Region:Global

Author(s):Shubham

Product Code:KRAC0676

Pages:87

Published On:August 2025

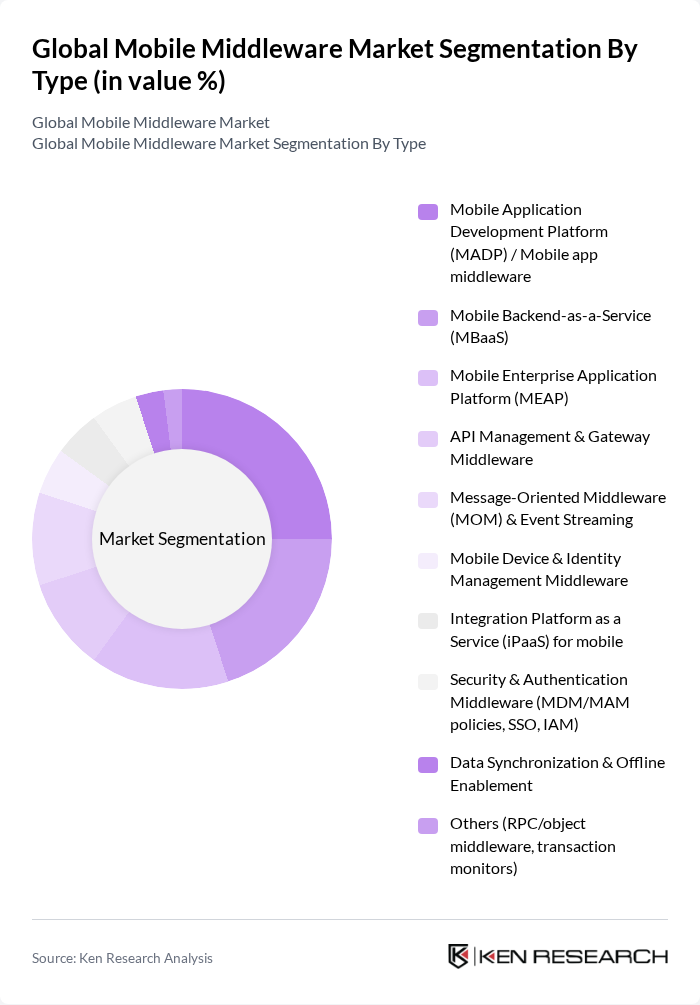

By Type:The mobile middleware market can be segmented into various types, including Mobile Application Development Platform (MADP), Mobile Backend-as-a-Service (MBaaS), Mobile Enterprise Application Platform (MEAP), API Management & Gateway Middleware, Message-Oriented Middleware (MOM) & Event Streaming, Mobile Device & Identity Management Middleware, Integration Platform as a Service (iPaaS) for mobile, Security & Authentication Middleware, Data Synchronization & Offline Enablement, and Others.

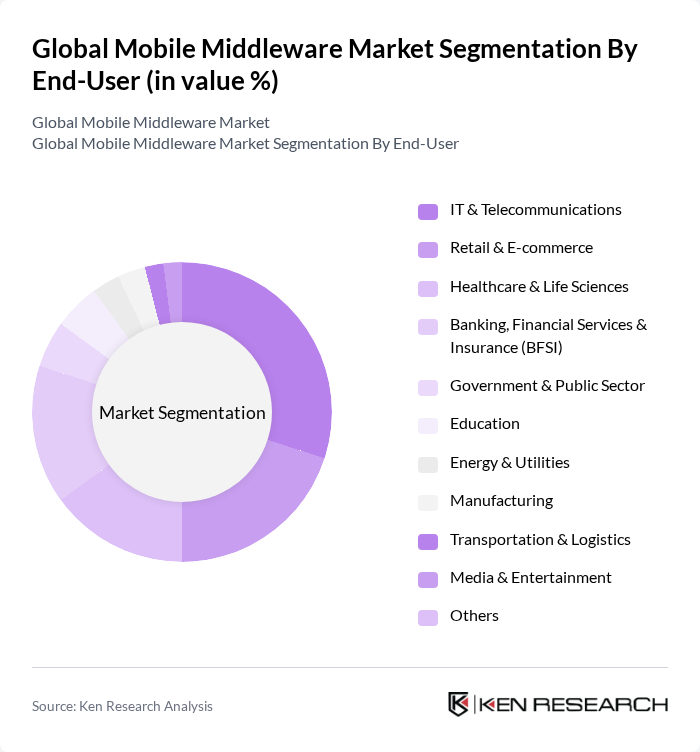

By End-User:The end-user segmentation includes IT & Telecommunications, Retail & E-commerce, Healthcare & Life Sciences, Banking, Financial Services & Insurance (BFSI), Government & Public Sector, Education, Energy & Utilities, Manufacturing, Transportation & Logistics, Media & Entertainment, and Others.

The Global Mobile Middleware Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Oracle Corporation, Microsoft Corporation, SAP SE, Red Hat, Inc. (IBM), MuleSoft, LLC (Salesforce), Software AG, TIBCO Software Inc., Appian Corporation, Pivotal Software, Inc. (VMware Tanzu), WSO2, Inc., Axway Software, Temenos (formerly Kony, Inc.), Progress Software Corporation, Jitterbit, Inc., Boomi, LP, OpenText Corporation, Fujitsu Limited, Hewlett Packard Enterprise (HPE), Unisys Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile middleware market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize digital transformation, the integration of mobile middleware with emerging technologies like AI and machine learning will enhance operational efficiencies. Furthermore, the adoption of 5G technology is expected to facilitate faster data processing and connectivity, enabling more sophisticated mobile applications and services, thus propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Application Development Platform (MADP) / Mobile app middleware Mobile Backend-as-a-Service (MBaaS) Mobile Enterprise Application Platform (MEAP) API Management & Gateway Middleware Message-Oriented Middleware (MOM) & Event Streaming Mobile Device & Identity Management Middleware Integration Platform as a Service (iPaaS) for mobile Security & Authentication Middleware (MDM/MAM policies, SSO, IAM) Data Synchronization & Offline Enablement Others (RPC/object middleware, transaction monitors) |

| By End-User | IT & Telecommunications Retail & E-commerce Healthcare & Life Sciences Banking, Financial Services & Insurance (BFSI) Government & Public Sector Education Energy & Utilities Manufacturing Transportation & Logistics Media & Entertainment Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Application | Mobile Banking & Payments Mobile Commerce & Customer Engagement Field Service & Workforce Mobility Telehealth & mHealth Mobile Learning & Collaboration IoT Device Integration & Edge Connectivity Messaging, Push Notifications & Real-time Analytics Content & Document Management Others |

| By Industry Vertical | BFSI Manufacturing Transportation and Logistics Media and Entertainment Healthcare Retail Energy & Utilities Government IT & Telecommunications Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Subscription-Based (SaaS per user/device/API call) Pay-Per-Use (consumption/transactions/events) One-Time License Fee (perpetual) Freemium/Tiered Enterprise Agreements & Volume Licensing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Mobile Middleware Solutions | 100 | IT Directors, Healthcare Application Developers |

| Financial Services Middleware Integration | 80 | Chief Technology Officers, Banking Software Engineers |

| Retail Mobile Application Middleware | 90 | Retail IT Managers, E-commerce Platform Developers |

| Telecommunications Middleware Solutions | 70 | Network Architects, Telecom Software Developers |

| Enterprise Mobile Middleware Adoption | 85 | Enterprise Architects, Business Analysts |

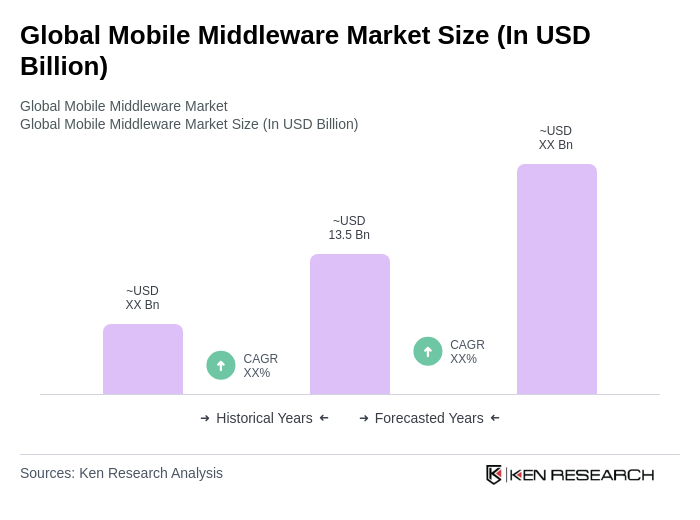

The Global Mobile Middleware Market is valued at approximately USD 13.5 billion, reflecting significant growth driven by the increasing demand for mobile applications, cloud computing, and the need for seamless integration between mobile devices and enterprise systems.