Region:Global

Author(s):Rebecca

Product Code:KRAC0279

Pages:99

Published On:August 2025

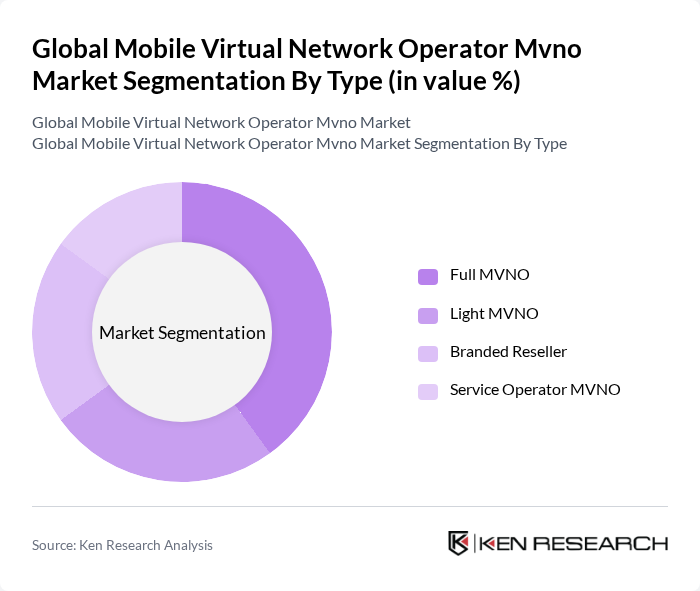

By Type:The MVNO market can be segmented into four types: Full MVNO, Light MVNO, Branded Reseller, and Service Operator MVNO. Each type represents a distinct operational model and market strategy, catering to a variety of consumer and enterprise needs. Full MVNOs typically manage more network elements and offer greater service differentiation, while Light MVNOs and Branded Resellers focus on marketing and customer relationships, relying more heavily on host network operators for technical infrastructure .

The Full MVNO segment is currently leading the market due to its ability to offer a comprehensive suite of services, including voice, data, and messaging, while maintaining control over the customer experience. This model enables Full MVNOs to differentiate through unique service offerings and branding, appealing to consumers and enterprises seeking tailored solutions. Operational flexibility and the potential for higher margins make Full MVNOs a preferred choice among new entrants and established players .

By End-User:The MVNO market is segmented by end-user into Individual Consumers, Small and Medium Enterprises (SMEs), Large Enterprises, and Government Agencies. Each segment exhibits distinct requirements and preferences, influencing the service offerings and go-to-market strategies of MVNOs. Individual consumers often prioritize affordability and flexibility, while enterprise and government segments focus on security, scalability, and customized solutions .

The Individual Consumers segment dominates the MVNO market, driven by the growing demand for affordable mobile plans, no-contract options, and value-added digital services. This segment encompasses a wide range of users, including students, professionals, and families, who prioritize cost-effectiveness and flexibility. MVNOs targeting this demographic focus on competitive pricing, digital onboarding, and tailored packages to attract and retain customers .

The Global Mobile Virtual Network Operator Mvno Market is characterized by a dynamic mix of regional and international players. Leading participants such as TracFone Wireless, Inc., Boost Mobile LLC, Lycamobile, Giffgaff, Tesco Mobile Ltd, Virgin Plus, Consumer Cellular, Mint Mobile, LLC, Red Pocket Mobile, Tello, FreedomPop, Google Fi, FRiENDi Mobile, Locus Telecommunications, LLC, UVNV, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the MVNO market appears promising, driven by technological advancements and evolving consumer preferences. As 5G networks become more widespread, MVNOs will have opportunities to innovate their service offerings, catering to niche markets and enhancing customer experiences. Additionally, the increasing integration of AI and big data analytics will enable MVNOs to optimize operations and personalize services, further solidifying their position in the telecommunications landscape. The focus on sustainability will also shape future strategies, as consumers increasingly favor eco-friendly practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Full MVNO Light MVNO Branded Reseller Service Operator MVNO |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies |

| By Service Offering | Voice Services Data Services Messaging Services IoT/M2M Connectivity |

| By Distribution Channel | Online Sales Retail Stores Direct Sales Third-Party Distributors |

| By Pricing Model | Prepaid Plans Postpaid Plans Pay-As-You-Go Plans Bundled/Custom Plans |

| By Customer Segment | Youth Segment Business Segment Senior Segment Migrant/International Segment |

| By Geographic Presence | Urban Areas Rural Areas Suburban Areas International Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer MVNO Usage | 120 | End-users, Mobile Service Subscribers |

| Business MVNO Solutions | 80 | IT Managers, Procurement Officers |

| Market Entry Strategies | 60 | Business Development Executives, Strategy Analysts |

| Regulatory Impact Assessment | 40 | Policy Makers, Regulatory Affairs Specialists |

| Consumer Preferences in Mobile Services | 100 | Market Researchers, Consumer Behavior Analysts |

The Global Mobile Virtual Network Operator (MVNO) market is valued at approximately USD 88 billion, reflecting significant growth driven by the demand for affordable mobile services and the increasing adoption of smartphones and mobile data usage.