Region:Global

Author(s):Dev

Product Code:KRAB0591

Pages:85

Published On:August 2025

By Type:The market is segmented into Entry-Level Cameras, Mid-Range Cameras, Professional Cameras, Compact Cameras, Specialty Cameras, Interchangeable Lens Cameras, and Fixed Lens Cameras. Each segment addresses distinct consumer needs: Entry-Level and Mid-Range Cameras appeal to hobbyists and casual users, while Professional Cameras lead the market due to their advanced features, superior image quality, and robust video capabilities. Interchangeable Lens Cameras are favored for their versatility, while Compact and Fixed Lens Cameras attract users seeking portability and ease of use , .

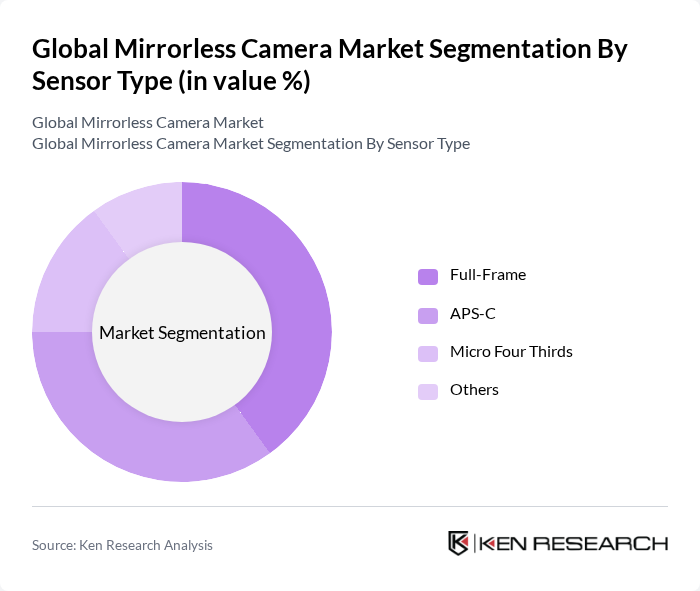

By Sensor Type:The segmentation by sensor type includes Full-Frame, APS-C, Micro Four Thirds, and Others. Full-Frame sensors dominate the market, favored by professionals for their superior image quality, dynamic range, and low-light performance. APS-C sensors are widely adopted in mid-range and enthusiast models, offering a balance between performance and affordability. Micro Four Thirds sensors are popular for compactness and versatility, while the 'Others' category includes emerging sensor formats and specialty applications , .

The Global Mirrorless Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Inc., Nikon Corporation, Sony Group Corporation, Fujifilm Holdings Corporation, Panasonic Holdings Corporation, OM Digital Solutions Corporation (formerly Olympus Imaging), Sigma Corporation, Leica Camera AG, Hasselblad AB, Blackmagic Design Pty Ltd, Ricoh Imaging Company, Ltd., Carl Zeiss AG, Tamron Co., Ltd., DJI Technology Co., Ltd., and RED Digital Cinema, LLC contribute to innovation, geographic expansion, and service delivery in this space , .

The future of the mirrorless camera market appears promising, driven by ongoing technological advancements and a growing consumer base interested in high-quality photography. As the market adapts to changing consumer preferences, manufacturers are likely to focus on enhancing features such as AI integration and sustainability. Additionally, the rise of online sales channels is expected to facilitate easier access to these products, further boosting market growth and consumer engagement in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Entry-Level Cameras Mid-Range Cameras Professional Cameras Compact Cameras Specialty Cameras Interchangeable Lens Cameras Fixed Lens Cameras |

| By Sensor Type | Full-Frame APS-C Micro Four Thirds Others |

| By End-User | Professional Photographers Hobbyists Content Creators (Vloggers, YouTubers, Social Media Influencers) Educational Institutions Corporate Users Others |

| By Distribution Channel | Online Retail Offline Retail (Specialty Camera Stores, Department Stores) Direct Sales Others |

| By Price Range | Budget Cameras Mid-Range Cameras Premium Cameras Luxury Cameras Others |

| By Brand | Canon Nikon Sony Fujifilm Panasonic Olympus Leica Sigma Others |

| By Camera Features | Image Stabilization Autofocus Systems Connectivity Options (Wi-Fi, Bluetooth, USB-C) Video Capabilities (4K, 6K, 8K) Weather Sealing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Professional Photographers | 60 | Wedding Photographers, Portrait Photographers |

| Amateur Photography Enthusiasts | 50 | Hobbyists, Social Media Influencers |

| Retailers of Camera Equipment | 40 | Store Managers, Sales Representatives |

| Videographers and Content Creators | 45 | Filmmakers, YouTubers |

| Industry Experts and Analysts | 40 | Market Analysts, Photography Consultants |

The Global Mirrorless Camera Market is valued at approximately USD 5 billion, driven by increasing demand for high-quality imaging solutions among both professional and amateur photographers, as well as the rise in content creation across digital platforms.