Region:Global

Author(s):Dev

Product Code:KRAD0571

Pages:99

Published On:August 2025

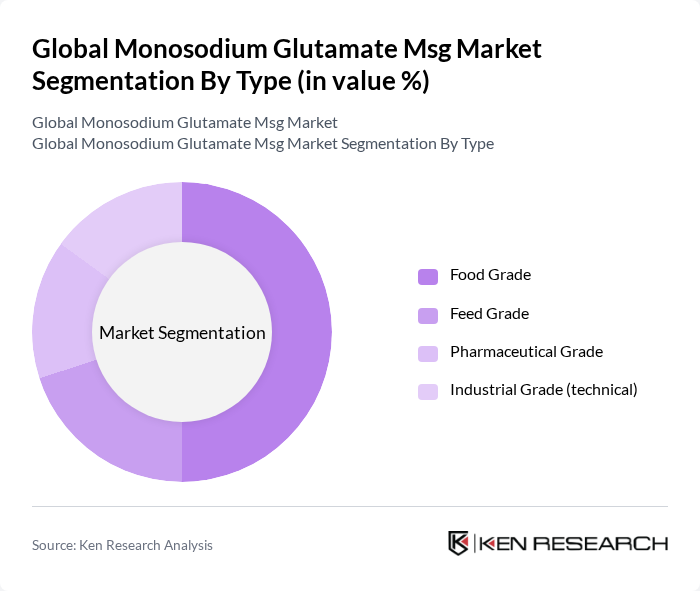

By Type:

The market is segmented into four types: Food Grade, Feed Grade, Pharmaceutical Grade, and Industrial Grade (technical). Among these, Food Grade MSG is the leading subsegment, driven by its extensive use in the food and beverage industry. Industry analyses indicate food grade dominates usage for seasonings, snacks, soups, sauces, and ready-to-eat meals as manufacturers seek to enhance umami while maintaining cost efficiency. The increasing consumer preference for umami flavors in various cuisines has led to a surge in demand for Food Grade MSG, with Asia’s culinary influence expanding globally. Additionally, the growing trend of home cooking and the rise of gourmet and convenience food products have further solidified its dominance in the market.

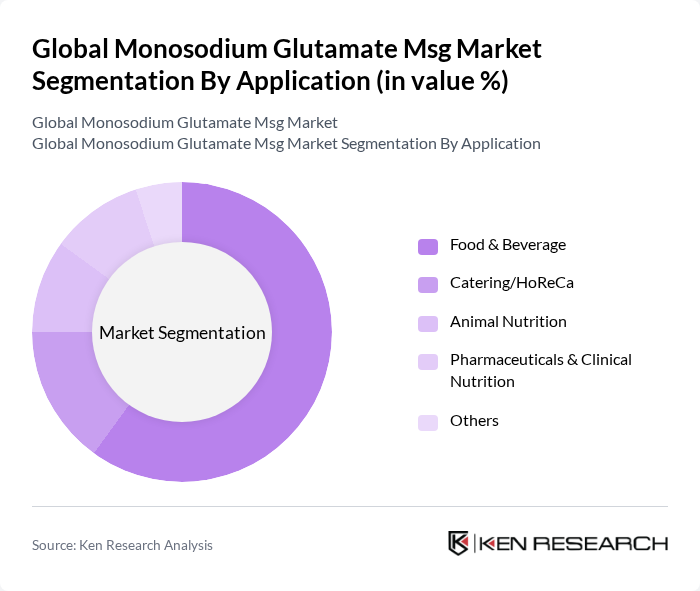

By Application:

The market is segmented into five applications: Food & Beverage, Catering/HoReCa, Animal Nutrition, Pharmaceuticals & Clinical Nutrition, and Others. The Food & Beverage application dominates the market, accounting for a significant share due to the widespread use of MSG in seasonings, snacks, soups, and sauces. The increasing demand for ready-to-eat meals and convenience foods has further propelled the growth of this segment, as manufacturers seek to enhance flavor profiles and meet consumer preferences.

The Global Monosodium Glutamate Msg Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., Meihua Holdings Group Co., Ltd., Fufeng Group Co., Ltd., Ningxia Eppen Biotech Co., Ltd., Shandong Xinle Monosodium Glutamate Co., Ltd., Vedan International (Holdings) Limited, Henan Lotus Flower Gourmet Powder Co., Ltd. (Lotus MSG), Shandong Qilu Biotechnology Group Co., Ltd., Shandong Shuntian MSG Co., Ltd., Fujian Wuyi Monosodium Glutamate Co., Ltd., Global Bio-Chem Technology Group Company Limited, Linghua Group Limited, COFCO Biochemical (Anhui) Co., Ltd., CJ CheilJedang Corp., Tate & Lyle PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the monosodium glutamate market appears promising, driven by evolving consumer preferences and innovations in food technology. As the demand for flavor enhancers continues to rise, particularly in emerging markets, MSG is likely to see increased adoption in various food applications. Additionally, the trend towards clean label products and sustainable sourcing will shape the market landscape, encouraging manufacturers to explore new formulations and marketing strategies that align with consumer values and health trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Grade Feed Grade Pharmaceutical Grade Industrial Grade (technical) |

| By Application | Food & Beverage: seasonings, snacks, soups, sauces, RTE meals Catering/HoReCa (foodservice) Animal Nutrition (feed) Pharmaceuticals & Clinical Nutrition (excipients, parenteral nutrition) Others (industrial/process use) |

| By End-User | Food & Snack Manufacturers Seasoning/Condiment Blenders Restaurants, QSRs, and Institutional Catering Retail/Household Consumers Pharmaceutical & Nutritional Formulators |

| By Distribution Channel | Direct/B2B (manufacturers to industrial buyers) Distributors/Wholesalers Modern Trade (supermarkets/hypermarkets) Online/E-commerce Traditional Trade (convenience & grocery) |

| By Packaging Type | Bulk (25 kg bags, FIBCs) Foodservice Packs (1–5 kg) Retail Packs (100 g–1 kg) Others (custom/industrial) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 120 | Production Managers, Quality Control Specialists |

| Food Retail Sector | 100 | Category Managers, Purchasing Agents |

| Food Service Industry | 80 | Restaurant Owners, Executive Chefs |

| Health and Nutrition Experts | 60 | Dietitians, Food Scientists |

| Regulatory Bodies | 40 | Food Safety Inspectors, Policy Makers |

The Global Monosodium Glutamate (MSG) market is valued at approximately USD 5.5 billion, driven by the increasing demand for flavor enhancers in the food and beverage industry, particularly in processed foods and international cuisines.