Region:Global

Author(s):Rebecca

Product Code:KRAA2845

Pages:100

Published On:August 2025

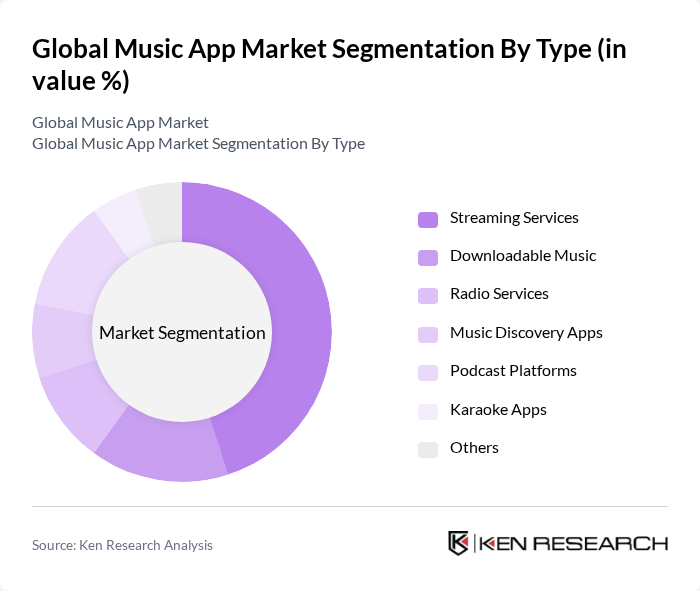

By Type:The market can be segmented into various types, including Streaming Services, Downloadable Music, Radio Services, Music Discovery Apps, Podcast Platforms, Karaoke Apps, and Others. Among these,Streaming Serviceshave emerged as the dominant segment, driven by consumer preferences for on-demand access to vast music libraries and the convenience of mobile usage. The shift from ownership to access has significantly influenced user behavior, leading to a surge in subscriptions and engagement with streaming platforms. Streaming services account for the majority of music app usage, with music streaming representing over 80% of total recorded music revenues globally.

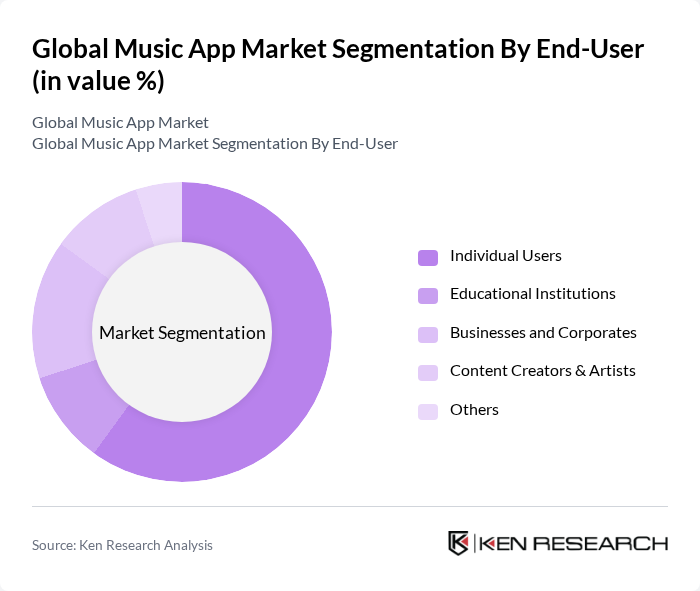

By End-User:The end-user segmentation includes Individual Users, Educational Institutions, Businesses and Corporates, Content Creators & Artists, and Others.Individual Usersrepresent the largest segment, as the majority of music app consumers are casual listeners seeking entertainment and personalized experiences. The increasing trend of music consumption among younger demographics, coupled with the rise of social media platforms, has further fueled the demand for music apps among individual users. Businesses and corporates also contribute significantly, using streaming services for background music to enhance customer experience and drive revenue.

The Global Music App Market is characterized by a dynamic mix of regional and international players. Leading participants such as Spotify Technology S.A., Apple Inc. (Apple Music), Amazon.com, Inc. (Amazon Music), Google LLC (YouTube Music), Tidal (Aspiro AB), Deezer S.A., Pandora Media, LLC (Sirius XM Holdings Inc.), SoundCloud Limited, iHeartMedia, Inc., Tencent Music Entertainment Group, Anghami, JioSaavn (Saavn Media Pvt. Ltd.), Gaana (Gamma Gaana Ltd.), Napster Group PLC, Qobuz (Xandrie SA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the music app market appears promising, driven by technological advancements and evolving consumer preferences. As AI and machine learning continue to enhance personalization, user engagement is expected to rise significantly. Additionally, the integration of social media features will likely foster community-driven experiences, further solidifying user loyalty. With the ongoing expansion into emerging markets, music apps are poised to tap into new user bases, creating opportunities for growth and innovation in the industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Streaming Services Downloadable Music Radio Services Music Discovery Apps Podcast Platforms Karaoke Apps Others |

| By End-User | Individual Users Educational Institutions Businesses and Corporates Content Creators & Artists Others |

| By Subscription Model | Freemium Premium (Paid Subscription) Ad-Supported Family Plans Student Plans Others |

| By Genre | Pop Rock Hip-Hop Classical Electronic/Dance Regional/Local Others |

| By Device Type | Smartphones Tablets Smart Speakers Wearables Connected Cars Others |

| By Distribution Channel | App Stores (Google Play, Apple App Store) Direct Downloads from Company Websites Pre-installed on Devices Third-Party Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Music Streaming User Experience | 120 | Active Users, Casual Listeners |

| Content Creation and Distribution | 60 | Independent Artists, Music Producers |

| Advertising Effectiveness in Music Apps | 50 | Marketing Managers, Brand Strategists |

| Subscription Model Preferences | 80 | Freemium Users, Premium Subscribers |

| Impact of Social Media on Music Consumption | 40 | Social Media Influencers, Digital Marketers |

The Global Music App Market is valued at approximately USD 47 billion, driven by the increasing adoption of smartphones, the rise of streaming services, and the demand for personalized music experiences. This valuation is based on a five-year historical analysis.