Region:Global

Author(s):Shubham

Product Code:KRAB0783

Pages:100

Published On:August 2025

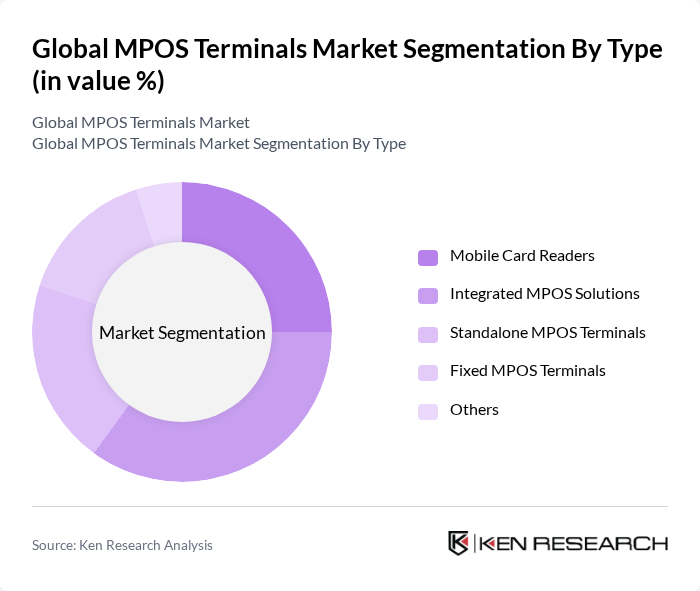

By Type:The market is segmented into various types of MPOS terminals, including Mobile Card Readers, Integrated MPOS Solutions, Standalone MPOS Terminals, Fixed MPOS Terminals, and Others. Among these, Integrated MPOS Solutions are gaining traction due to their ability to combine hardware and software, providing a seamless payment experience for businesses. The demand for mobile card readers is also significant, driven by the increasing number of small and medium enterprises adopting mobile payment solutions.

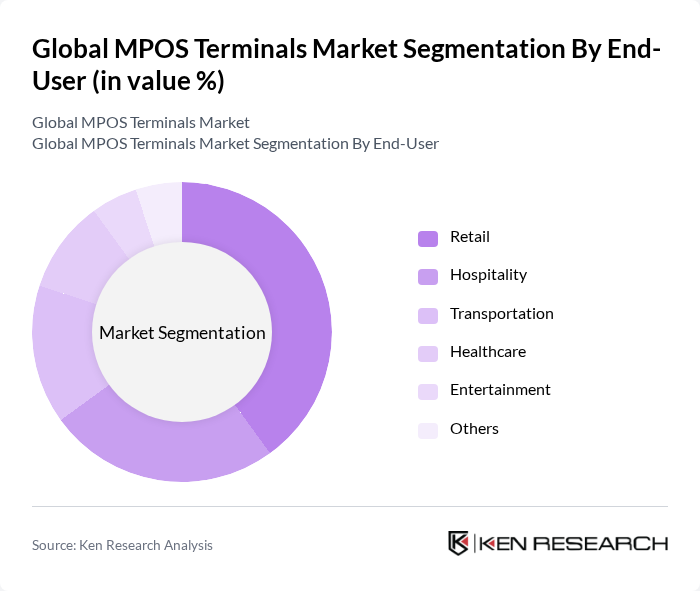

By End-User:The end-user segmentation includes Retail, Hospitality, Transportation, Healthcare, Entertainment, and Others. The retail sector is the largest end-user of MPOS terminals, driven by the need for efficient payment processing and enhanced customer service. The hospitality industry is also witnessing significant growth in MPOS adoption, as businesses seek to provide a seamless payment experience for guests.

The Global MPOS Terminals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Square, Inc. (Block, Inc.), PayPal Holdings, Inc., Ingenico Group (Worldline SA), Verifone Systems, Inc., Clover Network, Inc. (Fiserv, Inc.), SumUp Payments Limited, PayAnywhere (North American Bancard, LLC), Zettle by PayPal, Adyen N.V., Worldpay, Inc. (FIS), Toast, Inc., PAX Technology Limited, First Data Corporation (Fiserv, Inc.), Fiserv, Inc., NCR Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the MPOS terminals market in None appears promising, driven by the increasing integration of advanced technologies and the growing consumer preference for seamless payment experiences. As businesses continue to adapt to digital transformation, the demand for innovative payment solutions is expected to rise. Additionally, the expansion of mobile payment infrastructure will likely enhance accessibility, enabling more consumers to engage in cashless transactions, thereby fostering market growth and encouraging new entrants to innovate.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Card Readers Integrated MPOS Solutions Standalone MPOS Terminals Fixed MPOS Terminals Others |

| By End-User | Retail Hospitality Transportation Healthcare Entertainment Others |

| By Sales Channel | Direct Sales Online Sales Distributors Value-Added Resellers (VARs) Others |

| By Payment Method | Credit/Debit Cards Mobile Wallets Contactless Payments (NFC) Chip and PIN Payments Magnetic Stripe Payments Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Industry Vertical | Retail Transportation Healthcare Restaurants Entertainment Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail mPOS Adoption | 100 | Store Managers, Retail Operations Directors |

| Hospitality Sector Payment Solutions | 60 | Restaurant Owners, Hotel Managers |

| Healthcare Payment Systems | 50 | Clinic Administrators, Healthcare IT Managers |

| Transportation and Logistics Payments | 40 | Logistics Coordinators, Fleet Managers |

| Small Business mPOS Usage | 80 | Small Business Owners, Financial Officers |

The Global MPOS Terminals Market is valued at approximately USD 40.8 billion, driven by the increasing adoption of cashless transactions and mobile payment solutions across various sectors, enhancing customer experience and streamlining payment processes.