Region:Global

Author(s):Rebecca

Product Code:KRAA1380

Pages:95

Published On:August 2025

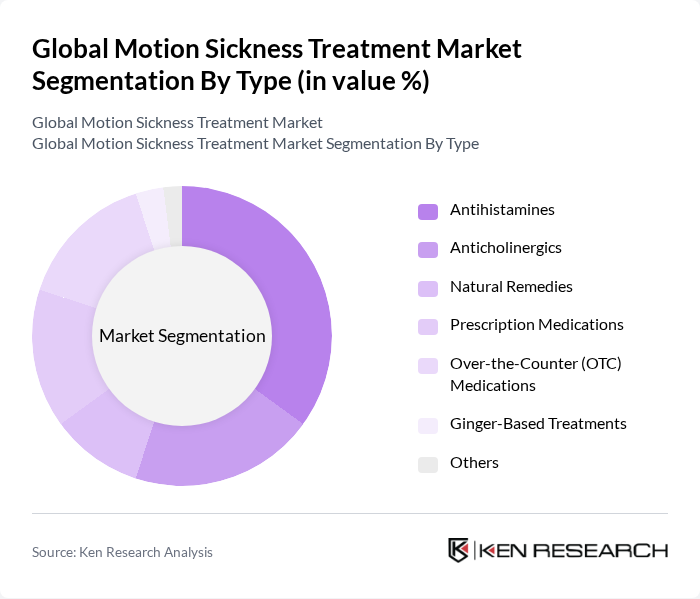

By Type:The market is segmented into various types of treatments, including Antihistamines, Anticholinergics, Natural Remedies, Prescription Medications, Over-the-Counter (OTC) Medications, Ginger-Based Treatments, and Others. Among these,Antihistaminesare the most widely used due to their effectiveness in alleviating symptoms of motion sickness. Consumers often preferOTC medicationsfor their convenience and accessibility, leading to a significant market share for this subsegment. Alternative therapies such as acupressure wristbands and herbal remedies are gaining traction, reflecting a growing interest in non-pharmaceutical options .

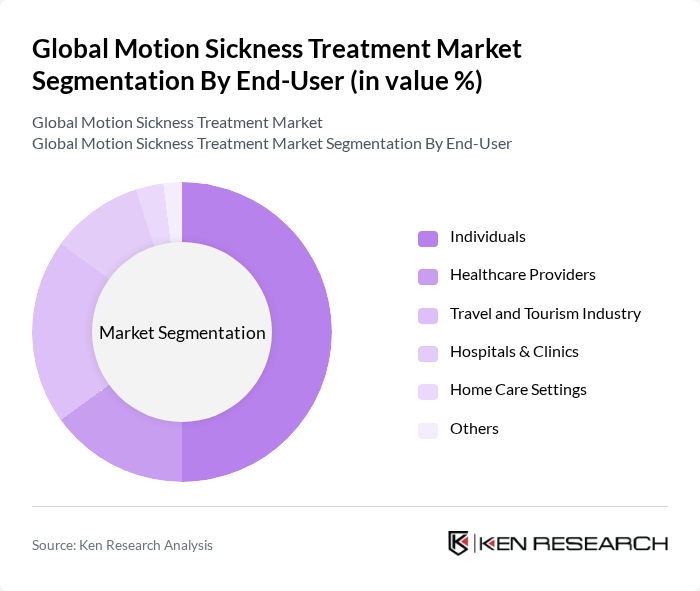

By End-User:The end-user segmentation includes Individuals, Healthcare Providers, the Travel and Tourism Industry, Hospitals & Clinics, Home Care Settings, and Others. TheIndividualssegment dominates the market as many people seek personal remedies for motion sickness, especially travelers. The increasing trend of travel and tourism has further propelled the demand for effective treatments, making this segment a key driver of market growth. Healthcare providers and hospitals play a critical role in severe cases, while home care settings and the travel industry continue to expand their offerings for motion sickness management .

The Global Motion Sickness Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as GlaxoSmithKline plc, Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., Novartis AG, Sanofi S.A., Bayer AG, Teva Pharmaceutical Industries Ltd., Perrigo Company plc, Prestige Consumer Healthcare Inc., Dr. Reddy's Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Aurobindo Pharma Ltd., Zydus Lifesciences Ltd., Hisamitsu Pharmaceutical Co., Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the motion sickness treatment market appears promising, driven by increasing consumer awareness and the development of innovative treatment options. As the travel industry continues to rebound post-pandemic, the demand for effective motion sickness solutions is expected to rise. Additionally, the integration of technology in treatment solutions, such as mobile apps for symptom tracking, will likely enhance user engagement and adherence, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Antihistamines Anticholinergics Natural Remedies Prescription Medications Over-the-Counter (OTC) Medications Ginger-Based Treatments Others |

| By End-User | Individuals Healthcare Providers Travel and Tourism Industry Hospitals & Clinics Home Care Settings Others |

| By Distribution Channel | Pharmacies Online Retail Hospitals Supermarkets/Hypermarkets Others |

| By Region | North America (U.S., Canada, Mexico) Europe (U.K., Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Age Group | Children Adults Elderly |

| By Severity of Motion Sickness | Mild Moderate Severe |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 150 | Neurologists, Gastroenterologists, General Practitioners |

| Patients with Motion Sickness | 150 | Individuals aged 18-65 experiencing motion sickness |

| Pharmaceutical Industry Experts | 100 | Product Managers, R&D Directors, Regulatory Affairs Specialists |

| Travel Industry Stakeholders | 80 | Travel Agents, Tour Operators, Airline Health Officers |

| Academic Researchers | 70 | Researchers focused on motion sickness and related fields |

The Global Motion Sickness Treatment Market is valued at approximately USD 740 million, driven by increased passenger mobility, consumer awareness, and advancements in drug delivery technologies. This market is expected to grow as more individuals seek effective treatments for motion sickness.