Region:Global

Author(s):Geetanshi

Product Code:KRAB0042

Pages:96

Published On:August 2025

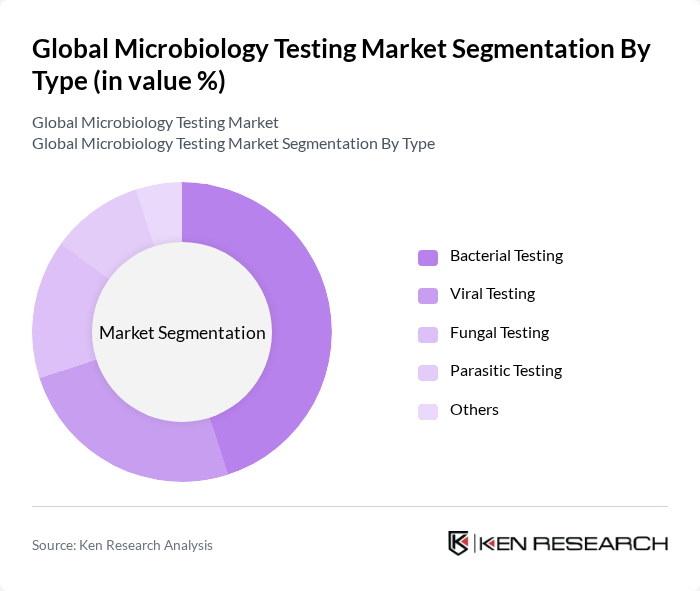

By Type:The microbiology testing market is segmented into bacterial testing, viral testing, fungal testing, parasitic testing, and others. Bacterial testing remains the most dominant segment due to the high incidence of bacterial infections and the growing need for effective diagnostic solutions. The increasing focus on antibiotic resistance and the need for rapid testing methods further drive the demand for bacterial testing solutions.

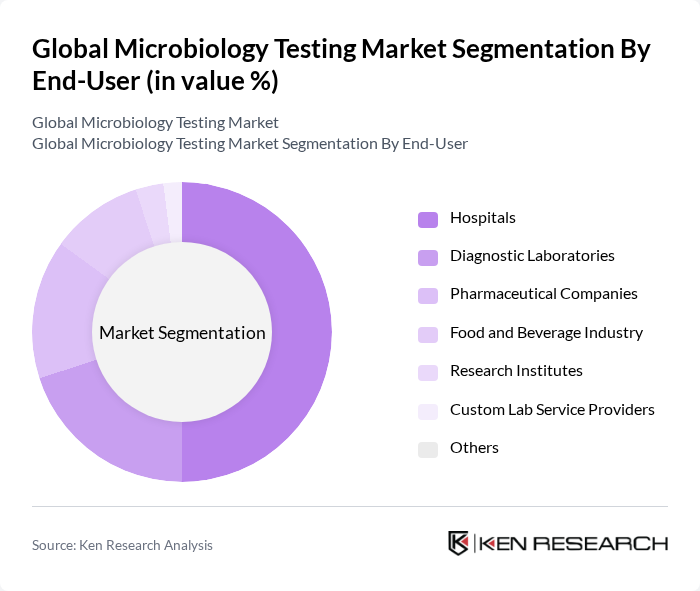

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, pharmaceutical companies, the food and beverage industry, research institutes, custom lab service providers, and others. Hospitals are the leading end-user segment, driven by the increasing number of patients requiring microbiological testing for accurate diagnosis and treatment. The growing emphasis on infection control and prevention in healthcare settings further propels the demand for microbiology testing services. Diagnostic laboratories and pharmaceutical companies also represent significant market shares due to their role in clinical research and drug development.

The Global Microbiology Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Becton, Dickinson and Company, bioMérieux S.A., Abbott Laboratories, QIAGEN N.V., Merck KGaA, Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Siemens Healthineers AG, Hologic, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Luminex Corporation, PerkinElmer, Inc., Charles River Laboratories International, Inc., IDEXX Laboratories, Inc., Danaher Corporation (Cepheid Inc.), Bruker Corporation, Shimadzu Corporation, NEOGEN Corporation contribute to innovation, geographic expansion, and service delivery in this space.

As the microbiology testing landscape evolves, the integration of automation and artificial intelligence is expected to reshape diagnostic processes significantly. In future, laboratories will increasingly adopt these technologies to enhance efficiency and accuracy. Additionally, the growing emphasis on personalized medicine will drive the development of tailored testing solutions, catering to individual patient needs. This shift will not only improve patient outcomes but also create new avenues for innovation and collaboration within the microbiology testing market.

| Segment | Sub-Segments |

|---|---|

| By Type | Bacterial Testing Viral Testing Fungal Testing Parasitic Testing Others |

| By End-User | Hospitals Diagnostic Laboratories Pharmaceutical Companies Food and Beverage Industry Research Institutes Custom Lab Service Providers Others |

| By Application | Clinical Diagnostics Environmental Testing Food Safety Testing Industrial Microbiology Pharmaceutical Microbiology Cosmetic Testing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sample Type | Blood Samples Urine Samples Swabs Tissue Samples Food & Beverage Samples Environmental Samples Others |

| By Testing Method | Culture-Based Testing Molecular Testing (e.g., PCR, NGS) Immunological Testing (e.g., ELISA, Lateral Flow) Rapid/Point-of-Care Testing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Microbiology Testing | 100 | Laboratory Directors, Clinical Microbiologists |

| Food Safety Testing | 80 | Quality Assurance Managers, Food Safety Inspectors |

| Environmental Microbiology Testing | 60 | Environmental Scientists, Laboratory Technicians |

| Pharmaceutical Microbiology Testing | 50 | Regulatory Affairs Specialists, Quality Control Managers |

| Research and Development in Microbiology | 40 | R&D Managers, Biotechnologists |

The Global Microbiology Testing Market is valued at approximately USD 5.8 billion, driven by the rising prevalence of infectious diseases, increased food safety awareness, and advancements in testing technologies.