Region:Global

Author(s):Shubham

Product Code:KRAC0724

Pages:93

Published On:August 2025

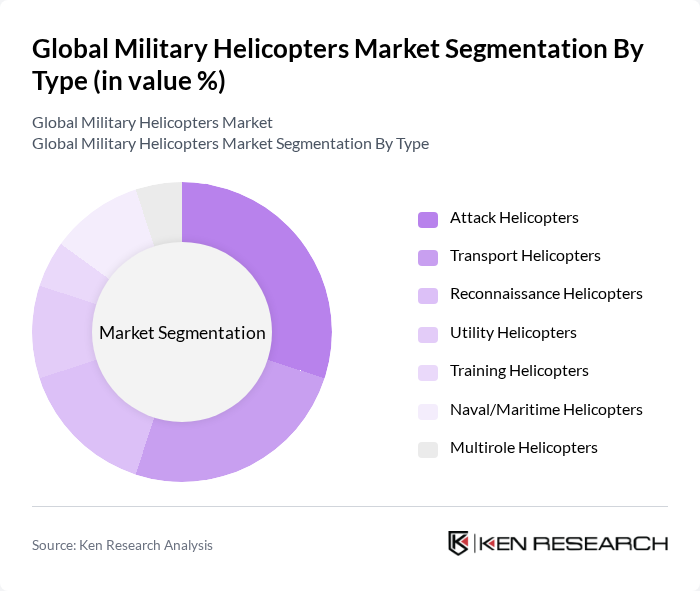

By Type:The military helicopters market can be segmented into various types, including Attack Helicopters, Transport Helicopters, Reconnaissance Helicopters, Utility Helicopters, Training Helicopters, Naval/Maritime Helicopters, and Multirole Helicopters. Each type serves distinct operational needs, with Attack Helicopters being favored for combat missions due to their firepower and agility, while Transport Helicopters are essential for troop and equipment movement.

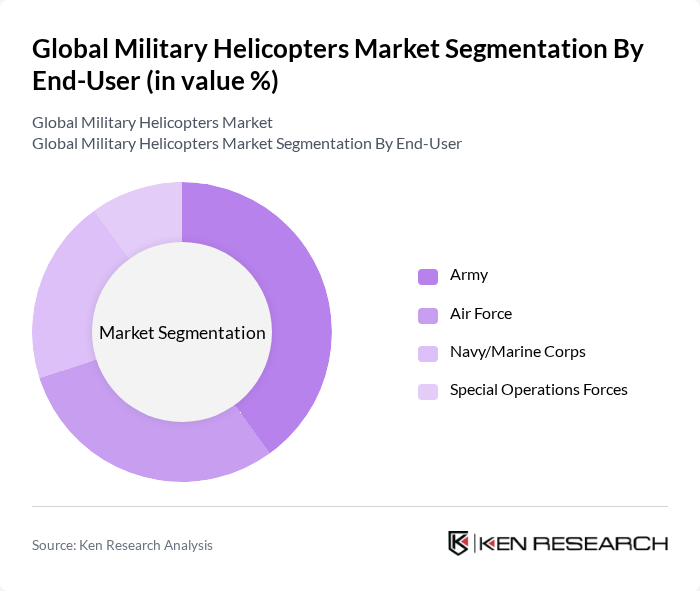

By End-User:The end-user segmentation includes Army, Air Force, Navy/Marine Corps, and Special Operations Forces. Each branch has specific requirements for helicopter capabilities, with the Army focusing on transport and attack helicopters, while the Air Force emphasizes reconnaissance and multirole platforms for diverse missions.

The Global Military Helicopters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boeing (CH-47 Chinook, AH-64 Apache), Lockheed Martin – Sikorsky (UH/HH/MH-60 Black Hawk family, CH-53K), Airbus Helicopters (H225M, H145M, H160M, Tiger), Bell Textron Inc. (AH-1Z, UH-1Y, V-280 program partner), Leonardo S.p.A. (AW101, AW159, AW139M, NH90 partner), Korea Aerospace Industries (KAI) (KUH-1 Surion, LAH/LCH military), Turkish Aerospace Industries (TAI) – Turkish Aerospace (T129 ATAK, T625 Gökbey), Russian Helicopters JSC (Rostec) (Mi-8/17, Mi-28, Ka-52), Hindustan Aeronautics Limited (HAL) (ALH Dhruv, LCH Prachand, LUH), NHIndustries (NH90 consortium: Airbus, Leonardo, GKN/Fokker), MD Helicopters (MD 530F/MD 530G Cayuse Warrior), Airbus-DRF/Thales (avionics/mission systems partner programs), Avicopter (AVIC Helicopter Co., Ltd.) (Z-10, Z-20), Harbin Aircraft Industry Group (HAIG) (Z-9 variants), Enstrom Helicopter Corporation (light training platforms) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the military helicopter market in None is poised for growth, driven by ongoing modernization efforts and technological advancements. As nations prioritize enhancing their defense capabilities, investments in next-generation helicopters equipped with advanced avionics and multi-role functionalities are expected to rise. Additionally, the increasing focus on sustainability will likely lead to the development of hybrid and electric helicopters, aligning military operations with environmental goals while improving operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Attack Helicopters Transport Helicopters Reconnaissance Helicopters Utility Helicopters Training Helicopters Naval/Maritime Helicopters Multirole Helicopters |

| By End-User | Army Air Force Navy/Marine Corps Special Operations Forces |

| By Mission/Application | Combat (Attack/Close Air Support) Assault and Tactical Lift Search and Rescue (SAR/CSAR) Medical Evacuation (MEDEVAC) Intelligence, Surveillance and Reconnaissance (ISR) Anti-Submarine Warfare (ASW) and Anti-Surface Warfare (ASuW) |

| By Component | Airframe Avionics and Mission Systems Engines/Powerplant Rotor Systems and Drive Train Weapons and Defensive Aids |

| By Procurement Route | New-Build (OEM) Upgrades/Retrofit Leasing and Service-Based Models |

| By Range/Class | Light Medium Heavy |

| By Engine Configuration | Single-Engine Twin-Engine Turboshaft Hybrid/Advanced Propulsion |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 120 | Procurement Officers, Defense Budget Analysts |

| Helicopter Manufacturers | 90 | Product Managers, Sales Directors |

| Military Operations Units | 80 | Operational Commanders, Maintenance Supervisors |

| Defense Analysts and Consultants | 60 | Market Analysts, Defense Policy Experts |

| Regulatory Bodies and Aviation Authorities | 50 | Regulatory Officers, Compliance Managers |

The Global Military Helicopters Market is valued at approximately USD 35 billion, driven by increasing defense budgets, technological advancements, and the demand for versatile military operations such as combat, transport, and reconnaissance missions.