Region:Global

Author(s):Geetanshi

Product Code:KRAD0161

Pages:92

Published On:August 2025

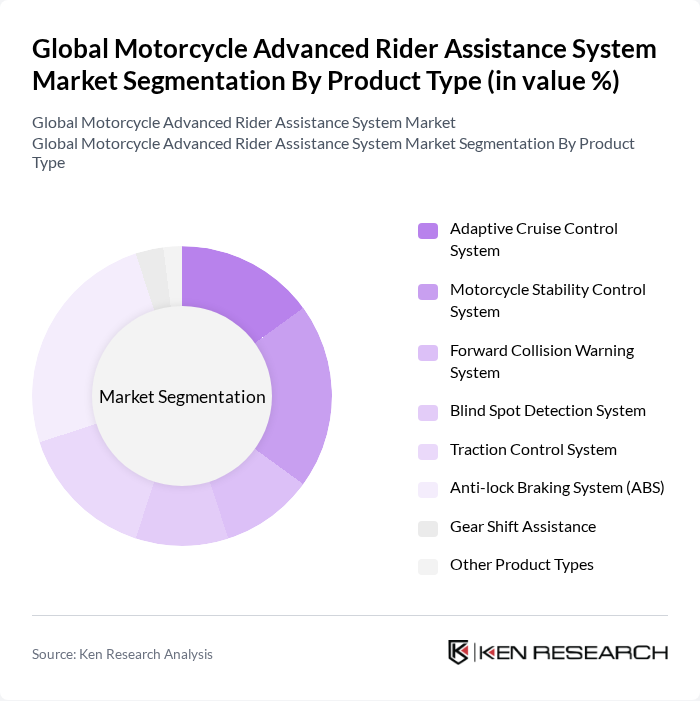

By Product Type:The product type segmentation includes various advanced rider assistance systems designed to enhance motorcycle safety and performance. The subsegments are Adaptive Cruise Control System, Motorcycle Stability Control System, Forward Collision Warning System, Blind Spot Detection System, Traction Control System, Anti-lock Braking System (ABS), Gear Shift Assistance, and Other Product Types. Among these, the Anti-lock Braking System (ABS) is the most dominant due to its critical role in preventing wheel lock-up during braking, significantly enhancing rider safety. The increasing awareness of safety features among consumers and regulatory mandates for ABS in many regions have further solidified its market leadership .

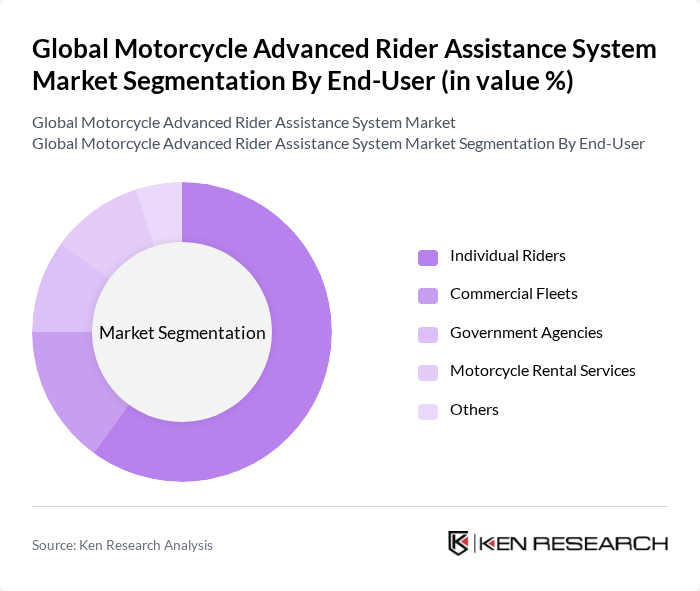

By End-User:The end-user segmentation encompasses various categories of motorcycle users, including Individual Riders, Commercial Fleets, Government Agencies, Motorcycle Rental Services, and Others. Individual Riders represent the largest segment, driven by the growing trend of personal motorcycle ownership and the increasing emphasis on safety features among consumers. The rise in motorcycle tourism and recreational riding has also contributed to the demand for advanced rider assistance systems among individual users, making this segment a key focus for manufacturers .

The Global Motorcycle Advanced Rider Assistance System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Garmin Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Yamaha Motor Co., Ltd., BMW Motorrad, Triumph Motorcycles Ltd., KTM AG, Piaggio & C. S.p.A., Suzuki Motor Corporation, Harley-Davidson, Inc., Polaris Industries Inc., Ducati Motor Holding S.p.A., TVS Motor Company, NXP Semiconductors contribute to innovation, geographic expansion, and service delivery in this space .

The future of the motorcycle advanced rider assistance system market appears promising, driven by technological innovations and increasing safety regulations. As manufacturers invest in research and development, we can expect a rise in integrated safety systems that enhance rider experience. Additionally, the growing trend of electric motorcycles will likely create new opportunities for advanced rider assistance technologies, further shaping the market landscape and encouraging collaboration between manufacturers and tech firms to develop cutting-edge solutions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Adaptive Cruise Control System Motorcycle Stability Control System Forward Collision Warning System Blind Spot Detection System Traction Control System Anti-lock Braking System (ABS) Gear Shift Assistance Other Product Types |

| By End-User | Individual Riders Commercial Fleets Government Agencies Motorcycle Rental Services Others |

| By Application | Urban Commuting Long-Distance Touring Off-Road Riding Racing Others |

| By Distribution Channel | Direct Sales Online Retail Dealerships Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Systems Mid-Range Systems High-End Systems Luxury Systems |

| By Technology | Radar-Based Systems Camera-Based Systems Lidar-Based Systems Sensor Fusion Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Motorcycle Manufacturers | 100 | Product Development Managers, Safety Compliance Officers |

| Motorcycle Retailers | 70 | Sales Managers, Customer Experience Specialists |

| Rider Training Organizations | 50 | Training Coordinators, Safety Instructors |

| Motorcycle Enthusiast Groups | 60 | Community Leaders, Event Organizers |

| Insurance Companies | 40 | Risk Assessment Analysts, Underwriters |

The Global Motorcycle Advanced Rider Assistance System market is valued at approximately USD 1.6 billion, driven by increasing safety concerns, technological advancements, and a rising demand for enhanced riding experiences among consumers.