiftly to market changes. These trends indicate a dynamic landscape where innovation and sustainability will play pivotal roles in shaping the market's trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade High Purity Grade (?99.9%) Laboratory Grade |

| By Application | Isophthalic Acid ,4-Xylenol and 2,6-Xylidine Solvents (Coatings, Adhesives, Dyes, Printing Inks) Others (Specialty Chemicals, Intermediates) |

| By End-User | Chemical Manufacturing Packaging Automotive Construction Pharmaceuticals |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America (United States, Canada) Europe (Germany, France, UK, Italy, Spain, Russia, Others) Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others) Latin America (Brazil, Mexico, Others) Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Others | Specialty Applications Niche Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Meta Xylene Production Facilities | 100 | Plant Managers, Production Supervisors |

| End-User Industries (e.g., Automotive, Paints) | 80 | Procurement Managers, Product Development Heads |

| Distribution and Logistics Companies | 60 | Logistics Coordinators, Supply Chain Analysts |

| Regulatory Bodies and Environmental Agencies | 50 | Policy Makers, Environmental Compliance Officers |

| Research Institutions and Academia | 40 | Research Scientists, Chemical Engineers |

The Global Meta Xylene Market is valued at approximately USD 210 billion, driven by increasing demand for meta xylene in the production of isophthalic acid, which is essential for manufacturing polyester resins and coatings.