Region:Global

Author(s):Dev

Product Code:KRAD0514

Pages:96

Published On:August 2025

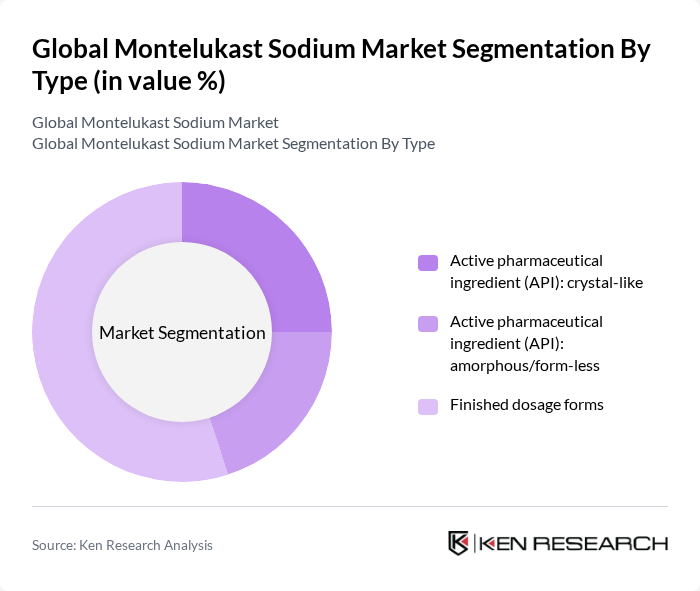

By Type:The market is segmented into three main types: Active pharmaceutical ingredient (API): crystal-like, Active pharmaceutical ingredient (API): amorphous/form-less, and Finished dosage forms. The finished dosage forms segment is currently dominating the market due to the increasing demand for ready-to-use medications that enhance patient compliance and convenience. The trend towards personalized medicine and the growing preference for oral dosage forms are also contributing to the growth of this segment.

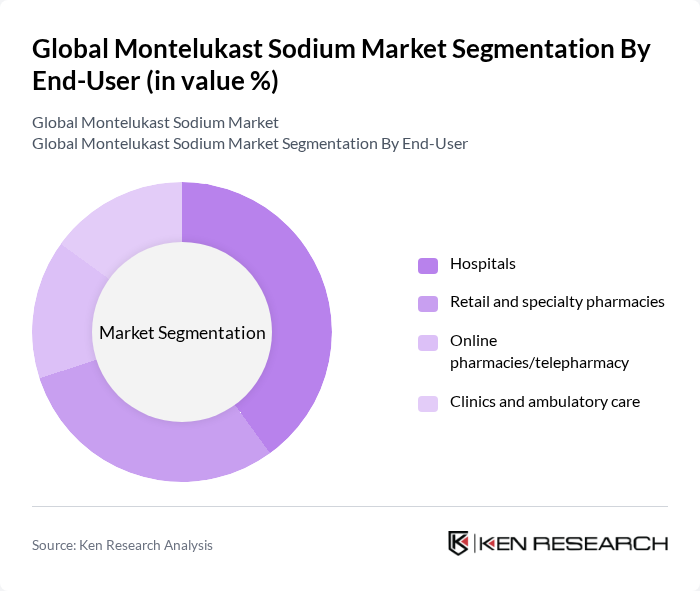

By End-User:The end-user segmentation includes Hospitals, Retail and specialty pharmacies, Online pharmacies/telepharmacy, and Clinics and ambulatory care. Hospitals are the leading end-user segment, driven by the high volume of prescriptions for Montelukast Sodium in managing asthma and allergic conditions. The increasing number of hospital admissions related to respiratory issues further fuels this demand, making hospitals a critical market segment.

The Global Montelukast Sodium Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Viatris Inc. (including Mylan heritage), Sandoz Group AG, Aurobindo Pharma Ltd., Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Lupin Ltd., Zydus Lifesciences Ltd., Glenmark Pharmaceuticals Ltd., Cipla Ltd., Hetero Labs Ltd., Alkem Laboratories Ltd., Apotex Inc., Torrent Pharmaceuticals Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The narrative statements on digital health, telemedicine, and preventive care are qualitative and do not include numerical claims; they require no correction. Where projections are implied, they refer to trends “in future” without dated assertions.

| Segment | Sub-Segments |

|---|---|

| By Type | Active pharmaceutical ingredient (API): crystal-like Active pharmaceutical ingredient (API): amorphous/form-less Finished dosage forms |

| By End-User | Hospitals Retail and specialty pharmacies Online pharmacies/telepharmacy Clinics and ambulatory care |

| By Distribution Channel | Hospital pharmacies Retail pharmacies E-commerce/direct-to-patient |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Dosage Form | Film-coated tablets Chewable tablets Oral granules/sachets Oral solution/suspension |

| By Packaging Type | Blister packs HDPE/PET bottles Sachets/stick packs |

| By Price Range | Economy (generic) Mid-range (branded generics) Premium (innovator brands/combination packs) |

| By Application | Asthma (maintenance and EIB prevention) Allergic rhinitis (seasonal and perennial) Urticaria and off-label uses Bronchospasm prophylaxis |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers (Pulmonologists) | 100 | Doctors, Nurse Practitioners |

| Pharmacists | 80 | Community Pharmacists, Hospital Pharmacists |

| Patients with Asthma | 140 | Asthma Patients, Caregivers |

| Allergy Specialists | 70 | Allergists, Immunologists |

| Healthcare Administrators | 60 | Pharmacy Directors, Health System Executives |

The Global Montelukast Sodium Market is valued at approximately USD 450 million, driven by the increasing prevalence of asthma and allergic rhinitis, as well as rising awareness regarding respiratory health and effective treatment options.