Region:Global

Author(s):Shubham

Product Code:KRAC0876

Pages:92

Published On:August 2025

Market.png)

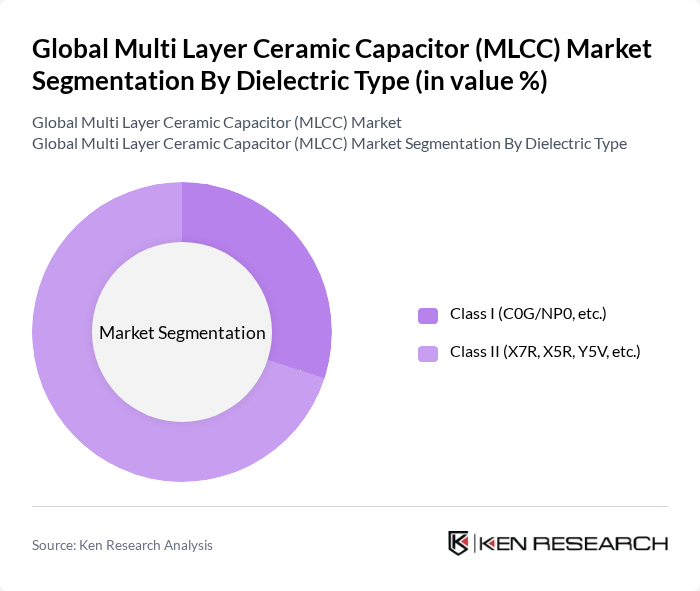

By Dielectric Type:The dielectric type segmentation includes Class I (C0G/NP0, etc.) and Class II (X7R, X5R, Y5V, etc.). Class II dielectrics are dominating the market due to their higher capacitance values and smaller sizes, making them ideal for consumer electronics, automotive, and IoT applications. The demand for compact and efficient components in modern electronic devices has led to a significant preference for Class II MLCCs, which are widely used in smartphones, tablets, electric vehicles, and connected devices.

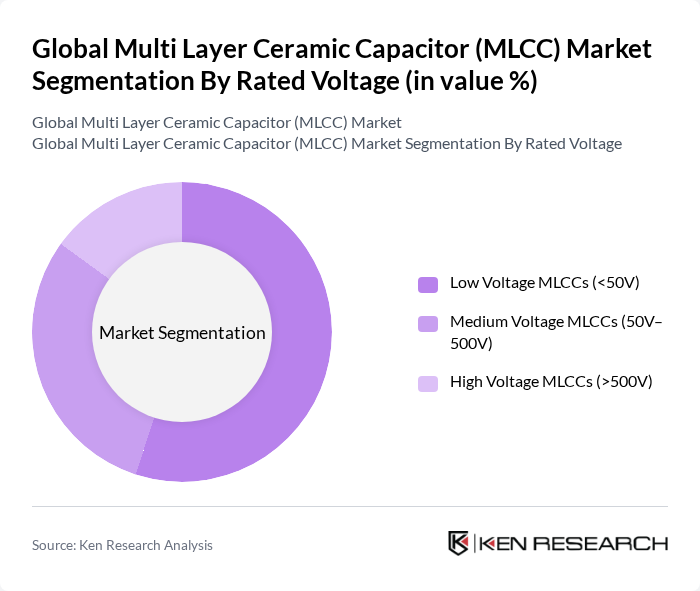

By Rated Voltage:The rated voltage segmentation includes Low Voltage MLCCs (<50V), Medium Voltage MLCCs (50V–500V), and High Voltage MLCCs (>500V). Low Voltage MLCCs are leading the market, primarily due to their extensive use in consumer electronics, portable devices, and automotive electronics. The increasing trend of miniaturization and integration in electronic components has driven the demand for low voltage solutions, making them essential for modern applications such as smartphones, wearables, and infotainment systems.

The Global Multi Layer Ceramic Capacitor (MLCC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Murata Manufacturing Co., Ltd., TDK Corporation, Samsung Electro-Mechanics Co., Ltd., Yageo Corporation, Vishay Intertechnology, Inc., KEMET Corporation, AVX Corporation, Taiyo Yuden Co., Ltd., Nichicon Corporation, Panasonic Holdings Corporation, Walsin Technology Corporation, Chaozhou Three-Circle (Group) Co., Ltd., Holy Stone Enterprise Co., Ltd., Samwha Capacitor Group, and Kyocera Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the MLCC market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of smart technologies in consumer electronics and the automotive industry will likely enhance the demand for high-capacitance MLCCs. Additionally, the ongoing shift towards sustainable manufacturing practices will encourage innovation in capacitor technology, positioning the MLCC market for robust growth. As industries adapt to these trends, the market is expected to evolve, presenting new opportunities for manufacturers and stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Dielectric Type | Class I (C0G/NP0, etc.) Class II (X7R, X5R, Y5V, etc.) |

| By Rated Voltage | Low Voltage MLCCs (<50V) Medium Voltage MLCCs (50V–500V) High Voltage MLCCs (>500V) |

| By Case Size | and above |

| By End-Use Industry | Consumer Electronics Automotive Electronics Industrial Equipment Telecommunications Healthcare Devices Aerospace & Defense Others |

| By Application | Power Supply Signal Processing Filtering Decoupling/Bypass Timing Circuits Energy Storage Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Electronics | 100 | Design Engineers, Product Managers |

| Consumer Electronics | 90 | R&D Managers, Procurement Specialists |

| Telecommunications Equipment | 70 | Network Engineers, Supply Chain Managers |

| Industrial Applications | 60 | Operations Managers, Quality Assurance Engineers |

| Medical Devices | 50 | Regulatory Affairs Specialists, Product Development Managers |

The Global Multi Layer Ceramic Capacitor (MLCC) Market is valued at approximately USD 14.1 billion, driven by the increasing demand for electronic devices, automotive applications, and advancements in telecommunications technology.