Region:Global

Author(s):Geetanshi

Product Code:KRAD0136

Pages:95

Published On:August 2025

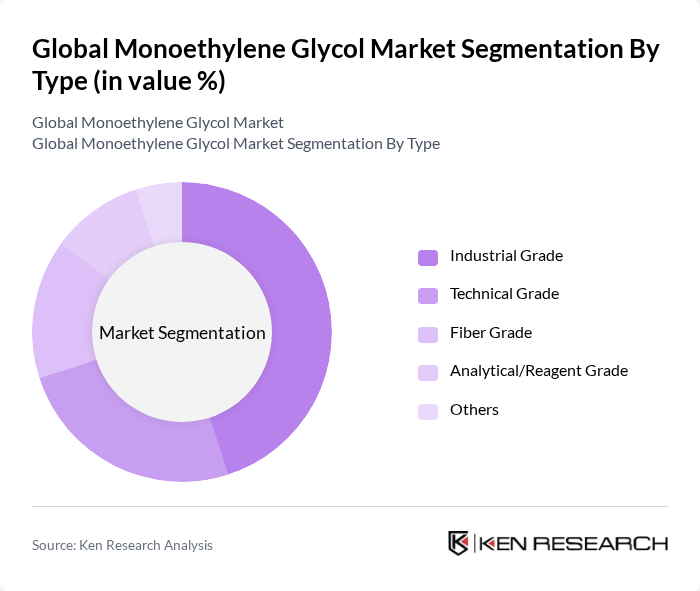

By Type:The market is segmented into various types, including Industrial Grade, Technical Grade, Fiber Grade, Analytical/Reagent Grade, and Others. Among these, the Industrial Grade segment is the most dominant due to its extensive use in manufacturing processes across multiple industries. The demand for Industrial Grade monoethylene glycol is driven by its application in antifreeze formulations and as a raw material for producing PET, which is widely used in packaging and textiles .

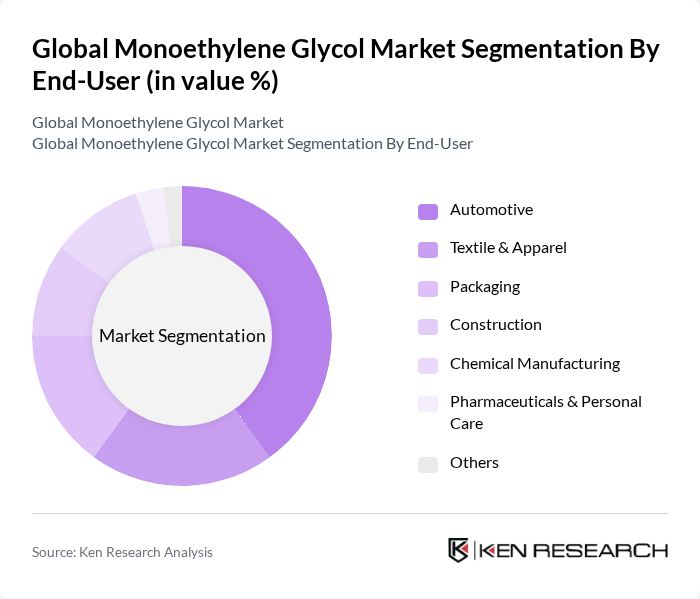

By End-User:The end-user segments include Automotive, Textile & Apparel, Packaging, Construction, Chemical Manufacturing, Pharmaceuticals & Personal Care, and Others. The Automotive sector is the leading end-user, primarily due to the high demand for antifreeze and coolant products. The increasing production of vehicles and the need for efficient thermal management systems in automobiles are driving the growth of monoethylene glycol in this sector. The textile and packaging industries are also significant contributors, leveraging MEG for polyester fiber and PET resin production .

The Global Monoethylene Glycol Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., China Petroleum & Chemical Corporation (Sinopec), LyondellBasell Industries N.V., Reliance Industries Limited, Indorama Ventures Public Company Limited, Formosa Plastics Corporation, Eastman Chemical Company, SABIC (Saudi Basic Industries Corporation), Huntsman Corporation, OCI Company Ltd., Mitsubishi Chemical Corporation, INEOS Group Limited, PETRONAS Chemicals Group Berhad, China National Petroleum Corporation (CNPC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the monoethylene glycol market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly practices, the demand for bio-based MEG is expected to rise. Additionally, emerging markets in Asia and Africa present significant growth opportunities, with rising industrialization and urbanization. Companies that invest in innovative production technologies and sustainable practices will likely gain a competitive edge in this evolving landscape, ensuring long-term growth and profitability.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Technical Grade Fiber Grade Analytical/Reagent Grade Others |

| By End-User | Automotive Textile & Apparel Packaging Construction Chemical Manufacturing Pharmaceuticals & Personal Care Others |

| By Application | Antifreeze and Coolants Polyester Fiber & PET Resin Production Resins and Coatings Deicing Fluids Heat Transfer Fluids Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, UK, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Medium Price High Price |

| By Packaging Type | Bulk Packaging Drums Intermediate Bulk Containers (IBCs) Bottles & Cans Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Antifreeze Applications | 100 | Product Managers, R&D Engineers |

| Textile Manufacturing Processes | 80 | Production Supervisors, Quality Control Managers |

| Consumer Goods Packaging | 70 | Packaging Engineers, Supply Chain Analysts |

| Pharmaceuticals and Personal Care | 50 | Regulatory Affairs Specialists, Product Development Managers |

| Industrial Applications and Solvents | 90 | Operations Managers, Procurement Specialists |

The Global Monoethylene Glycol Market is valued at approximately USD 28 billion, driven by increasing demand in industries such as automotive, textiles, and packaging, particularly for polyester fibers and antifreeze products.