Region:Global

Author(s):Shubham

Product Code:KRAA1890

Pages:94

Published On:August 2025

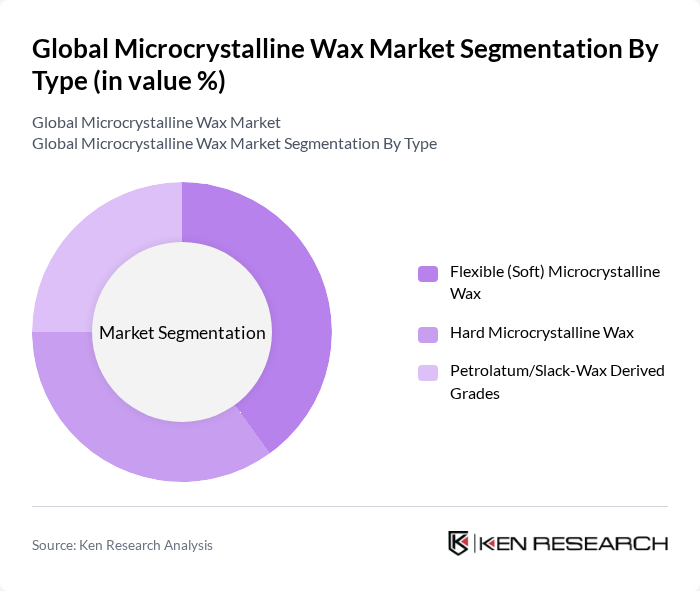

By Type:The market is segmented into three main types: Flexible (Soft) Microcrystalline Wax, Hard Microcrystalline Wax, and Petrolatum/Slack-Wax Derived Grades. Flexible microcrystalline wax is widely used in cosmetics and personal care products due to its ability to improve texture, flexibility, and oil retention in formulations. Hard microcrystalline wax is preferred in industrial applications for its durability, higher melting point, bonding strength, and resistance to deformation. Petrolatum/slack-wax derived grades are utilized in pharmaceuticals, food-contact, and packaging applications when processed to appropriate purity, benefiting from established regulatory pathways for refined petroleum waxes.

By Application:The applications of microcrystalline wax include Candles and Decorative Blends, Adhesives, Sealants & Hot-Melt Compounds, Packaging, Paper & Board Coatings, Personal Care & Cosmetics, Rubber & Tire, and Pharmaceuticals & Ointment Bases. Personal care and cosmetics is among the largest demand centers, supported by ongoing use in sticks, balms, ointments, and creams; packaging and paper/board coatings remain significant for moisture barrier and adhesion; adhesives and hot-melt systems leverage its tack and bonding properties; candles and blends continue to use microcrystalline wax for flexibility and burn modification; rubber and tire use it as a processing aid; and pharmaceutical/ointment bases value its inertness and structuring role.

The Global Microcrystalline Wax Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Sasol Limited, Shell Chemicals, Indian Oil Corporation Ltd. (IOCL), The International Group, Inc. (IGI Wax), Sonneborn LLC (HollyFrontier/Shell-owned legacy brands), Calumet Specialty Products Partners, L.P., Nippon Seiro Co., Ltd., Paramelt B.V., Kerax Limited, MOL Group (MOL Lubricants & Wax), HCI Wax (formerly H&R Group wax assets), Koster Keunen, Blended Waxes, Inc., Nanyang Tianhua Microcrystalline Wax Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microcrystalline wax market appears promising, driven by increasing consumer awareness regarding sustainability and the demand for high-quality products across various industries. Innovations in product formulations are expected to enhance the versatility of microcrystalline wax, while the expansion into emerging markets will provide new growth avenues. Additionally, the trend towards e-commerce will facilitate broader distribution channels, allowing manufacturers to reach a wider audience and adapt to changing consumer preferences effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible (Soft) Microcrystalline Wax Hard Microcrystalline Wax Petrolatum/Slack-Wax Derived Grades |

| By Application | Candles and Decorative Blends Adhesives, Sealants & Hot-Melt Compounds Packaging, Paper & Board Coatings Personal Care & Cosmetics Rubber & Tire Pharmaceuticals & Ointment Bases Others (Polishes, Electrical, Casting) |

| By End-User | Consumer Goods Manufacturers (Candles, Cosmetics) Industrial (Adhesives, Rubber, Packaging) Pharmaceuticals & Healthcare |

| By Distribution Channel | Direct/Contract Sales to OEMs Distributors and Specialty Chemical Traders Online/Marketplace and Spot Sales |

| By Packaging Type | Bulk (Drums, Totes, Slabs) Small Packs (Pastilles, Blocks) Custom/Private-Label Packaging |

| By Region | North America Europe Asia-Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetics Industry Usage | 120 | Product Development Managers, Brand Managers |

| Food Industry Applications | 90 | Quality Assurance Managers, Food Technologists |

| Pharmaceutical Sector Insights | 80 | Regulatory Affairs Specialists, R&D Managers |

| Industrial Applications | 70 | Operations Managers, Supply Chain Analysts |

| Market Trends and Innovations | 100 | Market Analysts, Industry Consultants |

The Global Microcrystalline Wax Market is valued at approximately USD 1.25 billion, based on a five-year historical analysis. Recent assessments indicate the market is within the USD 1.21.3 billion range, reflecting steady growth in various applications.