Region:Global

Author(s):Shubham

Product Code:KRAA3162

Pages:97

Published On:August 2025

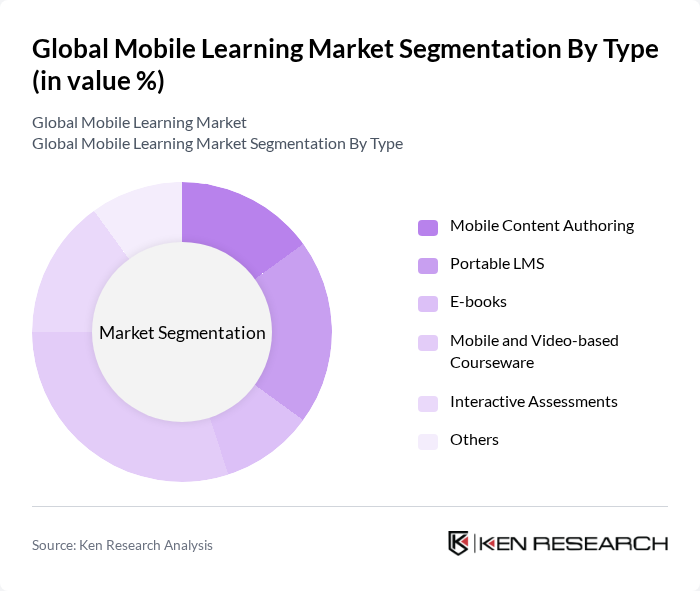

By Type:The mobile learning market can be segmented into various types, including Mobile Content Authoring, Portable LMS, E-books, Mobile and Video-based Courseware, Interactive Assessments, and Others. Among these, Mobile and Video-based Courseware is currently the leading sub-segment, driven by the increasing preference for engaging and interactive learning experiences. The rise of video content consumption, microlearning modules, and interactive formats has significantly influenced this trend, as learners seek more dynamic, visually appealing, and accessible educational materials. The demand for bite-sized, on-demand learning content is particularly strong among younger demographics and working professionals .

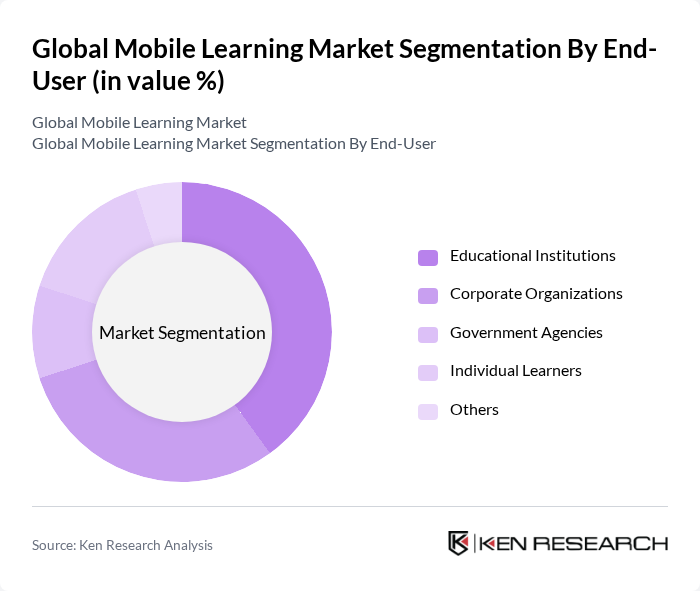

By End-User:The end-user segmentation includes Educational Institutions, Corporate Organizations, Government Agencies, Individual Learners, and Others. Educational Institutions are the dominant segment, as they increasingly adopt mobile learning solutions to enhance teaching methodologies and improve student engagement. The shift towards blended and hybrid learning environments, accelerated by recent global disruptions, has further increased the adoption of mobile learning tools in schools and universities. Corporate organizations also represent a significant segment, leveraging mobile learning for workforce upskilling and compliance training .

The Global Mobile Learning Market is characterized by a dynamic mix of regional and international players. Leading participants such as Moodle, Blackboard Inc., Adobe Systems Incorporated, Coursera Inc., Udemy Inc., LinkedIn Learning, Skillshare Inc., Pluralsight Inc., Edmodo, Khan Academy, TalentLMS (Epignosis LLC), LearnDash, Teachable, Google Classroom, SAP Litmos, Skillsoft, NetDimensions Limited (Learning Technologies Group), Promethean World Ltd, Upside Learning Solutions Pvt. Ltd., Cisco Systems, Inc., IBM Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of mobile learning is poised for transformative growth, driven by technological advancements and evolving educational needs. As artificial intelligence and machine learning technologies become more integrated into mobile learning platforms, personalized learning experiences will enhance engagement and retention. Additionally, the increasing adoption of augmented reality (AR) and virtual reality (VR) in educational contexts will create immersive learning environments, further attracting learners. These trends indicate a dynamic shift towards more interactive and tailored educational experiences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Content Authoring Portable LMS E-books Mobile and Video-based Courseware Interactive Assessments Others |

| By End-User | Educational Institutions Corporate Organizations Government Agencies Individual Learners Others |

| By Application | Academic Learning Corporate Training Test Preparation Skill Development Compliance Training Professional Development Others |

| By Distribution Channel | Direct Sales Online Marketplaces Educational Partnerships Others |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium Others |

| By Content Type | Video Content Text-Based Content Interactive Content Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Mobile Learning Adoption | 120 | School Administrators, Teachers, IT Coordinators |

| Higher Education Mobile Learning Strategies | 90 | University Faculty, Educational Technologists, Deans |

| Corporate Training Mobile Learning Solutions | 60 | HR Managers, Training Coordinators, Learning & Development Specialists |

| Mobile Learning Content Development | 50 | Content Creators, Instructional Designers, Educational Publishers |

| Mobile Learning User Experience | 70 | Students, User Experience Researchers, Mobile App Developers |

The Global Mobile Learning Market is valued at approximately USD 58 billion, reflecting significant growth driven by the increasing use of smartphones, high-speed internet access, and the demand for flexible learning solutions across various demographics.