Region:Global

Author(s):Dev

Product Code:KRAA1510

Pages:97

Published On:August 2025

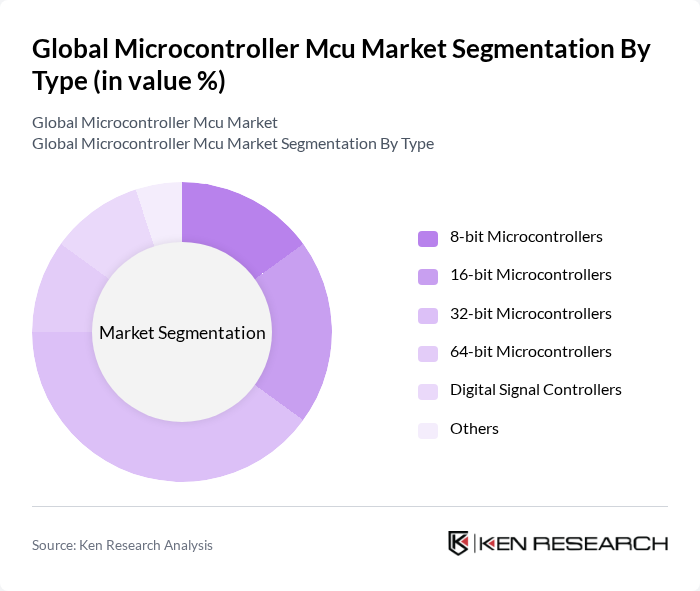

By Type:The market is segmented into 8-bit, 16-bit, 32-bit, 64-bit, digital signal controllers, and others. Among these, 32-bit microcontrollers hold the largest market share due to their superior processing capabilities, scalability, and versatility in applications ranging from automotive systems to advanced consumer electronics. The increasing complexity of applications and the need for higher performance and energy efficiency continue to drive demand for 32-bit microcontrollers, which accounted for over half of the market revenue in recent years.

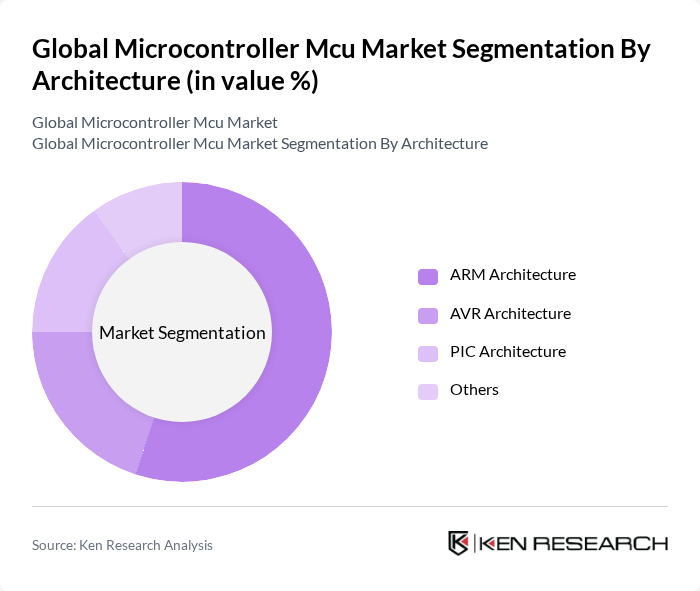

By Architecture:The architecture segmentation includes ARM, AVR, PIC, and others. ARM architecture leads the market, driven by its widespread adoption in mobile devices, automotive electronics, and IoT applications. ARM-based microcontrollers are preferred for their flexibility, energy efficiency, and robust ecosystem support, resulting in a dominant market share. AVR and PIC architectures remain relevant for cost-sensitive and legacy applications, while other architectures serve niche segments.

The Global Microcontroller MCU Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microchip Technology Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Texas Instruments Incorporated, Infineon Technologies AG, Renesas Electronics Corporation, Analog Devices, Inc., Cypress Semiconductor Corporation (now part of Infineon Technologies AG), ON Semiconductor Corporation (onsemi), Silicon Laboratories Inc., Atmel Corporation (now part of Microchip Technology Inc.), Broadcom Inc., Maxim Integrated Products, Inc. (now part of Analog Devices, Inc.), Nordic Semiconductor ASA, Dialog Semiconductor PLC (now part of Renesas Electronics Corporation), Nuvoton Technology Corporation, ROHM Semiconductor, Silan Microelectronics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microcontroller market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As industries increasingly adopt automation and smart technologies, the demand for energy-efficient and high-performance MCUs will rise. Additionally, the integration of artificial intelligence into microcontrollers is expected to enhance their capabilities, enabling smarter applications across various sectors. Companies that focus on innovation and strategic partnerships will likely thrive in this dynamic landscape, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | bit Microcontrollers bit Microcontrollers bit Microcontrollers bit Microcontrollers Digital Signal Controllers Others |

| By Architecture | ARM Architecture AVR Architecture PIC Architecture Others |

| By Memory | Embedded Memory Microcontrollers External Memory Microcontrollers |

| By End-User | Automotive Consumer Electronics Industrial Automation Healthcare Devices Aerospace & Defense Telecommunications Others |

| By Application | Embedded Systems Robotics Smart Home Devices Wearable Technology IoT Solutions Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Value-Added Resellers Others |

| By Component | Microcontroller Units Memory Components Input/Output Interfaces Power Management ICs Others |

| By Price Range | Low Price (<$1) Mid Price ($1-$5) High Price (>$5) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Microcontroller Applications | 100 | Automotive Engineers, Product Development Managers |

| Consumer Electronics Integration | 70 | Product Managers, R&D Engineers |

| Industrial Automation Solutions | 60 | Operations Managers, Automation Specialists |

| IoT Device Development | 80 | Embedded Systems Developers, IoT Architects |

| Healthcare Device Applications | 50 | Biomedical Engineers, Regulatory Affairs Specialists |

The Global Microcontroller MCU Market is valued at approximately USD 32 billion, driven by increasing automation demands across various sectors, including industrial, automotive, and consumer electronics.