Region:Global

Author(s):Dev

Product Code:KRAC0352

Pages:81

Published On:August 2025

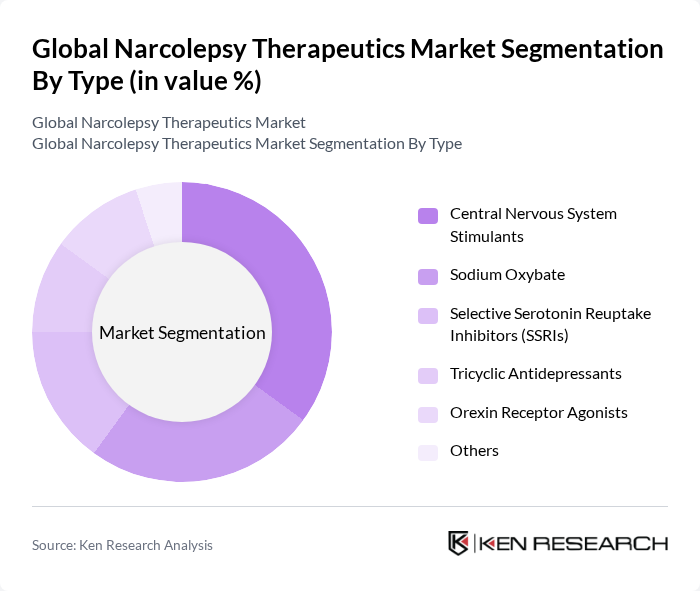

By Type:The market is segmented into various types of therapeutics, including Central Nervous System Stimulants, Sodium Oxybate, Selective Serotonin Reuptake Inhibitors (SSRIs), Tricyclic Antidepressants, Orexin Receptor Agonists, and Others. Central Nervous System Stimulants are leading the market due to their effectiveness in managing excessive daytime sleepiness, a primary symptom of narcolepsy. The growing awareness of narcolepsy and the increasing number of prescriptions for these stimulants are driving their dominance in the market. Additionally, the emergence of orexin receptor agonists is expanding therapeutic options for patients .

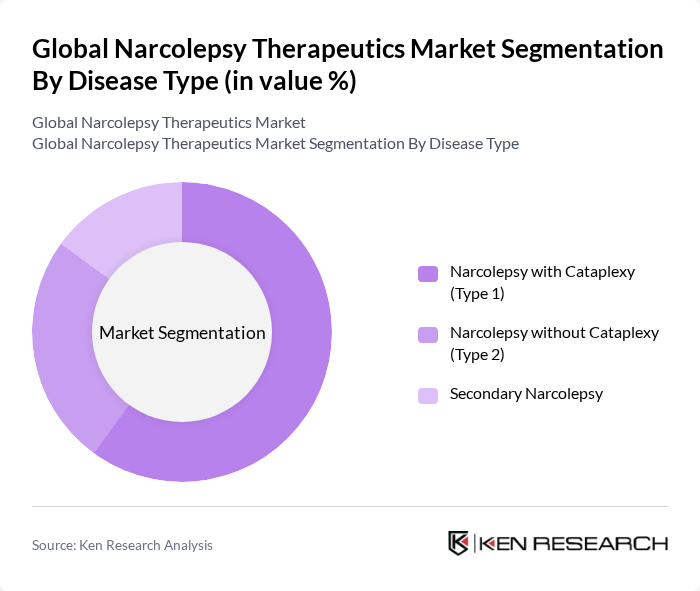

By Disease Type:The market is categorized into Narcolepsy with Cataplexy (Type 1), Narcolepsy without Cataplexy (Type 2), and Secondary Narcolepsy. Narcolepsy with Cataplexy is the dominant segment, primarily due to its higher prevalence and the severe impact it has on patients' quality of life. The availability of targeted therapies for this type has also contributed to its significant market share, as healthcare providers focus on effective management strategies for patients .

The Global Narcolepsy Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jazz Pharmaceuticals plc, Takeda Pharmaceutical Company Limited, UCB S.A., Teva Pharmaceutical Industries Ltd., Avadel Pharmaceuticals plc, Bioprojet Société Civile de Recherche, Harmony Biosciences Holdings, Inc., Axsome Therapeutics, Inc., Acorda Therapeutics, Inc., Otsuka Pharmaceutical Co., Ltd., Neurim Pharmaceuticals Ltd., Novartis AG, F. Hoffmann-La Roche Ltd., Merck & Co., Inc., and Pfizer Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the narcolepsy therapeutics market appears promising, driven by ongoing research and technological advancements. The integration of digital health solutions, such as mobile health applications, is expected to enhance patient engagement and adherence to treatment. Additionally, the shift towards personalized medicine will likely lead to more tailored therapeutic approaches, improving efficacy and patient satisfaction. As awareness continues to grow, the market is poised for significant developments in both treatment options and patient care models.

| Segment | Sub-Segments |

|---|---|

| By Type | Central Nervous System Stimulants Sodium Oxybate Selective Serotonin Reuptake Inhibitors (SSRIs) Tricyclic Antidepressants Orexin Receptor Agonists Others |

| By Disease Type | Narcolepsy with Cataplexy (Type 1) Narcolepsy without Cataplexy (Type 2) Secondary Narcolepsy |

| By End-User | Hospitals Specialty Clinics Homecare Settings |

| By Route of Administration | Oral Injectable Transdermal |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospital Pharmacies |

| By Age Group | Pediatric Adult Geriatric |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurologists Specializing in Sleep Disorders | 60 | Sleep Specialists, Clinical Researchers |

| Pharmaceutical Executives in Narcolepsy Therapeutics | 50 | Product Managers, R&D Directors |

| Patients Diagnosed with Narcolepsy | 100 | Patients, Caregivers |

| Healthcare Payers and Insurers | 40 | Policy Makers, Claims Analysts |

| Clinical Trial Coordinators for Narcolepsy Studies | 40 | Clinical Research Associates, Site Managers |

The Global Narcolepsy Therapeutics Market is valued at approximately USD 4.6 billion, reflecting a significant growth driven by increased awareness, diagnosis of narcolepsy, and advancements in drug development, particularly with novel therapies like orexin receptor agonists.