Region:Global

Author(s):Geetanshi

Product Code:KRAB0098

Pages:80

Published On:August 2025

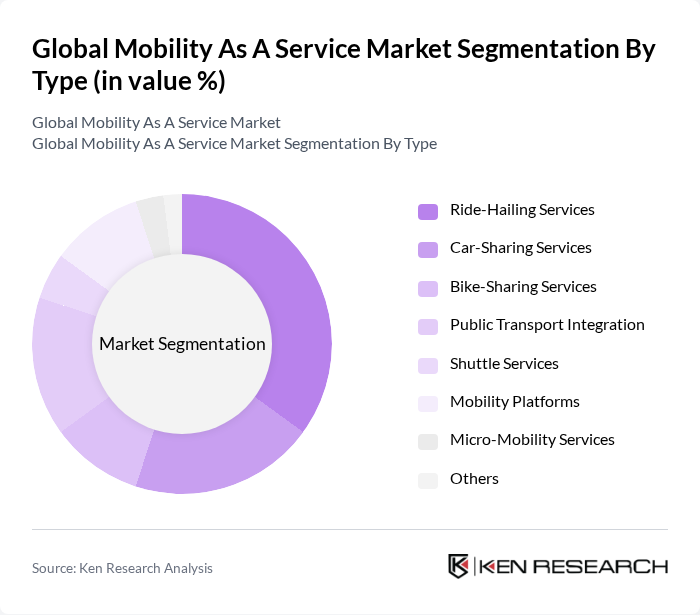

By Type:This segmentation includes various service types that cater to different mobility needs. The subsegments are Ride-Hailing Services, Car-Sharing Services, Bike-Sharing Services, Public Transport Integration, Shuttle Services, Mobility Platforms, Micro-Mobility Services, and Others. Each of these subsegments plays a crucial role in shaping the overall market landscape. Ride-hailing and car-sharing services are particularly prominent due to their widespread adoption in urban centers, while micro-mobility and public transport integration are gaining traction as cities prioritize sustainability and last-mile connectivity .

The Ride-Hailing Services subsegment is currently dominating the market due to its convenience and flexibility, appealing to a wide range of consumers. The rise of smartphone applications and real-time data integration has made it easier for users to access these services, leading to increased adoption. Additionally, the growing trend of urbanization and the need for efficient transportation solutions have further propelled the demand for ride-hailing services. This subsegment is characterized by major players like Uber and Lyft, which have established strong brand recognition and customer loyalty .

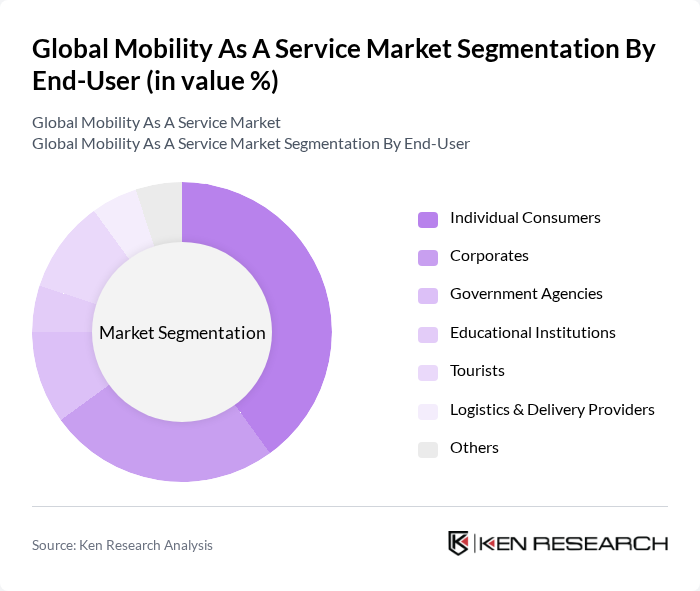

By End-User:This segmentation focuses on the different user categories that utilize mobility services. The subsegments include Individual Consumers, Corporates, Government Agencies, Educational Institutions, Tourists, Logistics & Delivery Providers, and Others. Each user group has distinct needs and preferences that influence their choice of mobility services. Individual consumers are the primary users, especially in urban areas, while corporates and government agencies increasingly adopt MaaS for employee mobility and fleet management .

Individual Consumers represent the largest segment in the market, driven by the increasing preference for on-demand transportation solutions. The convenience of accessing mobility services through mobile applications has made it a popular choice among urban dwellers. Additionally, the growing awareness of environmental sustainability has led consumers to opt for shared mobility options, further boosting this subsegment's growth. Corporates also contribute significantly, as many companies are adopting mobility solutions for employee transportation and travel management .

The Global Mobility As A Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uber Technologies, Inc., Lyft, Inc., Grab Holdings Inc., Didi Chuxing Technology Co., Ola Cabs (ANI Technologies Pvt. Ltd.), BlaBlaCar, Zipcar, SHARE NOW GmbH, Bolt Technology OÜ, Citymapper, Moovit (Intel Corporation), Via Transportation, Inc., MaaS Global Oy, Transit App, Inc., TIER Mobility SE, Europcar Mobility Group S.A., Hertz Global Holdings, Inc., Careem Networks FZ LLC, Movmi Shared Transportation Services Inc., Communauto Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mobility as a Service market appears promising, driven by ongoing urbanization and technological advancements. As cities increasingly adopt smart transportation solutions, the integration of AI and big data analytics will enhance user experiences and operational efficiencies. Furthermore, the shift towards electric and autonomous vehicles will likely reshape service offerings, making them more appealing to environmentally conscious consumers. The collaboration between public and private sectors will also play a crucial role in shaping the future landscape of mobility solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Ride-Hailing Services Car-Sharing Services Bike-Sharing Services Public Transport Integration Shuttle Services Mobility Platforms Micro-Mobility Services Others |

| By End-User | Individual Consumers Corporates Government Agencies Educational Institutions Tourists Logistics & Delivery Providers Others |

| By Service Model | Subscription-Based Pay-Per-Use Membership-Based Corporate Mobility Packages Others |

| By Vehicle Type | Electric Vehicles Hybrid Vehicles Conventional Vehicles Autonomous Vehicles Bicycles & E-Bikes Scooters & E-Scooters Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Intercity/Regional Others |

| By Payment Method | Mobile Payments Credit/Debit Cards Digital Wallets Cash Payments Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Regulatory Mandates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Mobility Service Providers | 60 | CEOs, Product Managers, Business Development Leads |

| Public Transportation Authorities | 50 | Transportation Planners, Policy Makers, Operations Managers |

| End-User Experience in MaaS | 100 | Commuters, Urban Residents, Mobility Enthusiasts |

| Technology Providers for Mobility Solutions | 40 | CTOs, Software Developers, Data Analysts |

| Investors in Mobility Startups | 40 | Venture Capitalists, Angel Investors, Industry Analysts |

The Global Mobility As A Service market is valued at approximately USD 237 billion, reflecting a significant growth driven by urbanization, demand for integrated transportation solutions, and the rise of digital platforms facilitating seamless mobility options.