Region:Global

Author(s):Dev

Product Code:KRAD0419

Pages:84

Published On:August 2025

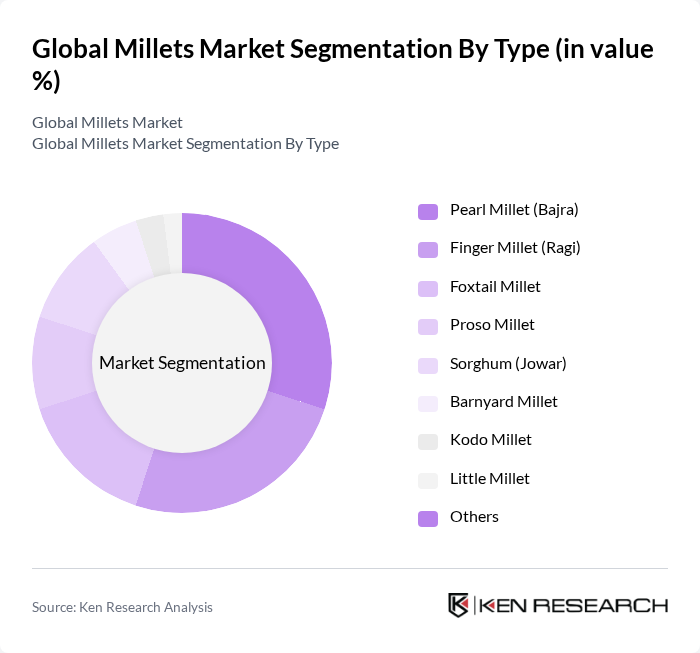

By Type:The market is segmented into various types of millets, including Pearl Millet (Bajra), Finger Millet (Ragi), Foxtail Millet, Proso Millet, Sorghum (Jowar), Barnyard Millet, Kodo Millet, Little Millet, and Others. Among these, Pearl Millet and Finger Millet are the most prominent in traditional producing regions due to widespread cultivation and dietary use, especially across India and Africa; sorghum also holds substantial share in feed and food applications. Health-focused demand is lifting interest across varieties given millets’ fiber, protein, and micronutrient profile and their gluten-free positioning in cereals, bakery, snacks, and RTE/RTC foods .

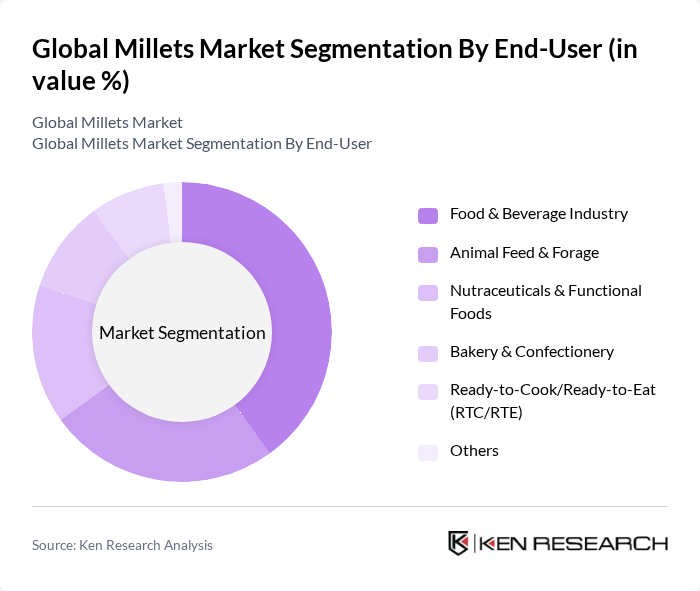

By End-User:The end-user segmentation includes the Food & Beverage Industry, Animal Feed & Forage, Nutraceuticals & Functional Foods, Bakery & Confectionery, Ready-to-Cook/Ready-to-Eat (RTC/RTE), and Others. The Food & Beverage Industry is the leading segment, driven by increasing incorporation of millets in staples, breakfast cereals, snacks, bakery mixes, and beverages, as well as clean-label, gluten-free, and low-GI products. Growth is also supported by expanded RTC/RTE launches and nutraceutical applications leveraging millets’ fiber, protein, and micronutrient content .

The Global Millets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, Bayer AG (Bayer Crop Science), Corteva Agriscience, ITC Limited (Aashirvaad), Sresta Natural Bioproducts Pvt. Ltd. (24 Mantra Organic), Nature Bio-Foods Ltd., Wholsum Foods Pvt. Ltd. (Slurrp Farm), Patanjali Ayurved Ltd., Tasty Bite Eatables Ltd., Dharani FaM CooP Ltd., Bonn Group of Industries, BrettYoung Seeds Limited, Ernst Conservation Seeds, Seedway, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the millets market appears promising, driven by increasing health awareness and a shift towards sustainable agricultural practices. Innovations in processing techniques are expected to enhance product offerings, making millets more appealing to consumers. Additionally, the growing popularity of plant-based diets will likely further boost demand. As governments continue to support millet cultivation, the market is poised for significant growth, with opportunities for value-added products and collaborations with health food brands emerging as key trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Pearl Millet (Bajra) Finger Millet (Ragi) Foxtail Millet Proso Millet Sorghum (Jowar) Barnyard Millet Kodo Millet Little Millet Others |

| By End-User | Food & Beverage Industry Animal Feed & Forage Nutraceuticals & Functional Foods Bakery & Confectionery Ready-to-Cook/Ready-to-Eat (RTC/RTE) Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Application | Whole Grain Flour Flakes & Puffed Beverages (Malt, Non-dairy, Fermented) Snacks & Breakfast Cereals Health Supplements Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Specialty & Health Food Stores HoReCa & Foodservice Direct/Institutional Sales Others |

| By Nature | Conventional Organic |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly/Sustainable Packaging Others |

| By Form | Whole Dehulled/Polished Sprouted/Germinated Ready-to-Cook Ready-to-Eat |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Millet Farmers | 120 | Farm Owners, Agricultural Workers |

| Health Food Retailers | 80 | Store Managers, Product Buyers |

| Food Manufacturers | 70 | Product Development Managers, Quality Assurance Officers |

| Nutritionists and Dieticians | 60 | Health Consultants, Wellness Coaches |

| Exporters and Importers | 50 | Trade Managers, Supply Chain Coordinators |

The Global Millets Market is valued at approximately USD 11 billion, reflecting a significant growth trend driven by increasing consumer awareness of millets' health benefits, including their high nutritional value and gluten-free properties.