Region:Global

Author(s):Shubham

Product Code:KRAD0644

Pages:93

Published On:August 2025

By Type:The market is segmented into various types of honey, each catering to different consumer preferences and applications. The key subsegments include Raw/Unfiltered Honey, Processed/Filtered Honey, Organic Honey, Manuka Honey, Monofloral Honey (e.g., Clover, Acacia, Sidr, Linden), Multifloral/Wildflower Honey, Honey Blends, Specialty/Infused & Functional Honey, and Others. Organic Honey has gained significant traction due to consumer shifts toward clean-label, chemical-residue–free products and growing availability through modern retail and online channels.

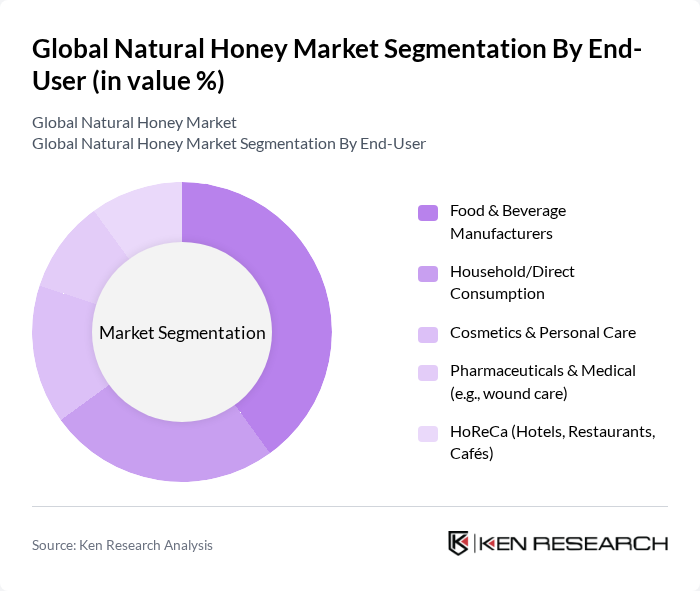

By End-User:The end-user segmentation includes Food & Beverage Manufacturers, Household/Direct Consumption, Cosmetics & Personal Care, Pharmaceuticals & Medical (e.g., wound care), and HoReCa (Hotels, Restaurants, Cafés). The Food & Beverage Manufacturers segment remains the largest end user, reflecting honey’s role as a clean-label sweetener in bakery, cereals, snacks, beverages, and health-focused formulations.

The Global Natural Honey Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capilano Honey Ltd. (ASX: CZZ; Australia), Comvita Limited (NZX: CVT; New Zealand), Manuka Health New Zealand Ltd. (New Zealand), Oha Honey (?haupo) / Grove-based MGO Brands (New Zealand), Wedderspoon Organic Inc. (USA/Canada), Dutch Gold Honey, Inc. (USA), Bee Maid Honey Limited (Canada), Barkman Honey, LLC (USA), Dabur India Ltd. (India), Patanjali Ayurved Ltd. (Foods Division; India), Marico Ltd. (Saffola Honey; India), Savannah Bee Company (USA), Y.S. Eco Bee Farms (USA), Nature Nate’s Honey Co. (North Dallas Honey Co.; USA), Sweet Harvest Foods (USA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the natural honey market appears promising, driven by increasing consumer awareness of health benefits and sustainability. As the demand for organic and natural products continues to rise, honey is expected to play a pivotal role in the food and beverage sector. Innovations in sustainable beekeeping practices and enhanced traceability measures will likely strengthen consumer confidence. Furthermore, the expansion of e-commerce platforms will facilitate greater access to natural honey, enhancing market growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Raw/Unfiltered Honey Processed/Filtered Honey Organic Honey Manuka Honey Monofloral Honey (e.g., Clover, Acacia, Sidr, Linden) Multifloral/Wildflower Honey Honey Blends Specialty/Infused & Functional Honey Others |

| By End-User | Food & Beverage Manufacturers Household/Direct Consumption Cosmetics & Personal Care Pharmaceuticals & Medical (e.g., wound care) HoReCa (Hotels, Restaurants, Cafés) |

| By Sales Channel | Supermarkets/Hypermarkets Convenience & Specialty Stores Online Retail/E-commerce Direct & Institutional/Bulk Sales |

| By Packaging Type | Glass Jars Plastic Squeeze Bottles/Containers Bulk Drums/IBCs Sachets & Portion Packs |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium (e.g., UMF/monofloral) Mid-Range Budget/Conventional |

| By Certification | Organic Certified Non-GMO Certified Fair Trade Certified UMF/MGO (Manuka) Certification Halal/Kosher Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Honey Producers | 100 | Beekeepers, Farm Owners |

| Retail Sector | 80 | Store Managers, Product Buyers |

| Food Manufacturers | 70 | Procurement Managers, Quality Assurance Officers |

| Exporters and Importers | 60 | Trade Managers, Logistics Coordinators |

| Consumers | 120 | Health-Conscious Shoppers, Organic Product Buyers |

The Global Natural Honey Market is valued at approximately USD 8.9 billion, reflecting a five-year historical analysis. This growth is attributed to the increasing preference for natural sweeteners and the health benefits associated with honey.