Region:Global

Author(s):Shubham

Product Code:KRAD0627

Pages:89

Published On:August 2025

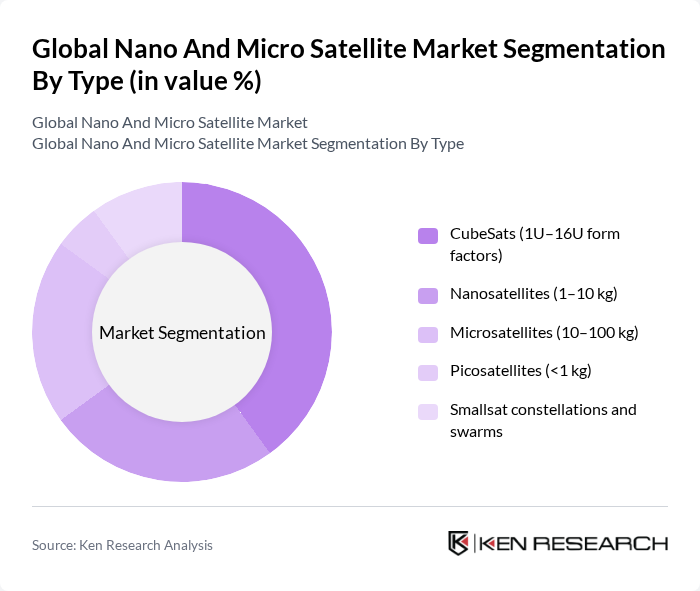

By Type:The market is segmented into various types, including CubeSats, Nanosatellites, Microsatellites, Picosatellites, and Smallsat constellations and swarms. CubeSats remain popular due to standardized form factors and lower build/launch costs that support rapid iteration for education, commercial imaging, weather, AIS/ADS-B, and IoT payloads. Nanosatellites and microsatellites continue to gain traction in Earth observation, communications, and RF sensing, aided by improved onboard processing, modular buses, and commercial rideshare access. The growing deployment of constellations for broadband, IoT, and persistent monitoring further boosts smallsat demand through higher launch cadence and replenishment cycles.

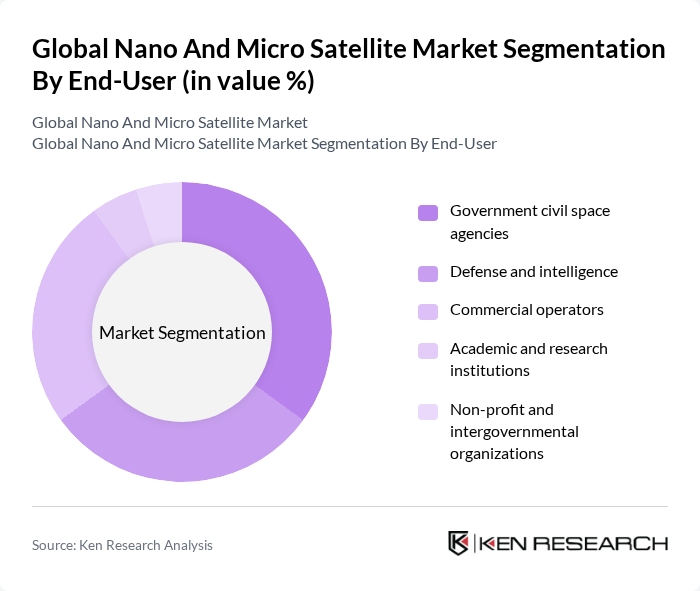

By End-User:The end-user segmentation includes government civil space agencies, defense and intelligence, commercial operators, academic and research institutions, and non-profit and intergovernmental organizations. Government civil users lead for Earth observation, climate and disaster monitoring, and scientific missions; defense demand is significant for tactical ISR, PNT augmentation, and space domain awareness; commercial operators are expanding quickly on the back of imagery/analytics, weather, maritime/aviation tracking, and IoT services. Broader access via rideshare launches, standardized licensing, and commercial ground networks supports adoption across academia and NGOs.

The Global Nano And Micro Satellite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Planet Labs PBC, Spire Global, Inc., Kongsberg NanoAvionics, Tyvak Nano-Satellite Systems (Terran Orbital), Surrey Satellite Technology Ltd. (SSTL), AAC Clyde Space AB, GomSpace A/S, Blue Canyon Technologies LLC (Raytheon), ISISPACE Group (Innovative Solutions In Space), Kepler Communications Inc., Rocket Lab USA, Inc., Northrop Grumman Space Systems, Airbus Defence and Space, Lockheed Martin Corporation, The Boeing Company, Sateliot, Fleet Space Technologies, Pixxel, Exolaunch GmbH, EnduroSat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nano and micro satellite market appears promising, driven by technological advancements and increasing global demand for satellite services. As the Internet of Things (IoT) expands, the integration of satellite technology will become crucial for data collection and connectivity. Additionally, the focus on sustainability in space missions will likely lead to innovative designs and materials, enhancing the efficiency and environmental impact of satellite operations. Collaborative efforts between public and private sectors will further accelerate growth in this dynamic market.

| Segment | Sub-Segments |

|---|---|

| By Type | CubeSats (1U–16U form factors) Nanosatellites (1–10 kg) Microsatellites (10–100 kg) Picosatellites (<1 kg) Smallsat constellations and swarms |

| By End-User | Government civil space agencies Defense and intelligence Commercial operators Academic and research institutions Non-profit and intergovernmental organizations |

| By Application | Earth observation and remote sensing Communications (IoT/NTN, AIS/ADS-B, broadband) Scientific research and exploration Technology demonstration and on-orbit services Space situational awareness (SSA) and space weather |

| By Launch Method | Dedicated small launch vehicles Rideshare missions Secondary payload/adapters & dispensers ISS/Kibo deployment and orbital transfer vehicles |

| By Orbit Type | Low Earth Orbit (LEO) Sun-synchronous and polar orbits Medium Earth Orbit (MEO) Highly Elliptical and cislunar orbits |

| By Payload Class | Imagers and hyperspectral payloads Communications payloads (S/L/Ku/Ka-band) Navigation and tracking payloads (AIS/ADS-B) Scientific instruments and tech demonstrators |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Satellite Applications | 100 | Business Development Managers, Product Managers |

| Government Space Programs | 80 | Policy Makers, Program Directors |

| Academic Research in Satellite Technology | 60 | Research Scientists, University Professors |

| Satellite Manufacturing Sector | 70 | Manufacturing Engineers, Quality Assurance Managers |

| Data Analytics from Satellite Imagery | 90 | Data Analysts, GIS Specialists |

The Global Nano and Micro Satellite Market is valued at approximately USD 3.9 billion, driven by increasing demand for satellite-based Earth observation and communications services, advancements in miniaturization, and the deployment of proliferated constellations for various missions.