Region:Global

Author(s):Geetanshi

Product Code:KRAD0058

Pages:96

Published On:August 2025

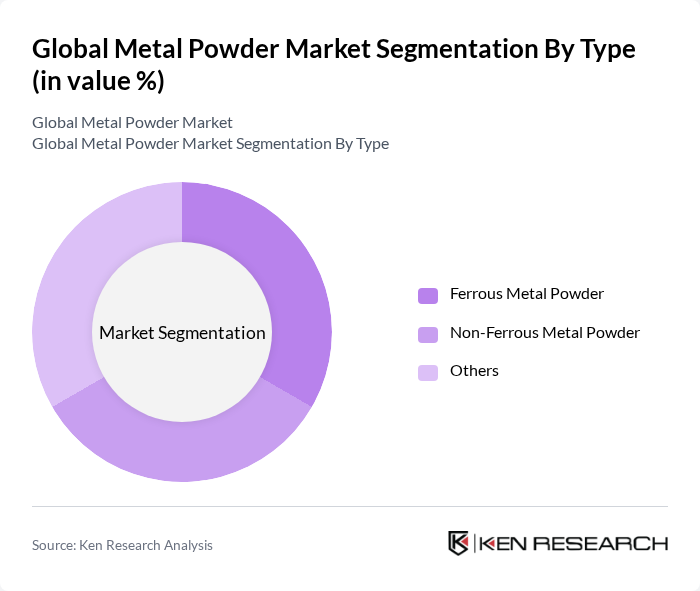

By Type:The market is segmented into Ferrous Metal Powder, Non-Ferrous Metal Powder, and Others.Ferrous metal powdersare widely used due to their strength, cost-effectiveness, and suitability for high-volume applications such as automotive and machinery components.Non-ferrous powdersare gaining traction for specialized applications in aerospace, electronics, and additive manufacturing, where properties such as corrosion resistance, lightweight, and electrical conductivity are critical. The "Others" segment includes precious metals and specialty powders used in niche applications .

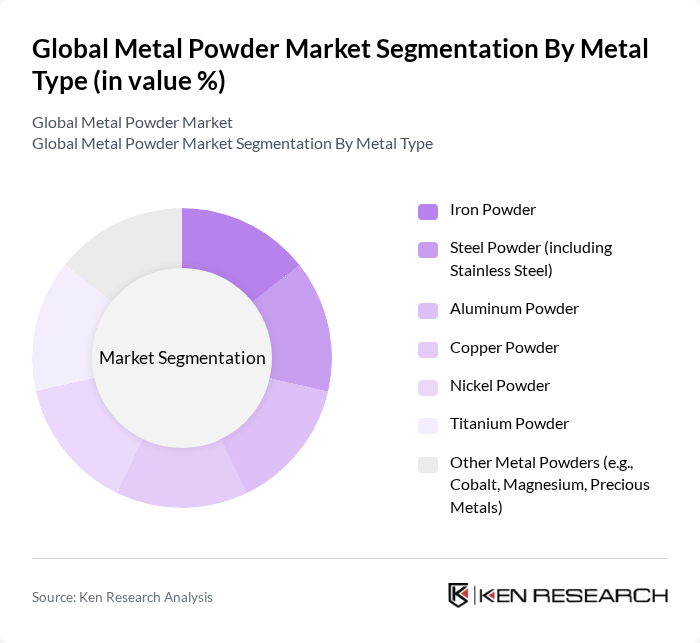

By Metal Type:The market is further categorized into Iron Powder, Steel Powder (including Stainless Steel), Aluminum Powder, Copper Powder, Nickel Powder, Titanium Powder, and Other Metal Powders.Iron and steel powdersdominate due to their extensive use in automotive, industrial, and construction applications.Aluminum and copper powdersare increasingly used in electronics, additive manufacturing, and lightweight structural components.Nickel, titanium, and specialty powdersare primarily utilized in high-performance sectors such as aerospace, medical devices, and energy .

The Global Metal Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Höganäs AB, GKN Powder Metallurgy (Dowlais Group plc), Carpenter Technology Corporation, PMG Group (Powder Metallurgy Group), Sandvik AB, 3D Systems Corporation, Arconic Corporation, BASF SE, Advanced Powder Products, Inc., Kymera International, Metal Powder Industries Federation (MPIF), Rio Tinto Group, AMETEK Inc., ExOne Company (Desktop Metal, Inc.), and Renishaw plc contribute to innovation, geographic expansion, and service delivery in this space .

The future of the metal powder market appears promising, driven by technological advancements and increasing applications across various industries. The shift towards sustainable manufacturing practices is expected to gain momentum, with companies investing in eco-friendly production methods. Additionally, the growth of e-commerce platforms for metal powder sales will enhance market accessibility, allowing manufacturers to reach a broader customer base. These trends indicate a dynamic landscape that will likely foster innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Ferrous Metal Powder Non-Ferrous Metal Powder Others |

| By Metal Type | Iron Powder Steel Powder (including Stainless Steel) Aluminum Powder Copper Powder Nickel Powder Titanium Powder Other Metal Powders (e.g., Cobalt, Magnesium, Precious Metals) |

| By Process | Atomization Reduction Electrolysis Mechanical Alloying Others |

| By Application | Additive Manufacturing (3D Printing) Metal Injection Molding (MIM) Pressing & Sintering Thermal Spray Coating Others |

| By End-User Industry | Automotive Aerospace & Defense Medical & Dental Electronics & Electrical Industrial Machinery Energy (including Renewable Energy) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Metal Powder Applications | 60 | Materials Engineers, Aerospace Manufacturers |

| Automotive Metal Powder Usage | 50 | Production Managers, Automotive Engineers |

| Medical Device Metal Powder Supply | 40 | Quality Assurance Managers, Medical Device Manufacturers |

| 3D Printing Metal Powder Market | 45 | R&D Managers, Additive Manufacturing Specialists |

| Metal Powder Recycling Initiatives | 40 | Sustainability Officers, Recycling Facility Managers |

The Global Metal Powder Market is valued at approximately USD 7.5 billion, driven by increasing demand in advanced manufacturing technologies across sectors like automotive, aerospace, healthcare, and electronics.