Region:Global

Author(s):Shubham

Product Code:KRAC0666

Pages:81

Published On:August 2025

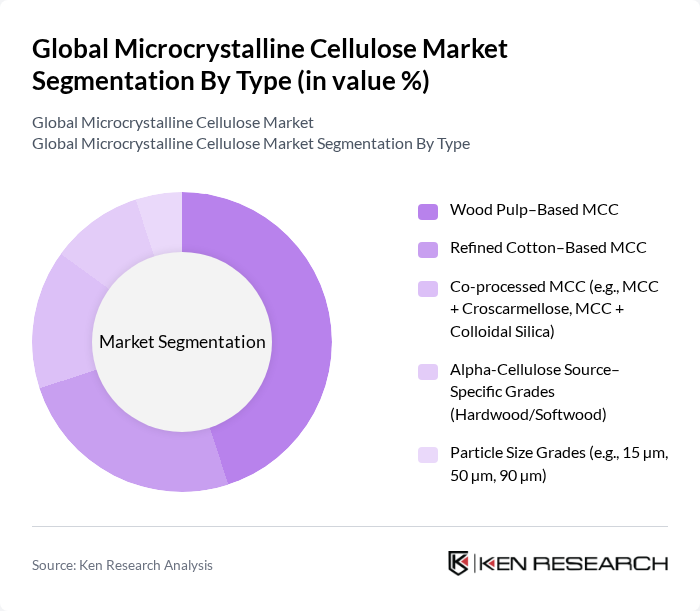

By Type:The market is segmented into various types of microcrystalline cellulose, each catering to specific applications and industries. The primary subsegments include Wood Pulp–Based MCC, Refined Cotton–Based MCC, Co-processed MCC, Alpha-Cellulose Source–Specific Grades, and Particle Size Grades. Among these, Wood Pulp–Based MCC is the most dominant due to its widespread use in pharmaceuticals and food applications, driven by its excellent binding and stabilizing properties.

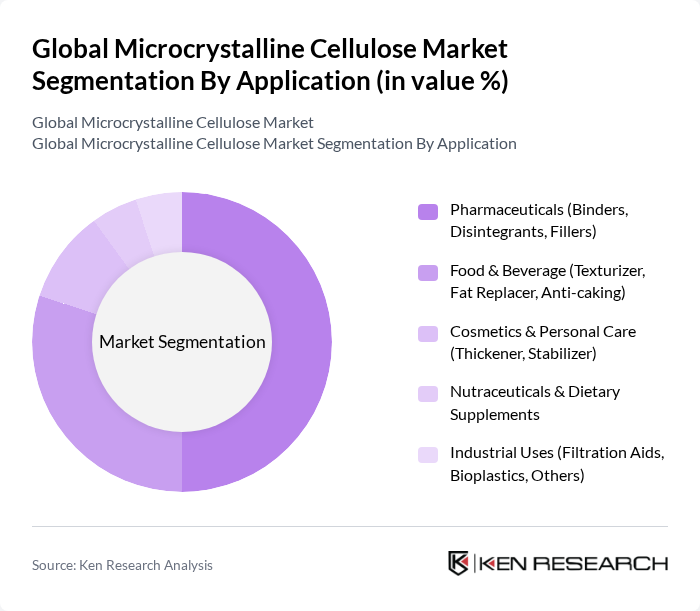

By Application:The applications of microcrystalline cellulose span across various sectors, including pharmaceuticals, food and beverage, cosmetics, nutraceuticals, and industrial uses. The pharmaceutical sector is the largest consumer, utilizing MCC as binders, disintegrants, and fillers due to its inert nature and excellent flow properties. The food and beverage industry follows closely, where MCC serves as a texturizer and fat replacer, reflecting the growing trend towards healthier food options.

The Global Microcrystalline Cellulose Market is characterized by a dynamic mix of regional and international players. Leading participants such as JRS PHARMA (J. Rettenmaier & Söhne GmbH + Co KG), Asahi Kasei Corporation, DuPont de Nemours, Inc. (including legacy FMC Biopolymer assets now under DuPont), Mingtai Chemical Co., Ltd., DFE Pharma GmbH & Co. KG, Roquette Frères, Anhui Sunhere Pharmaceutical Excipients Co., Ltd., Gujarat Microwax Pvt. Ltd. (Accent Microcell), Huzhou Zhanwang Pharmaceutical Co., Ltd., Sigachi Industries Limited, BLANVER Farmoquímica Ltda., Tembec Inc. (now Rayonier Advanced Materials), DKS Co. Ltd., Libraw Pharma (Celotech/Celopol MCC), Juku Orchem Private Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microcrystalline cellulose market appears promising, driven by the increasing demand for sustainable and natural ingredients across various industries. As consumers continue to prioritize health and wellness, the market is expected to witness a surge in product innovations and applications. Additionally, the expansion of e-commerce platforms is likely to facilitate greater access to microcrystalline cellulose, enabling manufacturers to reach a broader customer base and enhance market penetration.

| Segment | Sub-Segments |

|---|---|

| By Type | Wood Pulp–Based MCC Refined Cotton–Based MCC Co-processed MCC (e.g., MCC + Croscarmellose, MCC + Colloidal Silica) Alpha-Cellulose Source–Specific Grades (Hardwood/Softwood) Particle Size Grades (e.g., 15 µm, 50 µm, 90 µm) |

| By Application | Pharmaceuticals (Binders, Disintegrants, Fillers) Food & Beverage (Texturizer, Fat Replacer, Anti-caking) Cosmetics & Personal Care (Thickener, Stabilizer) Nutraceuticals & Dietary Supplements Industrial Uses (Filtration Aids, Bioplastics, Others) |

| By End-User | Generic & Branded Pharmaceutical Manufacturers Food & Beverage Processors Cosmetics & Personal Care Manufacturers Nutraceutical & Supplement Companies Contract Development & Manufacturing Organizations (CDMOs) |

| By Distribution Channel | Direct (Manufacturers to End-Users) Authorized Distributors & Channel Partners E-commerce/Online B2B Platforms Industrial Wholesalers Traders/Agents |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | –25 kg Sacks/Bags FIBC/Bulk Bags (500–1,000 kg) Drums Custom/Tailored Packs |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 120 | Product Development Managers, Quality Assurance Officers |

| Food Industry Utilization | 90 | Food Technologists, Regulatory Affairs Specialists |

| Cosmetic Formulations | 70 | R&D Managers, Cosmetic Chemists |

| Industrial Applications | 60 | Manufacturing Engineers, Supply Chain Managers |

| Market Trends and Innovations | 80 | Market Analysts, Industry Consultants |

The Global Microcrystalline Cellulose Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the increasing demand for natural and plant-based ingredients across various industries, including pharmaceuticals, food, and cosmetics.