Region:Global

Author(s):Dev

Product Code:KRAD0596

Pages:85

Published On:August 2025

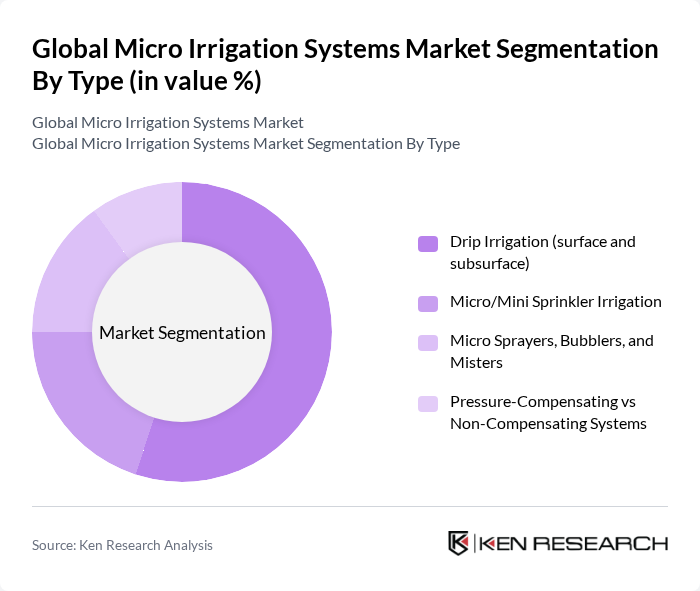

By Type:The market is segmented into various types of micro irrigation systems, including Drip Irrigation (surface and subsurface), Micro/Mini Sprinkler Irrigation, Micro Sprayers, Bubblers, and Misters, and Pressure-Compensating vs Non-Compensating Systems. Among these, Drip Irrigation is the most dominant segment due to its efficiency in water usage and ability to deliver nutrients directly to the plant roots, which is increasingly favored by farmers looking to maximize yield while minimizing resource use.

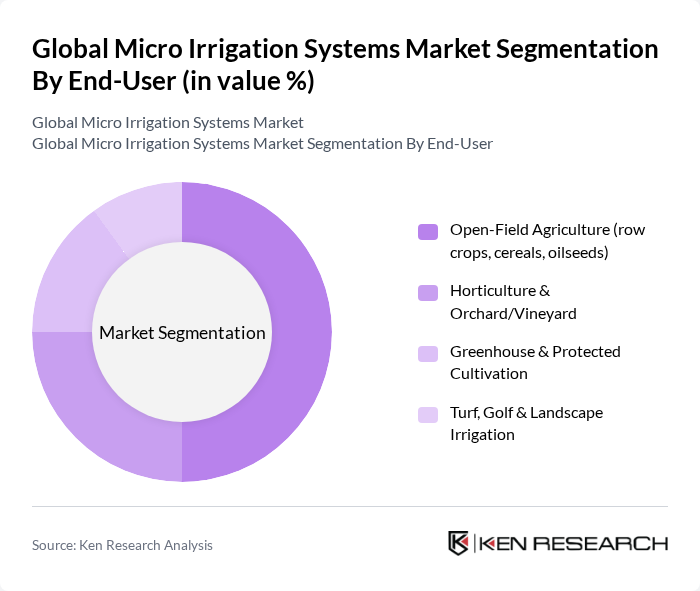

By End-User:The end-user segmentation includes Open-Field Agriculture (row crops, cereals, oilseeds), Horticulture & Orchard/Vineyard, Greenhouse & Protected Cultivation, and Turf, Golf & Landscape Irrigation. Open-Field Agriculture is the leading segment, driven by the increasing demand for food production and the need for efficient irrigation solutions in large-scale farming operations. This segment benefits from the growing trend of precision agriculture, which emphasizes the importance of water management.

The Global Micro Irrigation Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netafim Ltd. (Orbia Precision Agriculture), Jain Irrigation Systems Ltd., Rain Bird Corporation, Hunter Industries, The Toro Company, Lindsay Corporation, Rivulis Irrigation Ltd., Valmont Industries, Inc. (Valley Irrigation), Reinke Manufacturing Company, Inc., Irritec S.p.A., Rainfine (Dalian) Irrigation Co., Ltd., AZUD (Sistema AZUD, S.A.), Netafim USA, Metzerplas Cooperative Agricultural Organization Ltd. (Metzer), Eurodrip S.A. (now part of Rivulis) contribute to innovation, geographic expansion, and service delivery in this space.

The future of micro irrigation systems appears promising, driven by increasing awareness of sustainable agricultural practices and technological advancements. As governments worldwide implement policies to promote water conservation and food security, the adoption of micro irrigation is expected to rise. Additionally, the integration of IoT and smart technologies will enhance system efficiency, making them more appealing to farmers. This trend indicates a shift towards more sustainable farming practices, ensuring the long-term viability of micro irrigation systems in agriculture.

| Segment | Sub-Segments |

|---|---|

| By Type | Drip Irrigation (surface and subsurface) Micro/Mini Sprinkler Irrigation Micro Sprayers, Bubblers, and Misters Pressure-Compensating vs Non-Compensating Systems |

| By End-User | Open-Field Agriculture (row crops, cereals, oilseeds) Horticulture & Orchard/Vineyard Greenhouse & Protected Cultivation Turf, Golf & Landscape Irrigation |

| By Region | North America Europe Asia-Pacific Latin America |

| By Technology | Automated/Controller-Based Systems Manual/Conventional Systems Smart/IoT-Enabled Systems (sensors, telemetry, VRI) Solar-Powered and Low-Pressure Systems |

| By Application | Field Crops (corn, cotton, sugarcane, etc.) Orchard & Vineyard Crops Vegetables & Fruit (open-field and protected) Turf, Parks & Residential/Commercial Landscapes |

| By Investment Source | Private Investments Government Funding & Subsidy Schemes Multilateral/International Development Aid Microfinance & Agri-Cooperative Financing |

| By Policy Support | Government Subsidies & Rebate Programs Tax Incentives & Accelerated Depreciation Research & Extension Grants Water-Use Efficiency & Drought-Resilience Mandates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Micro Irrigation System Manufacturers | 90 | Product Managers, Sales Directors |

| Agricultural Producers Using Micro Irrigation | 120 | Farm Owners, Crop Managers |

| Distributors of Irrigation Equipment | 80 | Supply Chain Managers, Sales Representatives |

| Government Agricultural Policy Makers | 60 | Policy Analysts, Program Directors |

| Research Institutions Focused on Irrigation Technologies | 50 | Research Scientists, Agricultural Engineers |

The Global Micro Irrigation Systems Market is valued at approximately USD 12 billion, driven by the need for efficient water use in agriculture, sustainability goals, and advancements in technology such as automation and precision irrigation.