Region:Global

Author(s):Shubham

Product Code:KRAD0728

Pages:92

Published On:August 2025

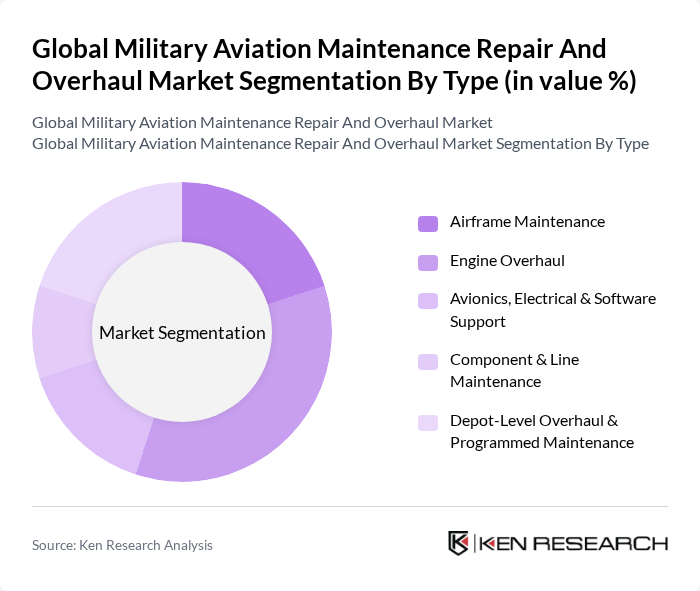

By Type:

The subsegments under this category include Airframe Maintenance, Engine Overhaul, Avionics, Electrical & Software Support, Component & Line Maintenance, and Depot-Level Overhaul & Programmed Maintenance. Among these, Engine Overhaul is currently dominating the market due to higher lifecycle costs and inspection intensity of modern military propulsion systems, including sustainment demands for advanced fighters and rotorcraft engines; increased flight hours in certain theaters and the complexity of next?gen powerplants reinforce engine shop loads and specialized overhaul requirements.

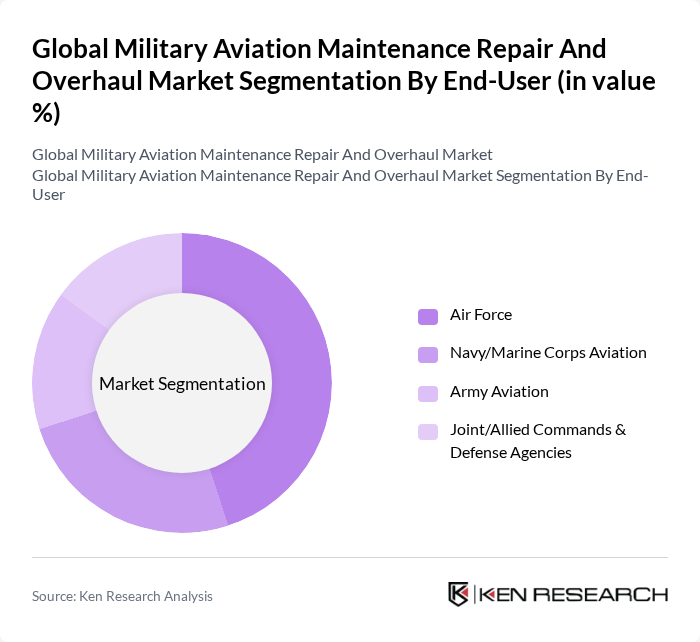

By End-User:

This category includes Air Force, Navy/Marine Corps Aviation, Army Aviation, and Joint/Allied Commands & Defense Agencies. The Air Force segment is leading the market, reflecting the size and complexity of fixed?wing combat and mobility fleets that demand recurring phase inspections, structural life-extension, engine overhauls, and software sustainment to maintain mission readiness.

The Global Military Aviation Maintenance Repair And Overhaul Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin Corporation, Boeing Defense, Space & Security, Northrop Grumman Corporation, RTX Corporation (Collins Aerospace & Pratt & Whitney Military Engines), BAE Systems plc, AAR CORP., Rolls-Royce plc (Defense), Safran Aircraft Engines & Safran Helicopter Engines, Thales Group, Leonardo S.p.A., L3Harris Technologies, Inc., Textron Inc. (Bell Textron), Honeywell International Inc. (Defense & Space), Elbit Systems Ltd., Airbus Defence and Space, Korean Air Aerospace Division (KAL-ASD), ST Engineering Aerospace Ltd., HENSOLDT AG, RUAG MRO International, Israel Aerospace Industries (IAI) – Bedek contribute to innovation, geographic expansion, and service delivery in this space.

The future of the military aviation MRO market is poised for significant transformation, driven by digitalization and the integration of advanced technologies. As military organizations increasingly adopt predictive maintenance and data analytics, operational efficiency is expected to improve. Additionally, the focus on sustainability will likely lead to the development of eco-friendly MRO practices, aligning with global environmental goals. These trends will shape the market landscape, fostering innovation and enhancing service delivery in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Airframe Maintenance Engine Overhaul Avionics, Electrical & Software Support Component & Line Maintenance Depot-Level Overhaul & Programmed Maintenance |

| By End-User | Air Force Navy/Marine Corps Aviation Army Aviation Joint/Allied Commands & Defense Agencies |

| By Service Type | Scheduled/Phase Maintenance Unscheduled/Corrective Maintenance Modifications, Retrofits & Upgrades (MLU/SLEP) Performance-Based Logistics (PBL) & Contractor Logistics Support (CLS) |

| By Aircraft Type | Fixed-Wing Combat (Fighters/Attack) Fixed-Wing Transport/Tanker/ISR Rotary-Wing (Helicopters/Tiltrotor) Unmanned Aerial Systems (Group 1–5) |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Contracting Model | In-House (Organic) Military MRO OEM MRO Services Independent MRO Providers Public-Private Partnerships & Joint Ventures |

| By Maintenance Strategy | Condition-Based & Predictive Maintenance Preventive/Time-Based Maintenance Corrective/Run-to-Failure Maintenance Reliability-Centered Maintenance (RCM) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Aircraft MRO Services | 120 | MRO Managers, Defense Procurement Officers |

| Helicopter Maintenance Operations | 90 | Maintenance Supervisors, Technical Directors |

| Unmanned Aerial Vehicle (UAV) MRO | 60 | UAV Program Managers, Engineering Leads |

| Avionics and Systems Overhaul | 70 | Avionics Technicians, Systems Engineers |

| Logistics and Supply Chain for MRO | 80 | Logistics Coordinators, Supply Chain Analysts |

The Global Military Aviation Maintenance Repair and Overhaul Market is valued at approximately USD 45 billion, driven by increasing defense budgets, the modernization of aging aircraft fleets, and the complexity of military aviation systems requiring specialized maintenance services.