Region:Global

Author(s):Shubham

Product Code:KRAC0765

Pages:92

Published On:August 2025

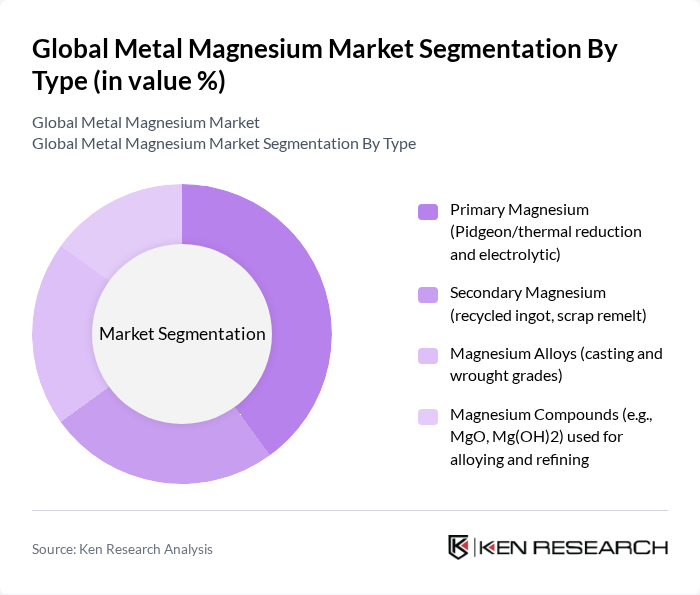

By Type:The market is segmented into four main types: Primary Magnesium, Secondary Magnesium, Magnesium Alloys, and Magnesium Compounds. Each of these subsegments plays a crucial role in the overall market dynamics, with varying applications and demand drivers. Primary magnesium is largely produced via the Pidgeon/thermal reduction route in China and electrolytic routes elsewhere and is consumed in die casting and aluminum alloying; secondary magnesium reflects recycled ingot and remelt from fabrication and end-of-life scrap; magnesium alloys encompass casting and wrought grades for transportation, electronics, and defense; magnesium compounds (e.g., MgO, Mg(OH)2) are used in refractories, desulfurization, and environmental applications and are adjacent to, but distinct from, metallic magnesium value chains .

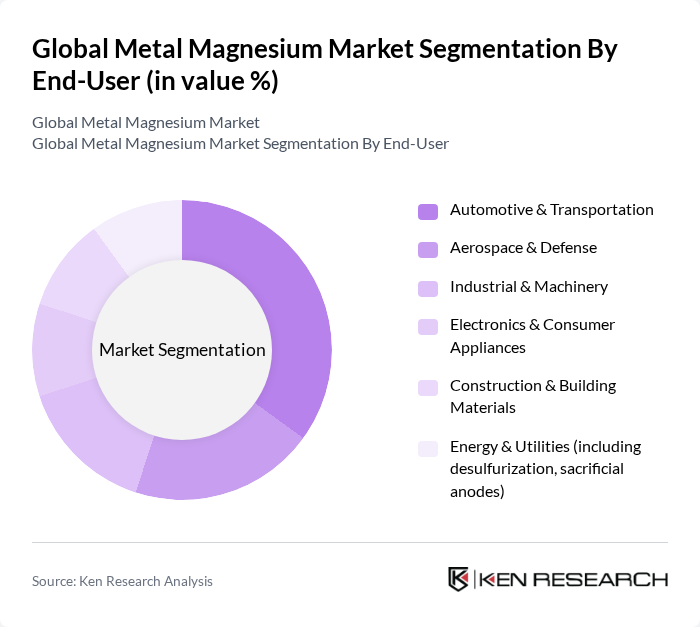

By End-User:The end-user segmentation includes Automotive & Transportation, Aerospace & Defense, Industrial & Machinery, Electronics & Consumer Appliances, Construction & Building Materials, and Energy & Utilities. Each sector has distinct requirements and growth potential, influencing the overall market landscape. Automotive and transportation remain the largest end-use owing to die-cast parts (e.g., transmission cases, steering components), followed by aerospace/defense where high strength-to-weight and electromagnetic shielding are valued; industrial/machinery, electronics, and energy applications leverage magnesium for alloying with aluminum, desulfurization in steelmaking, sacrificial anodes, and EMI shielding .

The Global Metal Magnesium Market is characterized by a dynamic mix of regional and international players. Leading participants such as US Magnesium LLC, Dead Sea Magnesium Ltd., POSCO Magnesium (POSCO Group), Luxfer MEL Technologies (formerly Magnesium Elektron), Tianjin Magnesium International Co., Ltd., China Magnesium Corporation Limited, Shanxi Yinguang Huasheng Magnesium Co., Ltd., Meridian Lightweight Technologies Inc., Nanjing Yunhai Special Metals Co., Ltd., MagPro Group (Magnesium Products of America, Inc.), Rima Industrial S.A., Nippon Kinzoku Co., Ltd., Norsk Hydro ASA (Magnesium Recycling/Alloying operations), Tasmanian Electro Metallurgical Company (TEMCO) Magnesium Projects, and Latrobe Magnesium Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the magnesium market appears promising, driven by technological advancements and increasing applications across various industries. The focus on lightweight materials and sustainable manufacturing practices is expected to enhance magnesium's market position. Additionally, investments in research and development are likely to lead to innovative magnesium alloys and recycling technologies, further expanding its applications and market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Primary Magnesium (Pidgeon/thermal reduction and electrolytic) Secondary Magnesium (recycled ingot, scrap remelt) Magnesium Alloys (casting and wrought grades) Magnesium Compounds (e.g., MgO, Mg(OH)2) used for alloying and refining |

| By End-User | Automotive & Transportation Aerospace & Defense Industrial & Machinery Electronics & Consumer Appliances Construction & Building Materials Energy & Utilities (including desulfurization, sacrificial anodes) |

| By Application | Die Casting (e.g., AZ91, AM60) Wrought Products (extrusions, sheets, forgings) Alloying Additive for Aluminum & Titanium Desulfurization in Steelmaking Sacrificial Anodes & Chemical Uses |

| By Distribution Channel | Direct Sales to OEMs Distributors/Traders Long-term Offtake/Contracts Spot & Online Metals Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Primary Magnesium Ingot (99.8% min) Alloy Ingot (common casting grades) Wrought/Extrusion Products Scrap & Recycled Feed |

| By Policy Support | Emissions & Energy Policies (carbon/EU ETS, power tariffs) Trade Measures (tariffs, anti-dumping, quotas) Mining & Permitting/Environmental Regulations Recycling & Circular Economy Incentives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Magnesium Applications | 120 | Product Engineers, Procurement Managers |

| Aerospace Magnesium Usage | 90 | Material Scientists, Quality Assurance Managers |

| Magnesium in Electronics Manufacturing | 80 | Manufacturing Engineers, Supply Chain Analysts |

| Construction Industry Magnesium Demand | 60 | Project Managers, Construction Material Suppliers |

| Magnesium Recycling Initiatives | 50 | Sustainability Officers, Recycling Facility Managers |

The Global Metal Magnesium Market is valued at approximately USD 4.4 billion, based on a five-year historical analysis. This valuation reflects the market's growth driven by demand in various industries, particularly automotive and aerospace.