Region:Global

Author(s):Dev

Product Code:KRAB0442

Pages:88

Published On:August 2025

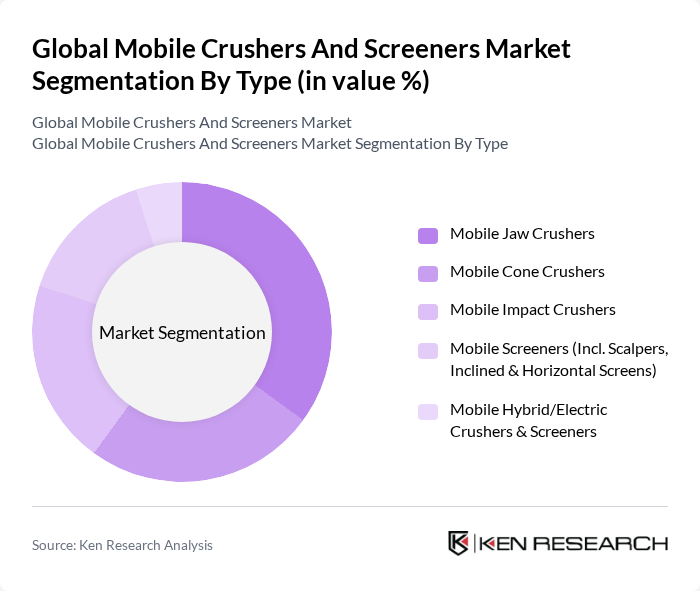

By Type:The mobile crushers and screeners market is segmented into various types, including mobile jaw crushers, mobile cone crushers, mobile impact crushers, mobile screeners (including scalpers, inclined & horizontal screens), and mobile hybrid/electric crushers & screeners. Among these, mobile jaw crushers are the most widely used due to their versatility and efficiency in crushing a variety of materials. The demand for mobile screeners is also significant, driven by the need for material separation in construction and recycling applications.

By End-User Industry:The end-user industries for mobile crushers and screeners include mining & quarrying, construction & infrastructure, recycling & waste management, demolition, and aggregates producers & contractors. The construction & infrastructure sector is the largest consumer, driven by ongoing urbanization and infrastructure development projects worldwide. The recycling & waste management industry is also growing, as more companies focus on sustainable practices and efficient waste processing.

The Global Mobile Crushers and Screeners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Metso, Sandvik AB, Terex Corporation, McCloskey International (a division of Metso), Kleemann GmbH (Wirtgen Group, John Deere), Astec Industries, Inc., Powerscreen (Terex), RUBBLE MASTER, Eagle Crusher Company, Inc., Keestrack NV, SBM Mineral Processing GmbH, Tesab Engineering, Komatsu Ltd., thyssenkrupp Industrial Solutions AG, H-E Parts International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile crushers and screeners market in None appears promising, driven by ongoing urbanization and technological advancements. As infrastructure projects continue to expand, the demand for efficient and eco-friendly equipment will rise. Additionally, the integration of automation and IoT technologies is expected to enhance operational efficiency. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge, positioning themselves favorably in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Jaw Crushers Mobile Cone Crushers Mobile Impact Crushers Mobile Screeners (Incl. Scalpers, Inclined & Horizontal Screens) Mobile Hybrid/Electric Crushers & Screeners |

| By End-User Industry | Mining & Quarrying Construction & Infrastructure Recycling & Waste Management Demolition Aggregates Producers & Contractors |

| By Distribution Channel | Direct/OEM Sales Authorized Dealers & Distributors Rental & Leasing Online/Configurator-Driven Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application/Material | Aggregate Production (Sand, Gravel, Crushed Stone) Road Construction & Maintenance Mining Operations (Ore Processing) C&D Recycling (Concrete, Asphalt) Industrial Minerals & Others |

| By Capacity (Throughput, Tonnes Per Hour) | Below 100 TPH –200 TPH –300 TPH Above 300 TPH |

| By Power Source | Diesel Electric Hybrid (Diesel-Electric) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Users | 140 | Project Managers, Site Supervisors |

| Mining Operations | 100 | Mining Engineers, Operations Managers |

| Recycling Facilities | 80 | Facility Managers, Environmental Compliance Officers |

| Equipment Distributors | 70 | Sales Managers, Product Specialists |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Compliance Officers |

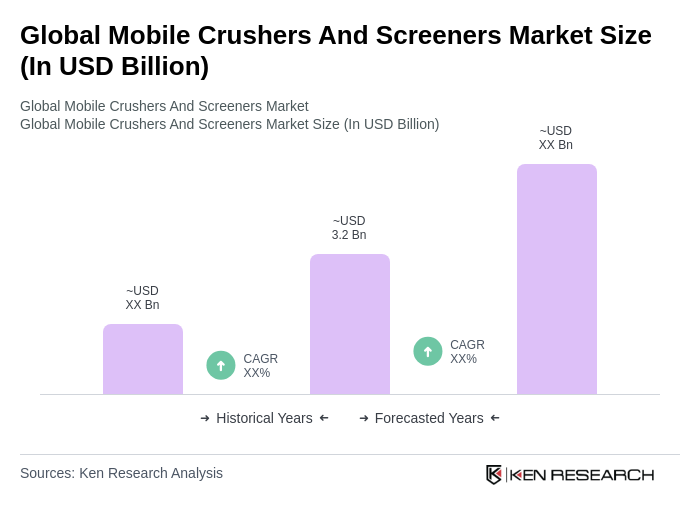

The Global Mobile Crushers and Screeners Market is valued at approximately USD 3.03.2 billion, reflecting growth from around USD 2.93.0 billion in the previous year, driven by increased demand in construction and mining activities.