Region:Global

Author(s):Rebecca

Product Code:KRAC0208

Pages:97

Published On:August 2025

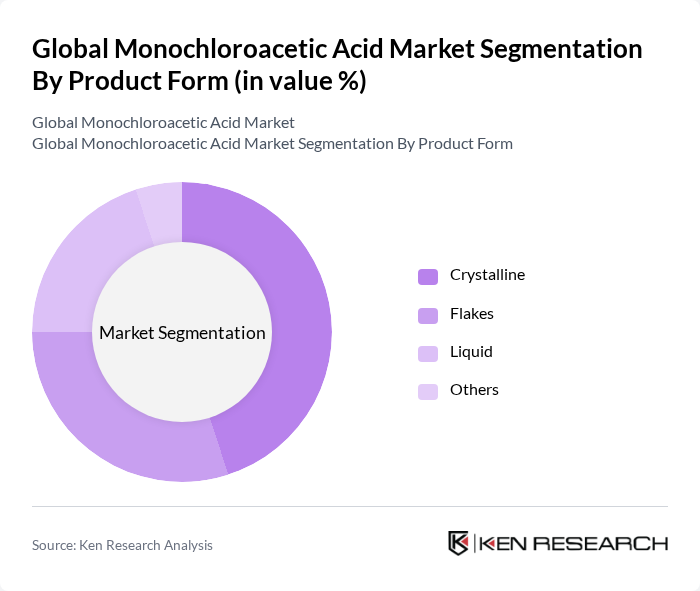

By Product Form:

The product form segmentation includes Crystalline, Flakes, Liquid, and Others. Among these, the Crystalline form is the most dominant due to its high purity and effectiveness in various applications, particularly in the production of carboxymethyl cellulose (CMC). The demand for crystalline monochloroacetic acid is driven by its extensive use in pharmaceuticals and agrochemicals, where quality and consistency are paramount. The Flakes and Liquid forms also hold significant market shares, catering to specific industrial needs, but the Crystalline form remains the preferred choice for many manufacturers .

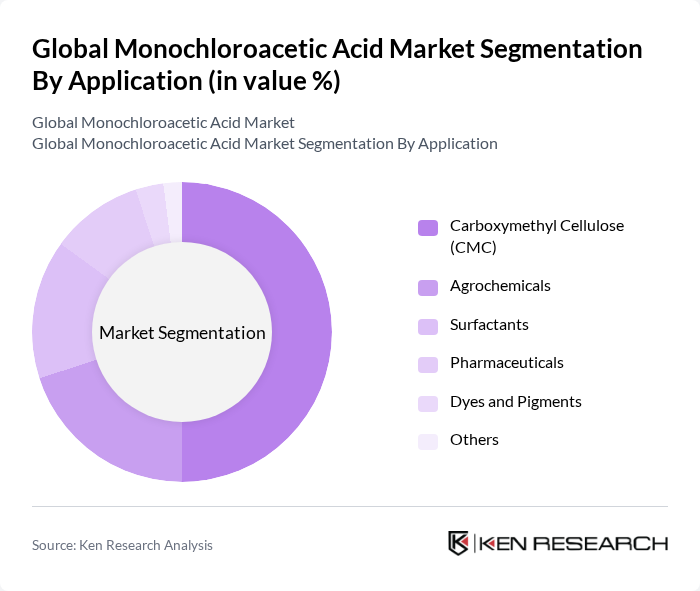

By Application:

The application segmentation includes Carboxymethyl Cellulose (CMC), Agrochemicals, Surfactants, Pharmaceuticals, Dyes and Pigments, and Others. The Carboxymethyl Cellulose (CMC) segment leads the market, driven by its widespread use in food, pharmaceuticals, and personal care products. The increasing demand for CMC in various industries, coupled with its versatile properties, positions it as the most significant application for monochloroacetic acid. Agrochemicals and Surfactants also represent substantial segments, reflecting the chemical's importance in enhancing agricultural productivity and cleaning products. Agrochemicals, particularly herbicides, are a major growth driver, while pharmaceutical and water treatment applications are expanding due to increased demand for effective intermediates .

The Global Monochloroacetic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as CABB Group GmbH, Akzo Nobel N.V., Merck KGaA, Daicel Corporation, The Dow Chemical Company, Eastman Chemical Company, Hubei Greenhome Fine Chemical Co., Ltd., Jiangshan Chemical Co., Ltd., Shijiazhuang Huaguang Chemical Co., Ltd., Shandong Minji Chemical Co., Ltd., Solvay S.A., BASF SE, Zhejiang Jianye Chemical Co., Ltd., Hubei Shunhui Chemical Co., Ltd., Hubei Jusheng Technology Co., Ltd., Nouryon, PCC SE, Niacet Corporation, Jubilant Ingrevia Limited, Archit Organosys Limited, Meghmani Organics Limited, IOL Chemicals & Pharmaceuticals Limited, Meridian Chem Bond Pvt. Ltd., Denak Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the monochloroacetic acid market appears promising, driven by the increasing focus on sustainable practices and technological advancements in production. As industries shift towards eco-friendly alternatives, the demand for biodegradable products is expected to rise, creating new avenues for growth. Additionally, strategic partnerships among manufacturers and research institutions are likely to foster innovation, enhancing production efficiency and expanding application areas, particularly in pharmaceuticals and agrochemicals.

| Segment | Sub-Segments |

|---|---|

| By Product Form | Crystalline Flakes Liquid Others |

| By Application | Carboxymethyl Cellulose (CMC) Agrochemicals Surfactants Pharmaceuticals Dyes and Pigments Others |

| By End-User Industry | Agriculture Chemical Manufacturing Pharmaceuticals Personal Care Food & Beverage Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Product Development Heads |

| Agrochemical Sector | 80 | Procurement Managers, Technical Sales Representatives |

| Food Industry Usage | 70 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Personal Care Products | 60 | Formulation Chemists, Brand Managers |

| Industrial Applications | 90 | Operations Managers, Supply Chain Analysts |

The Global Monochloroacetic Acid Market is valued at approximately USD 960 million, based on a five-year historical analysis. This valuation reflects the market's growth driven by demand in various sectors, including food, pharmaceuticals, and agrochemicals.