Region:Global

Author(s):Geetanshi

Product Code:KRAA1181

Pages:86

Published On:August 2025

By Game Type:The mobile games market is segmented into various game types, including Action Games, Puzzle Games, Role-Playing Games (RPG), Strategy Games, Simulation Games, Sports Games, Arcade & Hyper-Casual Games, Adventure Games, Card & Casino Games, and Others. Among these, Action Games have emerged as the dominant segment, driven by their engaging gameplay and the popularity of competitive gaming. The rise of esports and multiplayer features has further fueled the demand for action-oriented titles, making them a favorite among players .

By Player Demographics:The mobile games market is also segmented by player demographics, including Children (Under 13), Teenagers (13-18), Young Adults (19-34), Adults (35-54), and Seniors (55+). Young Adults represent the largest demographic segment, driven by their familiarity with technology and a preference for mobile gaming as a primary entertainment source. This age group is particularly attracted to multiplayer and competitive games, which enhance social interaction and engagement. The demographic distribution aligns with industry data showing that the majority of mobile gamers are under 35, with a significant portion engaging in social and competitive gaming experiences .

The Global Mobile Games Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tencent Games, Activision Blizzard, Inc., Electronic Arts Inc., Supercell Oy, Zynga Inc., Niantic, Inc., King Digital Entertainment, NetEase, Inc., Rovio Entertainment Corporation, Gameloft SE, Square Enix Holdings Co., Ltd., Bandai Namco Entertainment Inc., Ubisoft Entertainment S.A., Playtika Holding Corp., Glu Mobile Inc., Netmarble Corporation, GungHo Online Entertainment, Inc., Mixi, Inc., Scopely, Inc., DeNA Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile gaming industry appears promising, driven by technological advancements and evolving consumer preferences. The integration of augmented reality and artificial intelligence is expected to enhance gameplay experiences, attracting a broader audience. Additionally, the rise of subscription-based models is likely to reshape monetization strategies, providing developers with stable revenue streams. As emerging markets continue to expand their internet connectivity, the potential for user growth remains significant, paving the way for innovative gaming experiences and increased market engagement.

| Segment | Sub-Segments |

|---|---|

| By Game Type | Action Games Puzzle Games Role-Playing Games (RPG) Strategy Games Simulation Games Sports Games Arcade & Hyper-Casual Games Adventure Games Card & Casino Games Others |

| By Player Demographics | Children (Under 13) Teenagers (13-18) Young Adults (19-34) Adults (35-54) Seniors (55+) |

| By Distribution Channel | App Stores (Google Play, Apple App Store) Third-Party App Stores Direct Downloads Social Media Platforms Cloud Gaming Platforms |

| By Genre | Casual Games Hardcore Games Multiplayer Online Battle Arena (MOBA) Battle Royale Educational Games |

| By Monetization Model | Free-to-Play (F2P) Pay-to-Play (P2P) Freemium Subscription-Based Ad-Supported |

| By Device Type | Smartphones Tablets Wearable Devices Feature Phones |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Casual Mobile Gamers | 120 | Frequent Players, Age 18-35 |

| Mobile Game Developers | 60 | Product Managers, Game Designers |

| In-app Purchase Users | 90 | Active Gamers, Age 25-45 |

| Mobile Advertising Executives | 40 | Marketing Directors, Ad Operations Managers |

| Esports Enthusiasts | 50 | Competitive Gamers, Age 16-30 |

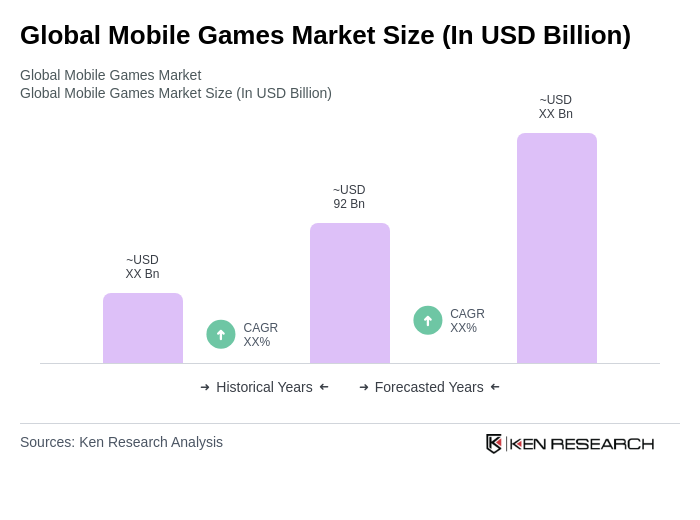

The Global Mobile Games Market is valued at approximately USD 92 billion, reflecting significant growth driven by smartphone penetration, mobile internet accessibility, and the increasing popularity of mobile gaming across various demographics.