Region:Global

Author(s):Dev

Product Code:KRAA2216

Pages:84

Published On:August 2025

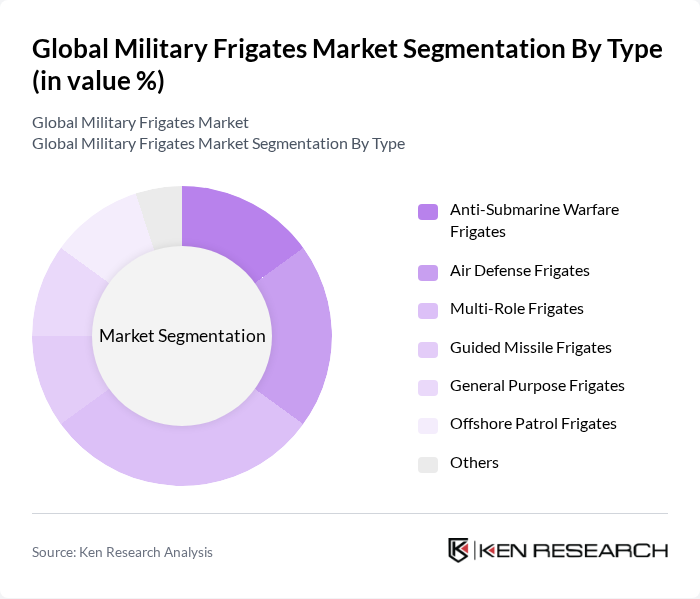

By Type:The market is segmented into various types of frigates, including Anti-Submarine Warfare Frigates, Air Defense Frigates, Multi-Role Frigates, Guided Missile Frigates, General Purpose Frigates, Offshore Patrol Frigates, and Others. Among these,Multi-Role Frigatesare currently dominating the market due to their versatility and capability to perform various missions, such as anti-surface, anti-air, and anti-submarine warfare. The increasing demand for adaptable naval platforms that can operate in diverse environments, integrate advanced sensor suites, and support modular mission payloads is driving the growth of this segment.

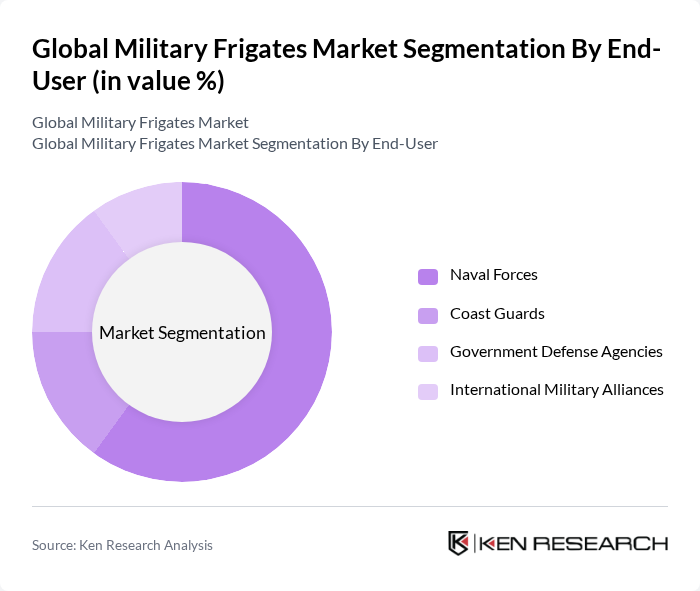

By End-User:The end-user segmentation includes Naval Forces, Coast Guards, Government Defense Agencies, and International Military Alliances. TheNaval Forcessegment is the leading end-user, driven by the increasing need for advanced naval capabilities to protect national interests and ensure maritime security. Countries are investing heavily in their naval forces to enhance deterrence and response capabilities against potential threats, which is propelling the growth of this segment.

The Global Military Frigates Market is characterized by a dynamic mix of regional and international players. Leading participants such as BAE Systems plc, Lockheed Martin Corporation, Naval Group, ThyssenKrupp Marine Systems GmbH, Fincantieri S.p.A., Huntington Ingalls Industries, Inc., Damen Shipyards Group, Saab AB, General Dynamics Corporation, Mitsubishi Heavy Industries, Ltd., Navantia S.A., Kongsberg Gruppen ASA, Rheinmetall AG, Northrop Grumman Corporation, Thales Group, Austal Limited, and United Shipbuilding Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the military frigates market is poised for significant transformation, driven by technological advancements and evolving defense strategies. As nations increasingly prioritize naval modernization, the integration of AI and automation will enhance operational capabilities. Furthermore, the focus on multi-role frigates will enable navies to adapt to diverse mission requirements. Collaborative efforts between governments and defense contractors will also foster innovation, ensuring that military fleets remain competitive in an ever-changing geopolitical landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Anti-Submarine Warfare Frigates Air Defense Frigates Multi-Role Frigates Guided Missile Frigates General Purpose Frigates Offshore Patrol Frigates Others |

| By End-User | Naval Forces Coast Guards Government Defense Agencies International Military Alliances |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Technology | Stealth Technologies Integrated Combat Systems Advanced Propulsion Systems Surveillance and Reconnaissance Technologies Automation & AI-Enabled Systems Others |

| By Application | Naval Warfare Maritime Security Operations Humanitarian Assistance Anti-Piracy Operations Others |

| By Investment Source | Government Funding Private Investments International Aid |

| By Policy Support | Defense Procurement Policies Subsidies for Domestic Production Tax Incentives for R&D Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Frigate Procurement Strategies | 100 | Defense Procurement Officers, Naval Strategists |

| Shipbuilding Industry Insights | 60 | Shipyard Managers, Engineering Leads |

| Naval Technology Trends | 50 | Defense Technology Analysts, R&D Managers |

| International Defense Collaborations | 40 | Policy Makers, Defense Attachés |

| Frigate Maintenance and Upgrades | 70 | Maintenance Managers, Logistics Coordinators |

The Global Military Frigates Market is valued at approximately USD 27 billion, driven by increasing defense budgets, advancements in naval warfare technology, and the need for enhanced maritime security amid geopolitical tensions.