Region:Global

Author(s):Shubham

Product Code:KRAD0758

Pages:100

Published On:August 2025

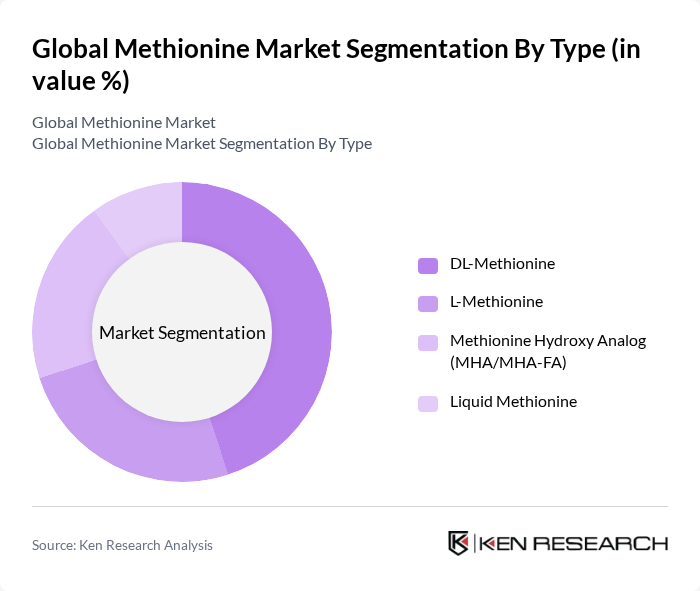

By Type:The market is segmented into four main types: DL-Methionine, L-Methionine, Methionine Hydroxy Analog (MHA/MHA-FA), and Liquid Methionine. DL-Methionine is widely used in feed for cost-effective sulfur amino acid balancing and reliable bioavailability in poultry and swine. L-Methionine is used in specialty nutrition and pharmaceutical applications. MHA/MHA-FA (e.g., 2-hydroxy-4-(methylthio)butanoic acid and its salts) is a viable alternative to DL-Methionine in many feed programs, often used to support lower crude protein diets and sustainability goals. Liquid Methionine formats enable dosing and handling advantages in integrated feed mills and premix plants.

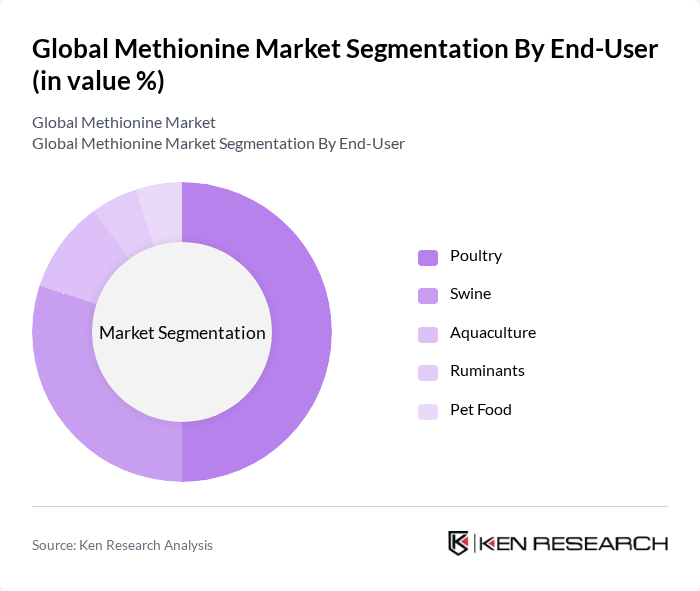

By End-User:The end-user segmentation includes Poultry, Swine, Aquaculture, Ruminants, and Pet Food. The poultry sector is the largest consumer of methionine, driven by the increasing demand for chicken and eggs globally. The swine industry follows closely, as methionine is essential for optimal growth and feed efficiency. Aquaculture is rapidly growing, particularly in Asia, where fish farming is prevalent. Ruminants and pet food segments are also significant, but they represent a smaller share of the overall market.

The Global Methionine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Evonik Industries AG, Bluestar Adisseo Company, CJ CheilJedang Corporation, Novus International, Inc. (Mitsui & Co., Ltd.), Sumitomo Chemical Co., Ltd., Zhejiang NHU Co., Ltd., Sinopec (China Petroleum & Chemical Corporation), BASF SE, Kemin Industries, Inc., Volzhsky Orgsynthese JSC, Iris Biotech GmbH, Tokyo Chemical Industry Co., Ltd. (TCI), AlzChem Group AG, Phibro Animal Health Corporation, Trouw Nutrition (a Nutreco company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the methionine market appears promising, driven by the increasing focus on sustainable agricultural practices and the growing demand for high-quality animal nutrition. Innovations in production technologies are expected to enhance efficiency and reduce environmental impact. Furthermore, the rising trend of plant-based diets is likely to create new opportunities for methionine in alternative protein sources, while the expansion of the aquaculture sector will continue to drive demand for this essential amino acid in feed formulations.

| Segment | Sub-Segments |

|---|---|

| By Type | DL-Methionine L-Methionine Methionine Hydroxy Analog (MHA/MHA-FA) Liquid Methionine |

| By End-User | Poultry Swine Aquaculture Ruminants Pet Food |

| By Application | Animal Feed (Feed-grade) Food & Beverage (Food-grade) Pharmaceuticals & Nutraceuticals Industrial & Others |

| By Distribution Channel | Direct Sales to Integrators & Premixers Distributors/Traders Online/EDI & Contract Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, North Africa, Rest of MEA) |

| By Pricing Strategy | Formula/Index-linked Pricing Spot/Transactional Pricing Contract/Tiered Pricing |

| By Product Form | Powder Liquid Granules/Crystals Coated/Protected Forms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Feed Manufacturers | 120 | Feed Formulators, Production Managers |

| Swine Nutrition Experts | 80 | Animal Nutritionists, Veterinarians |

| Aquaculture Feed Producers | 60 | Feed Mill Managers, Aquaculture Specialists |

| Livestock Farmers | 100 | Farm Owners, Livestock Managers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

The Global Methionine Market is valued at approximately USD 6.5 billion, driven by increased demand for high-quality animal feed, particularly in the poultry and swine sectors, as well as the growing focus on feed efficiency and protein conversion.