Region:Global

Author(s):Geetanshi

Product Code:KRAA0077

Pages:93

Published On:August 2025

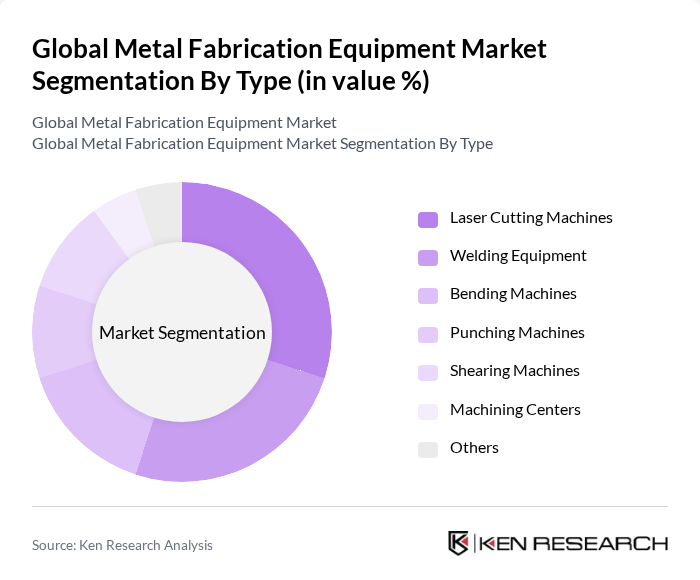

By Type:The market is segmented into various types of equipment, including Laser Cutting Machines, Welding Equipment, Bending Machines, Punching Machines, Shearing Machines, Machining Centers, and Others. Among these, Laser Cutting Machines and Welding Equipment are the most prominent due to their versatility and efficiency in various applications. The demand for these machines is driven by the need for precision and speed in manufacturing processes, particularly in industries such as automotive and aerospace. The adoption of CNC and robotic technologies has further increased the efficiency and scalability of these equipment types .

By End-User:The end-user segments include Automotive, Aerospace, Construction, Electronics, Shipbuilding, Energy & Power, and Others. The Automotive sector is the largest consumer of metal fabrication equipment, driven by the continuous demand for innovative vehicle designs and lightweight materials. The Aerospace industry also significantly contributes to the market, requiring high-precision components and advanced fabrication techniques. Construction and electronics sectors are also experiencing increased adoption due to infrastructure development and the need for miniaturized, high-performance components .

The Global Metal Fabrication Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trumpf GmbH + Co. KG, Amada Co., Ltd., Bystronic AG, Mazak Corporation, Lincoln Electric Holdings, Inc., ESAB AB, Mitsubishi Electric Corporation, KUKA AG, FANUC Corporation, JET Tools, Baileigh Industrial, Inc., HGG Group, Heller Machine Tools, and Prima Power contribute to innovation, geographic expansion, and service delivery in this space.

The future of the metal fabrication equipment market appears promising, driven by technological advancements and increasing demand for customized solutions. As industries embrace automation and smart manufacturing, the integration of AI and machine learning will enhance production efficiency and quality. Furthermore, the focus on sustainability will lead to the development of eco-friendly fabrication processes, positioning companies to meet evolving consumer preferences and regulatory requirements while capitalizing on emerging market opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Laser Cutting Machines Welding Equipment Bending Machines Punching Machines Shearing Machines Machining Centers Others |

| By End-User | Automotive Aerospace Construction Electronics Shipbuilding Energy & Power Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | CNC Machining Additive Manufacturing Traditional Fabrication Techniques Automation & Robotics Others |

| By Application | Industrial Equipment Consumer Goods Infrastructure Defense Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Metal Fabrication Equipment Manufacturers | 60 | CEOs, Product Managers, R&D Directors |

| End-User Industries (Automotive, Aerospace) | 50 | Procurement Managers, Production Supervisors |

| Equipment Distributors and Suppliers | 40 | Sales Managers, Supply Chain Coordinators |

| Industry Experts and Consultants | 40 | Market Analysts, Industry Advisors |

| Trade Associations and Regulatory Bodies | 40 | Policy Makers, Industry Representatives |

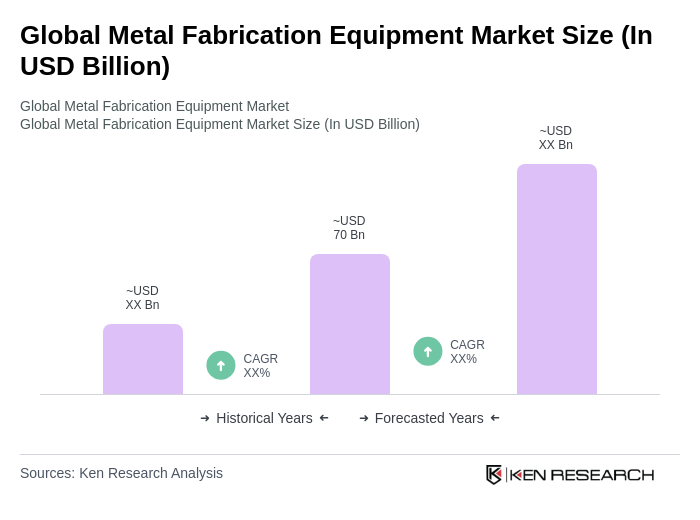

The Global Metal Fabrication Equipment Market is valued at approximately USD 70 billion, driven by advancements in manufacturing technologies, rising automation, and growth in the automotive and aerospace sectors.