Global Nanomedicine Market Overview

- The Global Nanomedicine Market is valued at USD 209 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in nanotechnology, increasing investments in research and development, and the rising prevalence of chronic diseases that require innovative treatment solutions. The integration of nanomedicine in drug delivery systems and diagnostics has significantly enhanced therapeutic efficacy and patient outcomes. Recent trends include the expansion of nanomedicine applications in oncology, cardiovascular, and neurological treatments, as well as the growing adoption of mRNA and liposome-based vaccines, which are accelerating market growth , .

- Key players in this market include the United States, Germany, and Japan, which dominate due to their robust healthcare infrastructure, significant investment in biotechnology, and a strong focus on research and development. The presence of leading pharmaceutical companies and research institutions in these countries further contributes to their market leadership, fostering innovation and collaboration in nanomedicine. North America currently holds the largest market share, followed by Europe and Asia-Pacific, reflecting the region’s advanced regulatory frameworks and strong R&D ecosystem , .

- In 2023, the U.S. Food and Drug Administration (FDA) implemented new guidelines for the approval of nanomedicine products, emphasizing the need for comprehensive safety and efficacy data. This regulation, known as the FDA Guidance for Industry: Considerations for the Design and Development of Nanotechnology-Based Drug Products, aims to streamline the approval process while ensuring that nanomedicine products meet stringent safety standards, thereby enhancing public trust and encouraging further investment in this innovative field .

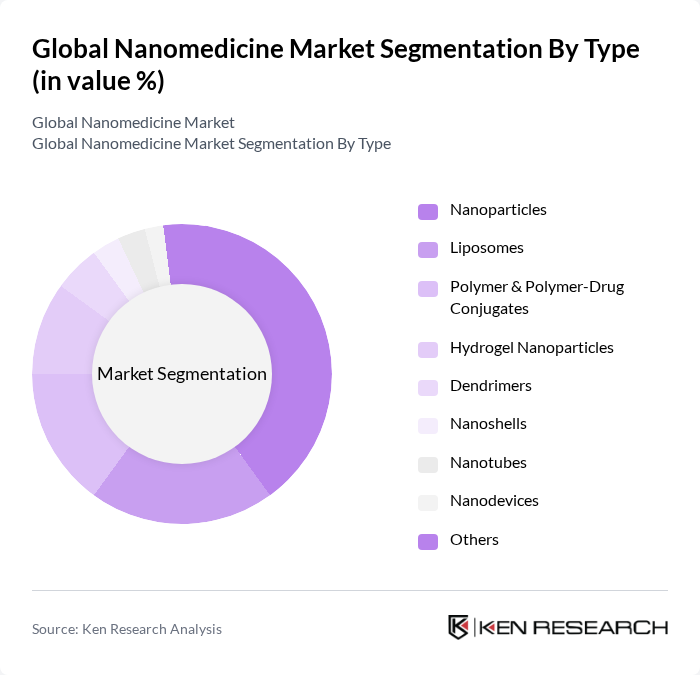

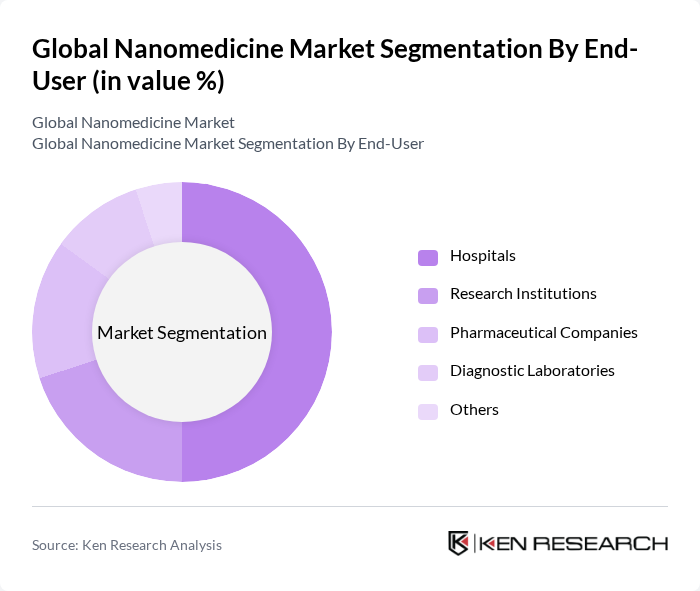

Global Nanomedicine Market Segmentation

By Type:The nanomedicine market can be segmented into various types, including nanoparticles, liposomes, polymer & polymer-drug conjugates, hydrogel nanoparticles, dendrimers, nanoshells, nanotubes, nanodevices, and others. Among these, nanoparticles are the most widely used due to their versatility in drug delivery and imaging applications. Their ability to enhance the solubility and bioavailability of drugs makes them a preferred choice in therapeutic formulations.

By End-User:The end-user segmentation includes hospitals, research institutions, pharmaceutical companies, diagnostic laboratories, and others. Hospitals are the leading end-users, driven by the increasing adoption of advanced treatment modalities and the need for effective drug delivery systems. The growing number of surgical procedures and the demand for personalized medicine further enhance the utilization of nanomedicine in hospital settings.

Global Nanomedicine Market Competitive Landscape

The Global Nanomedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Johnson & Johnson, Pfizer Inc., Novartis AG, Merck & Co., Inc., Sanofi S.A., Roche Holding AG, Gilead Sciences, Inc., AstraZeneca PLC, Eli Lilly and Company, Bayer AG, Takeda Pharmaceutical Company Limited, Biogen Inc., Regeneron Pharmaceuticals, Inc., Vertex Pharmaceuticals Incorporated, Celgene Corporation, Nanosphere, Inc., Cytimmune Sciences, Inc., BIND Therapeutics, Inc., Nanobiotix S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Global Nanomedicine Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as cancer, diabetes, and cardiovascular disorders is a significant growth driver for nanomedicine. According to the World Health Organization, chronic diseases accounted for 71% of global deaths in the past, with projections indicating that in future, the number of people living with diabetes will reach 537 million. This growing patient population necessitates innovative treatment solutions, positioning nanomedicine as a critical component in addressing these health challenges.

- Advancements in Nanotechnology:The rapid advancements in nanotechnology are propelling the nanomedicine market forward. In future, the global investment in nanotechnology research is expected to exceed $100 billion, driven by innovations in drug formulation and delivery systems. These advancements enable the development of more effective therapies with fewer side effects, enhancing patient outcomes. As a result, the integration of nanotechnology into healthcare is becoming increasingly vital, fostering growth in the nanomedicine sector.

- Rising Demand for Targeted Drug Delivery Systems:The demand for targeted drug delivery systems is surging, driven by the need for more effective treatments with reduced side effects. In future, the global market for targeted drug delivery is projected to reach $60 billion. Nanomedicine plays a crucial role in this area, allowing for precise delivery of therapeutics directly to affected cells. This targeted approach not only improves treatment efficacy but also minimizes systemic toxicity, making it a preferred choice among healthcare providers.

Market Challenges

- High Cost of Nanomedicine Development:The development of nanomedicine is often hindered by high costs associated with research, production, and clinical trials. In future, the average cost of developing a new nanomedicine product is estimated to be around $2.6 billion, significantly higher than traditional pharmaceuticals. This financial barrier limits the entry of new players into the market and restricts innovation, posing a challenge to the overall growth of the nanomedicine sector.

- Regulatory Hurdles and Compliance Issues:Navigating the regulatory landscape for nanomedicine presents significant challenges. In future, it is anticipated that regulatory agencies will implement stricter guidelines for the approval of nanomedicine products, which could extend the time to market. The complexity of assessing the safety and efficacy of nanomaterials complicates compliance, leading to delays and increased costs for developers. This regulatory uncertainty can deter investment and slow market growth.

Global Nanomedicine Market Future Outlook

The future of the nanomedicine market appears promising, driven by ongoing technological advancements and increasing healthcare demands. As the prevalence of chronic diseases continues to rise, the need for innovative treatment solutions will grow. Additionally, the integration of artificial intelligence in drug development and diagnostics is expected to enhance the efficiency of nanomedicine applications. With a focus on personalized medicine and sustainable practices, the sector is poised for significant evolution, attracting investments and fostering collaborations across the healthcare landscape.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present substantial opportunities for nanomedicine growth. With increasing healthcare expenditures projected to reach $1.5 trillion in future, these regions are investing in advanced medical technologies. This trend opens avenues for nanomedicine companies to introduce innovative solutions tailored to local healthcare needs, enhancing patient access to cutting-edge treatments.

- Collaborations with Biotechnology Firms:Collaborations between nanomedicine companies and biotechnology firms are becoming increasingly vital. In future, partnerships are expected to drive innovation, with over 30% of new nanomedicine products emerging from collaborative efforts. These alliances facilitate knowledge sharing, resource pooling, and accelerated product development, ultimately enhancing the competitive landscape and expanding market reach.