Region:Global

Author(s):Rebecca

Product Code:KRAA2176

Pages:91

Published On:August 2025

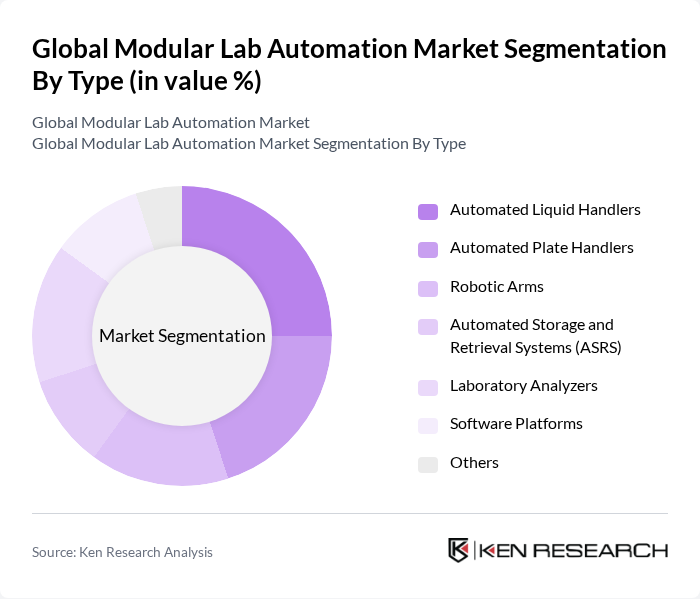

By Type:The market is segmented into Automated Liquid Handlers, Automated Plate Handlers, Robotic Arms, Automated Storage and Retrieval Systems (ASRS), Laboratory Analyzers, Software Platforms, and Others. Each of these subsegments plays a crucial role in enhancing laboratory efficiency, throughput, and data traceability. Automated Liquid Handlers and Plate Handlers are widely adopted for sample preparation and high-throughput screening, while Robotic Arms and ASRS support flexible, scalable workflows. Laboratory Analyzers and Software Platforms drive integration, data management, and process control across diverse laboratory applications .

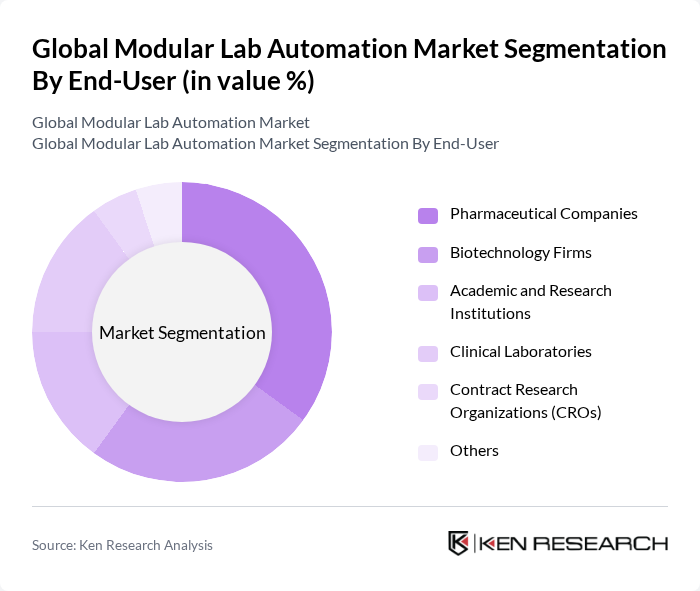

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, Clinical Laboratories, Contract Research Organizations (CROs), and Others. Pharmaceutical and biotechnology sectors are the largest adopters, leveraging modular automation for drug discovery, genomics, and process optimization. Academic and research institutions utilize these systems for reproducibility and collaborative studies, while clinical laboratories focus on high-throughput diagnostics and data integrity .

The Global Modular Lab Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Beckman Coulter, Inc. (Danaher Corporation), Tecan Group Ltd., PerkinElmer, Inc. (now Revvity, Inc.), Hamilton Company, Eppendorf AG, Roche Diagnostics, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., QIAGEN N.V., Merck KGaA, Hudson Robotics, Inc., Labcorp, Illumina, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of modular lab automation is poised for significant growth, driven by the increasing demand for efficiency and accuracy in laboratory operations. As laboratories continue to embrace digital transformation, the integration of AI and machine learning will enhance data analysis capabilities, leading to more informed decision-making. Furthermore, the trend towards sustainability will encourage the development of eco-friendly automation solutions, aligning with global environmental goals and regulatory requirements, ultimately shaping the future landscape of laboratory automation.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Liquid Handlers Automated Plate Handlers Robotic Arms Automated Storage and Retrieval Systems (ASRS) Laboratory Analyzers Software Platforms Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Clinical Laboratories Contract Research Organizations (CROs) Others |

| By Application | Drug Discovery Genomics Proteomics Clinical Diagnostics Cell Biology Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Lab Automation | 120 | Lab Managers, Automation Specialists |

| Biotechnology Research Facilities | 90 | R&D Directors, Lab Technicians |

| Academic Research Labs | 60 | Principal Investigators, Lab Coordinators |

| Clinical Testing Laboratories | 50 | Quality Control Managers, Operations Supervisors |

| Environmental Testing Labs | 40 | Environmental Scientists, Lab Directors |

The Global Modular Lab Automation Market is valued at approximately USD 3.2 billion, driven by the increasing demand for high-throughput screening and advancements in automation technologies, including robotics and artificial intelligence.