Region:Global

Author(s):Rebecca

Product Code:KRAA1400

Pages:98

Published On:August 2025

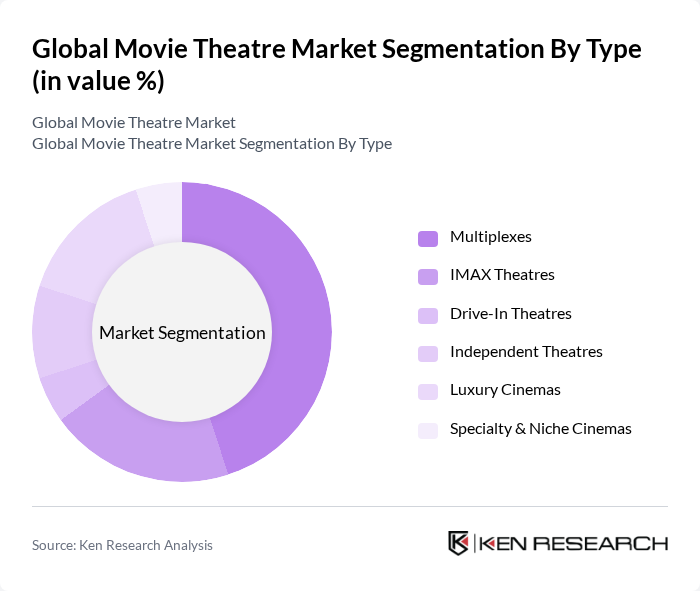

By Type:The market is segmented into various types of theatres, each catering to different audience preferences and experiences. The dominant sub-segment ismultiplexes, which offer a variety of films and amenities, attracting a broad audience.IMAX theatresalso hold a significant share due to their unique viewing experience, whileluxury cinemasare gaining popularity among affluent consumers seeking premium experiences.Drive-in theatresandindependent theatrescontinue to serve niche audiences, and specialty cinemas focus on curated or alternative content .

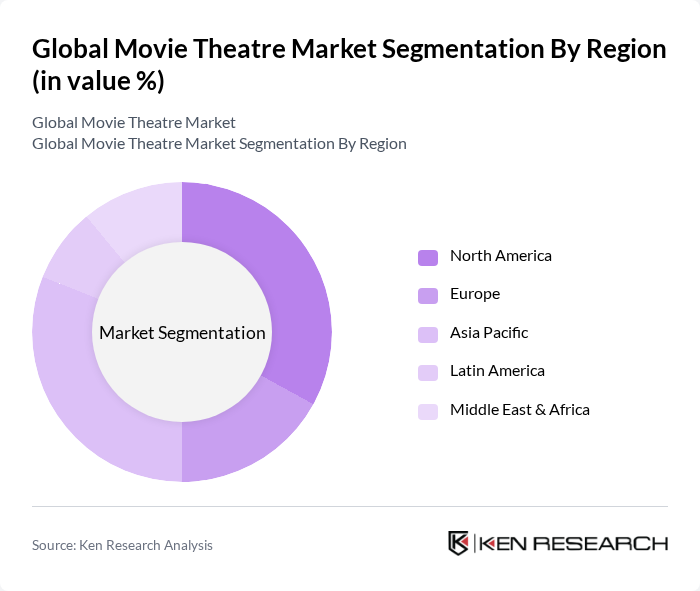

By Region:The market is segmented by region, withNorth America,Europe, andAsia Pacificbeing the most significant contributors. North America leads due to its established cinema culture and high ticket prices. Asia Pacific is rapidly growing, driven by increasing disposable incomes, urbanization, and a burgeoning middle class, especially in China and India. Europe maintains a steady market presence, with diverse film offerings and cultural events. Latin America and the Middle East & Africa represent smaller shares, influenced by economic and cultural factors .

The Global Movie Theatre Market is characterized by a dynamic mix of regional and international players. Leading participants such as AMC Entertainment Holdings Inc., Regal Entertainment Group, Cinemark Holdings, Inc., Cineworld Group plc, Vue International, Landmark Theatres, Alamo Drafthouse Cinema, Cinépolis, Kinepolis Group NV, National Amusements, Inc., CGV Cinemas (CJ CGV Co., Ltd.), Pathé, Studio Movie Grill, Hoyts Group, PVR INOX Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the movie theatre industry appears promising, driven by a combination of technological advancements and evolving consumer preferences. As theatres continue to innovate with enhanced viewing experiences and integrate digital platforms, they are likely to attract a broader audience. Additionally, the focus on sustainability and eco-friendly practices is expected to resonate with environmentally conscious consumers, further boosting attendance. The industry's adaptability to changing market dynamics will be crucial in navigating challenges and capitalizing on emerging opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Multiplexes IMAX Theatres Drive-In Theatres Independent Theatres Luxury Cinemas Specialty & Niche Cinemas |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By End-User | Families Young Adults Seniors Corporate Groups |

| By Genre | Action Comedy Drama Horror Documentary Others |

| By Ticket Pricing | Premium Pricing Standard Pricing Discounted Pricing |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Service Offered | Food and Beverage Services VIP & Premium Services Loyalty Programs Event-Based Screenings (e.g., sports, concerts) |

| By Distribution Channel | Online Ticket Sales Box Office Sales Third-Party Resellers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Cinema Attendance | 100 | Cinema Managers, Marketing Directors |

| Independent Film Screenings | 80 | Independent Theater Owners, Film Curators |

| Consumer Preferences in Movie Genres | 120 | Frequent Moviegoers, Casual Viewers |

| Impact of Streaming on Cinema | 60 | Film Industry Analysts, Streaming Service Executives |

| Regional Box Office Trends | 40 | Regional Distributors, Box Office Analysts |

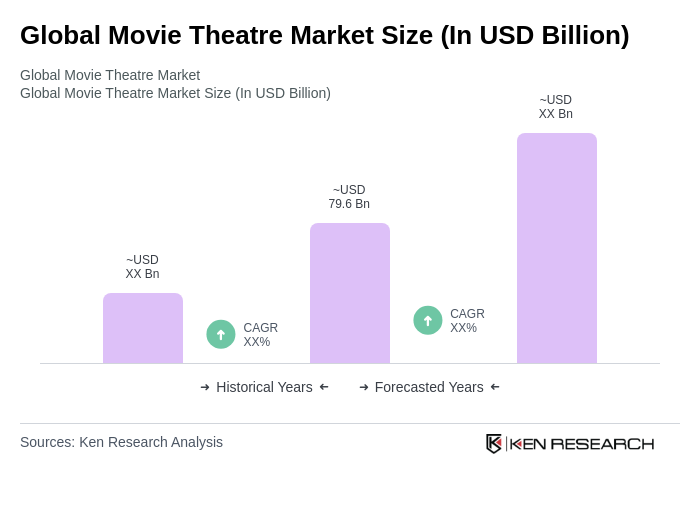

The Global Movie Theatre Market is valued at approximately USD 79.6 billion, reflecting a recovery in cinema attendance post-pandemic, driven by technological advancements and the popularity of blockbuster franchises.