Region:Global

Author(s):Geetanshi

Product Code:KRAA0002

Pages:87

Published On:July 2025

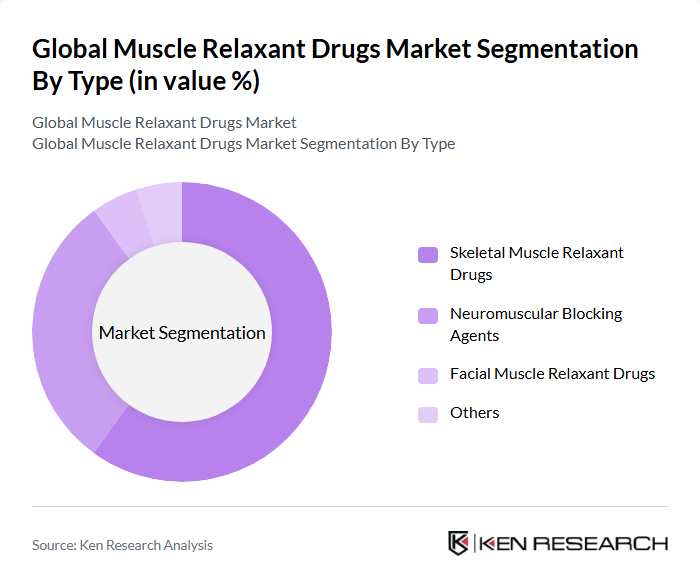

By Type:The muscle relaxant drugs market is primarily segmented into skeletal muscle relaxant drugs and neuromuscular blocking agents. Among these, skeletal muscle relaxant drugs dominate the market due to their widespread use in treating conditions such as muscle spasms and pain management. The increasing incidence of chronic pain conditions and the growing preference for oral formulations contribute to the rising demand for skeletal muscle relaxants. Neuromuscular blocking agents, while essential in surgical procedures, have a more specialized application, which limits their market share compared to skeletal muscle relaxants .

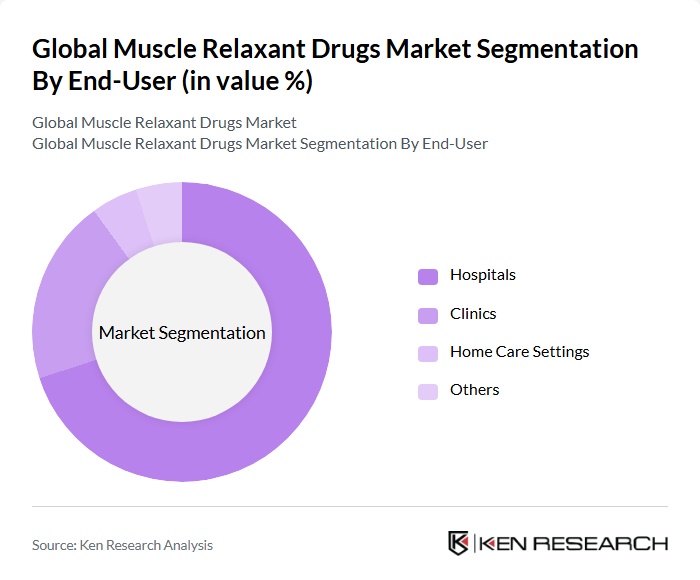

By End-User:The muscle relaxant drugs market is segmented by end-user into hospitals, outpatient clinics, rehabilitation centers, and home care settings. Hospitals are the leading end-user segment, primarily due to the high volume of surgical procedures and the need for effective pain management in acute care settings. The increasing number of surgeries and the growing trend of outpatient procedures are driving the demand for muscle relaxants in hospitals. Outpatient clinics are also witnessing significant growth as they cater to patients requiring less intensive care, further expanding the market .

The Global Muscle Relaxant Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., Novartis AG, Teva Pharmaceutical Industries Ltd., AbbVie Inc., Johnson & Johnson, Amgen Inc., GSK (GlaxoSmithKline) plc, Sanofi S.A., Astellas Pharma Inc., Mylan N.V., Bayer AG, Hikma Pharmaceuticals PLC, Sandoz (a Novartis division), Endo International plc, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Limited, Dr. Reddy's Laboratories Ltd., Zydus Lifesciences Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the muscle relaxant drugs market in None appears promising, driven by ongoing advancements in drug development and an increasing focus on personalized medicine. As healthcare providers adopt combination therapies and telemedicine for pain management, the accessibility and effectiveness of muscle relaxants are expected to improve. Additionally, the rising awareness of the benefits of muscle relaxants will likely enhance patient compliance and treatment outcomes, fostering a more robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Skeletal Muscle Relaxant Drugs Neuromuscular Blocking Agents Facial Muscle Relaxant Drugs Others |

| By End-User | Hospitals Outpatient Clinics Rehabilitation Centers Home Care Settings Others |

| By Route of Administration | Oral Injectable Topical Others |

| By Therapeutic Area | Pain Management Spasticity Management Neurological Disorders Post-Surgical Recovery Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Adults Pediatric Geriatric Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Physicians, Nurse Practitioners, Physician Assistants |

| Pharmacists | 80 | Community Pharmacists, Hospital Pharmacists |

| Pharmaceutical Sales Representatives | 60 | Sales Representatives, Territory Managers |

| Clinical Researchers | 50 | Clinical Trial Coordinators, Research Scientists |

| Regulatory Affairs Professionals | 40 | Regulatory Managers, Compliance Officers |

The Global Muscle Relaxant Drugs Market is valued at approximately USD 4.8 billion, driven by the increasing prevalence of musculoskeletal disorders, a growing geriatric population, and advancements in drug formulations and delivery methods.