Region:Global

Author(s):Dev

Product Code:KRAC0468

Pages:85

Published On:August 2025

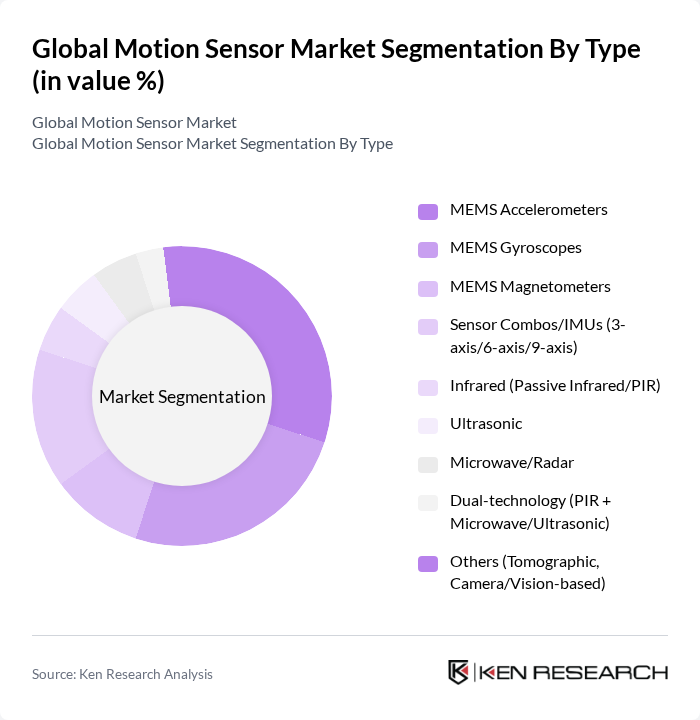

By Type:The motion sensor market is segmented into various types, including MEMS Accelerometers, MEMS Gyroscopes, MEMS Magnetometers, Sensor Combos/IMUs (3-axis/6-axis/9-axis), Infrared (Passive Infrared/PIR), Ultrasonic, Microwave/Radar, Dual-technology (PIR + Microwave/Ultrasonic), and Others (Tomographic, Camera/Vision-based). Among these, MEMS Accelerometers and MEMS Gyroscopes are leading the market due to their widespread application in consumer electronics and automotive sectors.

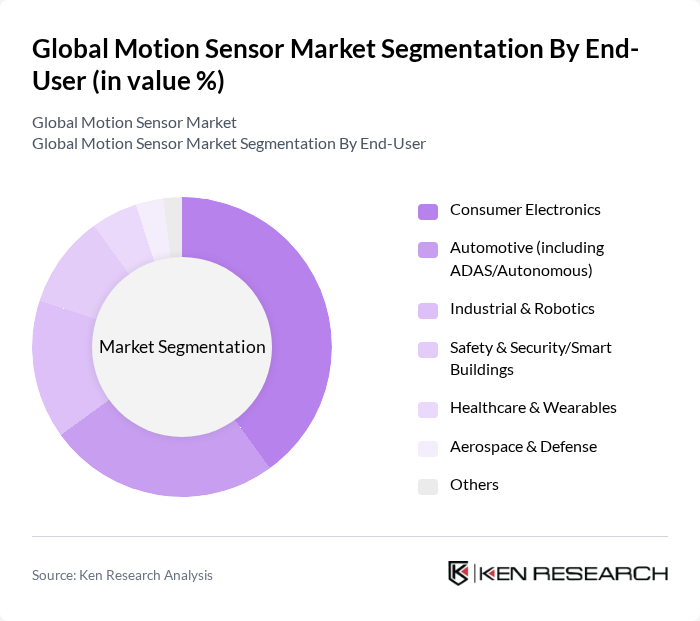

By End-User:The market is segmented by end-user applications, including Consumer Electronics, Automotive (including ADAS/Autonomous), Industrial & Robotics, Safety & Security/Smart Buildings, Healthcare & Wearables, Aerospace & Defense, and Others. The Consumer Electronics segment is the largest, driven by the increasing integration of motion sensors in smartphones, tablets, and gaming devices.

The Global Motion Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch Sensortec GmbH (Robert Bosch GmbH), STMicroelectronics N.V., Texas Instruments Incorporated, Analog Devices, Inc., Honeywell International Inc., Infineon Technologies AG, NXP Semiconductors N.V., Omron Corporation, Murata Manufacturing Co., Ltd., Panasonic Holdings Corporation, Qualcomm Technologies, Inc., Siemens AG, Samsung Electronics Co., Ltd., ams-OSRAM AG, TDK Corporation (including InvenSense) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the motion sensor market appears promising, driven by technological advancements and increasing consumer awareness. As industries continue to embrace automation and smart technologies, the demand for motion sensors is expected to rise. Innovations in AI and machine learning will enhance sensor capabilities, while the push for energy-efficient solutions will further stimulate market growth. Additionally, the integration of motion sensors in healthcare and security applications will open new avenues for expansion, ensuring a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | MEMS Accelerometers MEMS Gyroscopes MEMS Magnetometers Sensor Combos/IMUs (3-axis/6-axis/9-axis) Infrared (Passive Infrared/PIR) Ultrasonic Microwave/Radar Dual-technology (PIR + Microwave/Ultrasonic) Others (Tomographic, Camera/Vision-based) |

| By End-User | Consumer Electronics Automotive (including ADAS/Autonomous) Industrial & Robotics Safety & Security/Smart Buildings Healthcare & Wearables Aerospace & Defense Others |

| By Application | Smartphones, Wearables & Gaming ADAS/Vehicle Dynamics & Navigation Industrial Automation & Condition Monitoring Security/Intrusion Detection & Surveillance Smart Lighting & HVAC Control Healthcare Monitoring & Elderly Care Drones/Robotics & Motion Tracking |

| By Component | Sensors (Accelerometer, Gyro, Magnetometer, PIR, Radar) Sensor Fusion ICs/MCUs Software/Algorithms (Sensor Fusion, AI/ML) Modules & Reference Designs |

| By Distribution Channel | Direct (OEM/ODM) Distributors (e.g., Avnet, Arrow, Digi-Key) Online (Manufacturer Web, E-commerce) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level (commodity MEMS/PIR) Mid-Range Premium/Automotive & Industrial-Grade |

| By Connectivity | Wired Wireless (BLE, Zigbee, Wi?Fi, Sub?GHz) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Motion Sensors | 120 | Automotive Engineers, Product Development Managers |

| Consumer Electronics Applications | 90 | Product Managers, R&D Specialists |

| Industrial Automation Sensors | 80 | Operations Managers, Automation Engineers |

| Healthcare Monitoring Devices | 60 | Healthcare Technology Specialists, Biomedical Engineers |

| Smart Home Devices | 70 | IoT Developers, Home Automation Experts |

The Global Motion Sensor Market is valued at approximately USD 6.6 billion, driven by the increasing demand for smart devices, advancements in IoT technology, and the rising adoption of automation across various industries.