Region:Global

Author(s):Dev

Product Code:KRAA1571

Pages:82

Published On:August 2025

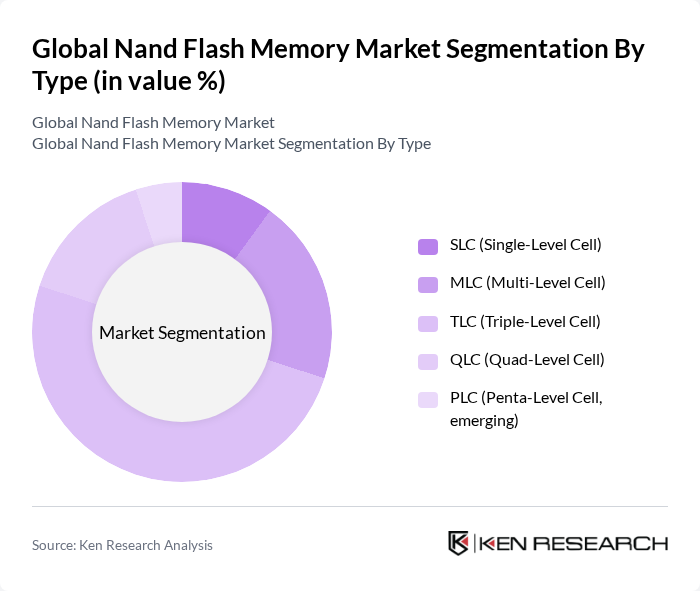

By Type:The Nand flash memory market is segmented into various types, including SLC (Single-Level Cell), MLC (Multi-Level Cell), TLC (Triple-Level Cell), QLC (Quad-Level Cell), and PLC (Penta-Level Cell, emerging). Each type serves different applications based on performance, endurance, and cost-effectiveness. Among these, TLC is widely used in mainstream consumer and enterprise SSDs due to its balance of density, cost, and endurance; QLC is expanding in high-capacity SSDs for read-intensive workloads; PLC remains in early R&D and pilot phases.

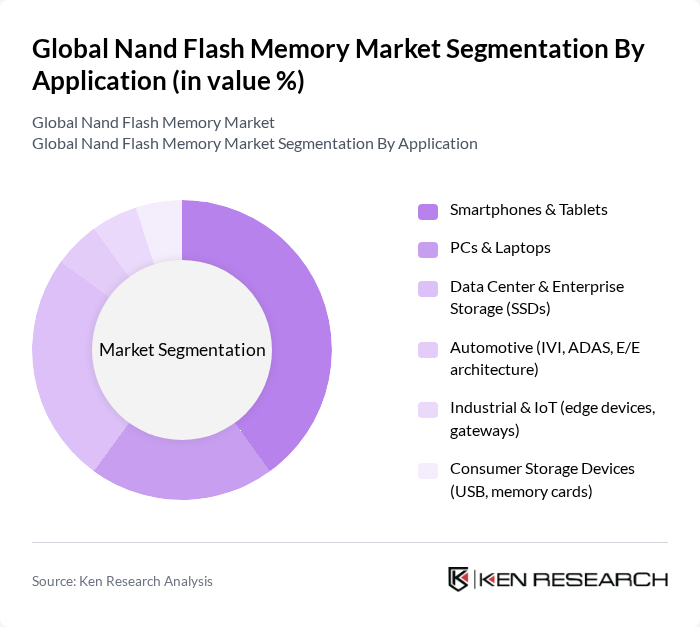

By Application:The applications of Nand flash memory are diverse, including smartphones & tablets, PCs & laptops, data center & enterprise storage (SSDs), automotive (IVI, ADAS, E/E architecture), industrial & IoT (edge devices, gateways), and consumer storage devices (USB, memory cards). The smartphone and tablet segment is currently leading the market due to the increasing adoption of mobile devices and the demand for high-capacity storage solutions.

The Global Nand Flash Memory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Micron Technology, Inc., SK hynix Inc., Kioxia Holdings Corporation, Western Digital Corporation, Solidigm (a subsidiary of SK hynix), Yangtze Memory Technologies Co., Ltd. (YMTC), Kingston Technology Company, Inc., ADATA Technology Co., Ltd., Transcend Information, Inc., Corsair Gaming, Inc., PNY Technologies, Inc., Seagate Technology Holdings plc, Winbond Electronics Corporation, Silicon Motion Technology Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the NAND flash memory market appears promising, driven by technological advancements and increasing demand across various sectors. The shift towards 3D NAND technology is expected to enhance storage density and performance, while the rise of edge computing will create new applications for flash memory. Additionally, the growing emphasis on sustainability will likely lead to innovations in eco-friendly manufacturing processes, positioning the industry for long-term growth and resilience against market fluctuations.

| Segment | Sub-Segments |

|---|---|

| By Type | SLC (Single-Level Cell) MLC (Multi-Level Cell) TLC (Triple-Level Cell) QLC (Quad-Level Cell) PLC (Penta-Level Cell, emerging) |

| By Application | Smartphones & Tablets PCs & Laptops Data Center & Enterprise Storage (SSDs) Automotive (IVI, ADAS, E/E architecture) Industrial & IoT (edge devices, gateways) Consumer Storage Devices (USB, memory cards) |

| By End-User | Consumer OEMs (smartphone, PC, CE) Cloud Service Providers & Hyperscalers Enterprise & OEMs (servers, networking) Automotive OEMs & Tier-1s Industrial OEMs |

| By Distribution Channel | Direct Sales to OEMs Tier-1 Distributors & VARs Online Retail (consumer storage products) Offline Retail (consumer storage products) Design-in via Module/SSD Vendors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level (consumer) Mainstream Performance/Enterprise |

| By Technology | D (Planar) NAND D NAND (e.g., 96–238+ layers) Embedded Form Factors (UFS/eMMC) SSD Interfaces (SATA, NVMe/PCIe) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 120 | Product Development Managers, Supply Chain Analysts |

| Data Center Operators | 90 | IT Infrastructure Managers, Data Center Architects |

| Mobile Device Producers | 100 | Procurement Managers, R&D Engineers |

| Automotive Electronics Suppliers | 70 | Quality Assurance Managers, Technical Directors |

| Flash Memory Retailers | 60 | Sales Managers, Marketing Directors |

The Global Nand Flash Memory Market is valued at approximately USD 55 billion, driven by the increasing demand for high-performance storage solutions across various sectors, including consumer electronics, data centers, and automotive applications.