Region:Global

Author(s):Dev

Product Code:KRAD0485

Pages:90

Published On:August 2025

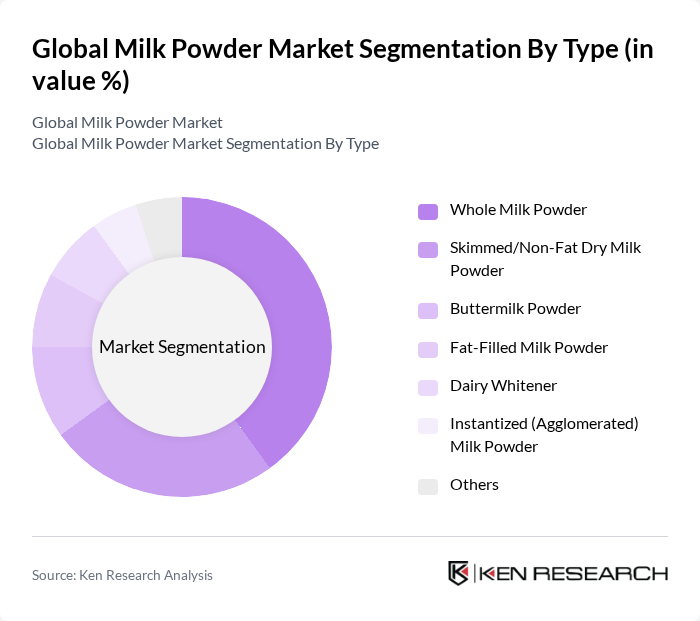

By Type:The market is segmented into various types of milk powder, including Whole Milk Powder, Skimmed/Non-Fat Dry Milk Powder, Buttermilk Powder, Fat-Filled Milk Powder, Dairy Whitener, Instantized (Agglomerated) Milk Powder, and Others.Whole Milk Powderis widely used in confectionery, bakery fillings, and reconstituted dairy beverages, whileSkimmed/Non-Fat Dry Milk Powderis a staple ingredient for recombined dairy, bakery, confectionery, and as a base for infant formula and nutritional products. Demand forDairy Whiteneris increasing in beverages due to convenience and solubility, and instantized/agglomerated formats support better dispersibility for foodservice and household use .

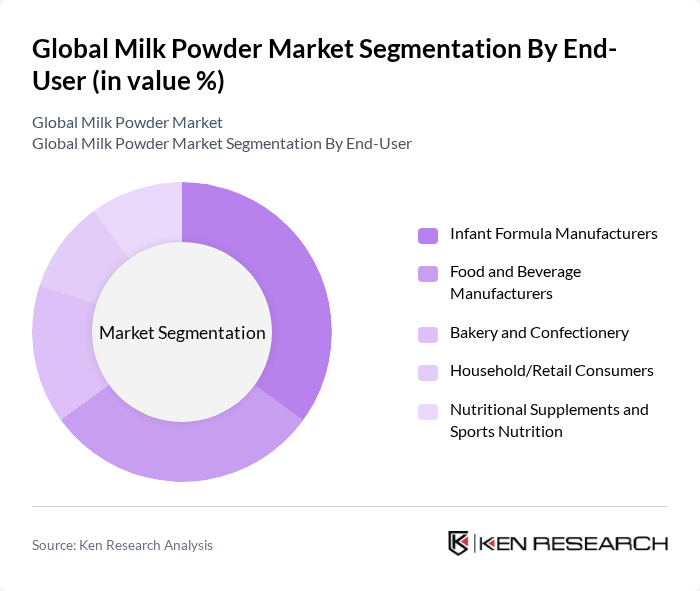

By End-User:The end-user segmentation includes Infant Formula Manufacturers, Food and Beverage Manufacturers, Bakery and Confectionery, Household/Retail Consumers, and Nutritional Supplements and Sports Nutrition. TheInfant Formula Manufacturerssegment remains a major consumer of skim and whole milk powders due to the use of milk powder as a key base in infant and follow-on formula.Food and Beverage Manufacturersuse milk powder extensively for dairy drinks, yogurt, ice cream, confectionery, and ready-to-mix beverages, whileBakery and Confectioneryutilizes milk powder for flavor, Maillard browning, and texture improvement .

The Global Milk Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Royal FrieslandCampina N.V., Fonterra Co-operative Group Limited, Groupe Lactalis, Arla Foods amba, Reckitt (Mead Johnson Nutrition), Abbott Laboratories, Glanbia plc, Saputo Inc., Olam International (ofi – Olam Food Ingredients), Agropur Cooperative, Dairy Farmers of America, Inc., Synlait Milk Limited, Yili Group (Inner Mongolia Yili Industrial Group Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the milk powder market in None appears promising, driven by increasing health awareness and the expansion of dairy processing capabilities. As consumers continue to prioritize nutritional products, the demand for milk powder is expected to rise significantly. Innovations in product formulations and packaging will likely enhance market appeal. Additionally, the integration of sustainable practices in dairy production will play a crucial role in shaping consumer preferences and driving growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Milk Powder Skimmed/Non-Fat Dry Milk Powder Buttermilk Powder Fat-Filled Milk Powder Dairy Whitener Instantized (Agglomerated) Milk Powder Others |

| By End-User | Infant Formula Manufacturers Food and Beverage Manufacturers Bakery and Confectionery Household/Retail Consumers Nutritional Supplements and Sports Nutrition |

| By Distribution Channel | Business-to-Business (B2B) Supermarkets and Hypermarkets Convenience and Specialty Stores Online Retail/E-commerce Direct/Institutional Sales |

| By Packaging Type | Bulk Bags and Sacks (15–25 kg) Industrial Totes/Drums Retail Cans/Tins Retail Pouches/Sachets Eco-Friendly/Recycle-Ready Packaging |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Price Range | Premium Mid-Range Economy |

| By Application | Infant Nutrition Dairy Products (Cheese, Yogurt, Recombined Milk) Bakery and Confectionery Beverages and Dairy Whitener Ready-to-Eat and Processed Foods Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Milk Powder Sales | 150 | Store Managers, Category Buyers |

| Dairy Processing Insights | 100 | Production Managers, Quality Control Supervisors |

| Export Market Dynamics | 80 | Export Managers, Trade Compliance Officers |

| Consumer Preferences Survey | 140 | Health-Conscious Consumers, Parents |

| Food Service Sector Analysis | 70 | Restaurant Owners, Catering Managers |

The Global Milk Powder Market is valued at approximately USD 36 billion, driven by increasing demand for convenient, shelf-stable dairy ingredients, particularly in food processing and infant nutrition sectors.